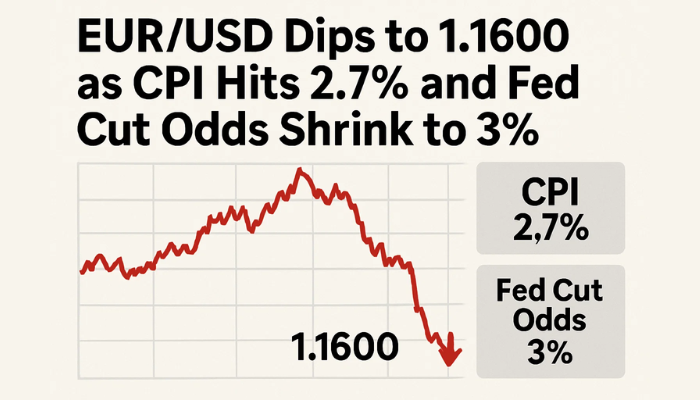

Gold Price Eyes Breakout at $3,370 as CPI Climbs and Trump Tariffs Loom

Gold slipped lower on Tuesday as traders digested inflation data and waited for potential tariff moves from the US.

Quick overview

- Gold prices fell on Tuesday, with spot gold down 0.5% and US gold futures down 0.7%, as traders reacted to inflation data and potential US tariffs.

- The US Consumer Price Index showed a 0.3% increase for June, the largest monthly jump since January, but the market largely dismissed it.

- Former President Trump threatened 30% tariffs on EU and Mexican imports, reigniting safe-haven demand discussions, though market reactions have been muted.

- Gold is nearing a breakout point, with key resistance at $3,370 and potential upside targets of $3,396 and $3,422.

Gold slipped lower on Tuesday as traders digested inflation data and waited for potential tariff moves from the US.

Spot gold fell 0.5% to $3,328.06 and US gold futures dropped 0.7% to $3,336.70. The dollar rose 0.6% making gold more expensive for non-dollar buyers and adding pressure to the metal.

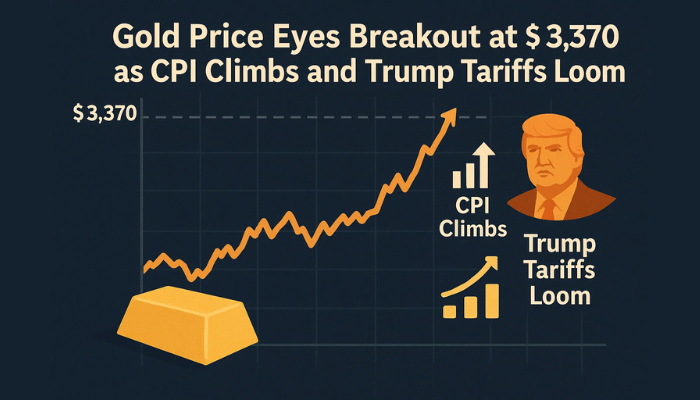

Tuesday’s US Consumer Price Index (CPI) report showed a 0.3% increase for June—the biggest monthly jump since January—as expected. While that might seem like a red flag for inflation, the market shrugged it off.

Former President Donald Trump threw uncertainty into the mix over the weekend by threatening to impose 30% tariffs on EU and Mexican imports. That has reignited safe-haven demand talk but so far the market reaction has been muted.

Despite the small dip some are still bullish.

“I think the market is still focused on tariffs, keeping gold underpinned. I remain bullish on gold,” said Peter Grant of Zaner Metals.

Trump also told the Fed via Truth Social to cut rates, citing low inflation. Traders are already pricing in a rate cut by September which is a tailwind for gold in the medium term.

Gold Technical Outlook: $3,370 Is Key for Breakout

Gold (XAU/USD) is in a symmetrical triangle, a chart pattern that usually precedes big moves.

The price is holding just above the 50 period SMA at $3,330 which is short term support. The triangle apex is approaching so a breakout is likely soon.

Upside Targets:

- Resistance trendline: ~$3,370

- Next targets: $3,396 and $3,422 (previous highs)

Downside Risk:

- First support: $3,330

- Further down: $3,309 and $3,283 (lower triangle boundary)

The RSI is below 50 but slightly up so bulls may be regrouping.

Watch for candlestick patterns for breakout confirmation:

- Bullish signal: Engulfing or spinning top at support

- Bearish warning: Rejection candle at resistance### Next: Tariffs, PPI and the Fed

CPI was as expected, but Wednesday’s PPI could influence Fed policy.

Gold loves rate cuts as it has no yield. If geopolitical tensions rise or economic data disappoints it could get bullish again.

What to Watch:

- US tariff announcements

- PPI data

- Rate cut speculation

Gold is almost out of its consolidation phase so a break above $3,370 with rising volume could be the start of another leg up. Until then expect tight range bound trading with every headline pushing sentiment one way or the other.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account