Ethereum (ETH) Forecast: Bullish Momentum Builds as Key Levels Fall

Quick overview

- Ethereum (ETH) has shown strong resilience in 2025, breaking key resistance levels and confirming a bullish market structure.

- The cryptocurrency has surpassed the short-term target of $2638, reaching as high as $3039, with the next critical resistance at $3323.7.

- Recent developments in Ethereum's ecosystem, including Danksharding and increased Layer-2 activity, support its bullish outlook.

- A confirmed weekly close above $2836.5 could lead to significant price advances towards $3323.7 and $3629.4.

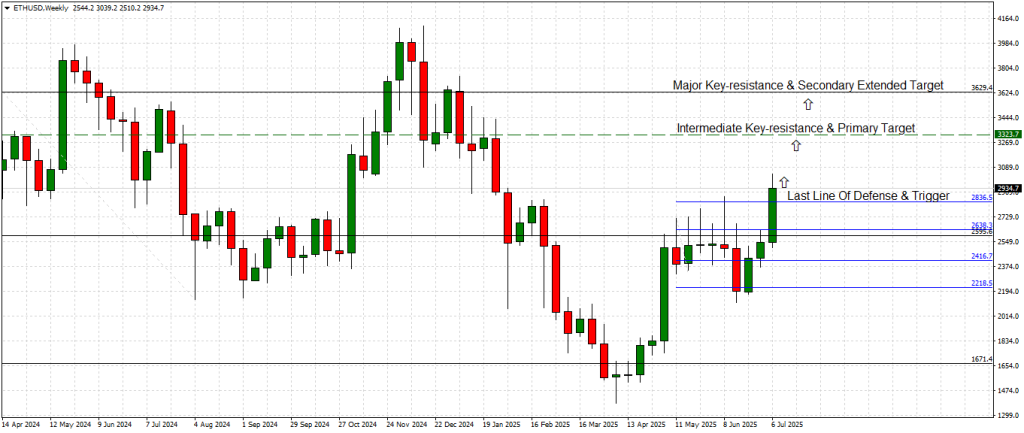

Ethereum (ETH) continues to show remarkable resilience in 2025, closely tracking the bullish scenario we outlined in our June 22 forecast. Back then, we highlighted the importance of the local support at $2416 and the inflection point at $2595 — both of which have since held firm and been decisively broken to the upside, confirming the bullish market structure we anticipated.

As of this week, Ethereum has successfully breached our short-term target of $2638, climbing as high as $3039. This move validates our prediction and suggests Ethereum is firmly locked into a broader bullish cycle. The next critical level now sits at $3323.7, a key resistance Ethereum is currently moving towards. A clean breakout and weekly close above the local trigger level at $2836.5 would clear the path for a swift advance toward the intermediate key-resistance and primary target at $3323.7.

Technical Overview (Weekly Chart)

Using the latest uploaded Weekly chart:

-

Support Levels:

-

$2836.5 (trigger zone and last line of defense)

-

$2595 (Major pivotal inflection zone)

-

-

Resistance Levels:

-

$3323.7 (Next significant key-resistance & primary profit target)

-

$3629.4 (major resistance and medium/long-term target)

-

The Weekly price action shows strong bullish candlesticks with successive higher lows, confirming persistent buying pressure. The break above $2595 acted as a springboard, invalidating the prior downtrend structure and shifting market sentiment firmly bullish.

As per our forecast logic, once Ethereum secures a confirmed close above $2836.5, it will officially enter a vacuum area with little overhead resistance up to $3323.7 — a level consistent with Fibonacci extension golden ratio of 161.8%.

Should that target be reached, the secondary extended target to $3629.4 would come into play, representing a roughly 24% move from current levels.

Technology & Ecosystem Update (July 2025)

On the development front, Ethereum’s ecosystem remains the largest and most dynamic in the crypto market. Over the past month:

-

Danksharding Development: The Ethereum Foundation confirmed major progress on the next stage of scaling — Danksharding. The introduction of blob-carrying transactions in EIP-4844 via the upcoming “Pectra” upgrade (scheduled for Q4 2025) will radically improve data availability for rollups, reducing L2 transaction fees even further.

-

Layer-2 Expansion: Leading L2 solutions like Arbitrum, Optimism, and Base have each recorded a notable increase in active users and TVL (Total Value Locked). Combined L2 activity has now surpassed mainnet Ethereum transactions per day, a first in the network’s history — a clear sign of network scalability maturing.

-

DeFi Resurgence: A bullish sentiment across DeFi protocols has returned, with leading projects such as Aave, Uniswap, and Lido Finance seeing user and TVL growth upward of 12% month-over-month. Ethereum continues to host the most liquid and capital-efficient decentralized protocols.

-

Real-World Asset Tokenization (RWA): BlackRock’s RWA pilot on Ethereum, alongside other institutional asset management firms, is continuing to expand, onboarding an estimated $500M worth of tokenized Treasuries and corporate bonds onto the Ethereum mainnet in the past quarter.

Summary: Bullish Outlook with Structured Targets

Ethereum has delivered on our June forecast expectations, breaking through pivotal levels and currently consolidating against $2836.5. A successful breakout at this juncture would likely ignite a push to $3323.7, with a medium-term extended target at $3629.4 remaining on the table.

With fundamental developments like Danksharding and L2 adoption scaling rapidly — and DeFi showing solid recovery — the broader macro and ecosystem landscape continues to support Ethereum’s bullish case into the second half of 2025.

Bottom Line:

Stay cautiously bullish while monitoring for a weekly close above $2836.5. Should that happen, expect significant follow-through toward $3323.7 and potentially $3629.4 in the coming weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM