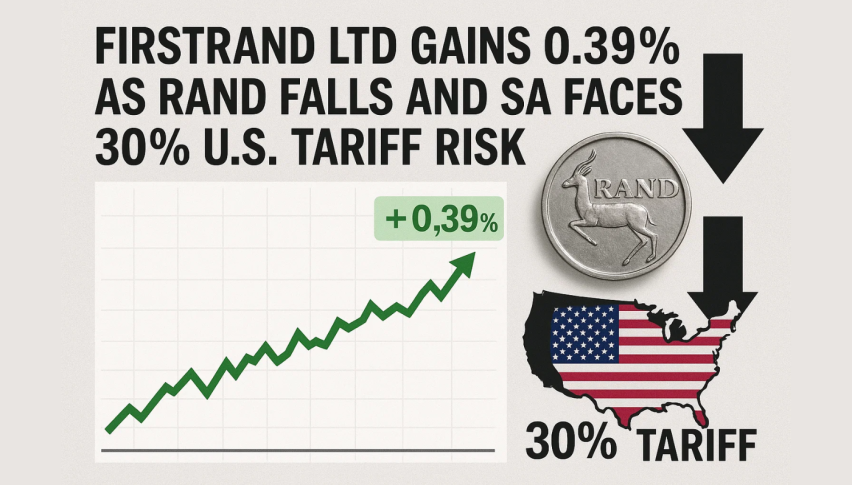

FirstRand Ltd Gains 0.39% as Rand Falls and SA Faces 30% U.S. Tariff Risk

FirstRand Ltd (JSE: FSR) up 0.39% to 7,563 ZAC, +29 ZAC today. Investors are showing resilience in the face of mounting macro headwinds...

Quick overview

- FirstRand Ltd shares increased by 0.39% to 7,563 ZAC amid investor resilience despite macroeconomic challenges.

- The SARB is expected to cut rates by 25bps, which may support credit growth and positively impact FirstRand's earnings.

- The rand weakened due to stalled US trade talks, contributing to rising bond yields and market uncertainty.

- Technical analysis indicates a bullish setup for FirstRand if the stock breaks above the 7,619 ZAC resistance level.

FirstRand Ltd (JSE: FSR) up 0.39% to 7,563 ZAC, +29 ZAC today. Investors are showing resilience in the face of mounting macro headwinds – rand weakening, bond yields rising and US tariffs on SA exports.

Markets are waiting for Thursday’s SARB announcement and August 1 deadline for US tariffs on SA exports. These events, combined with ongoing pressure, will impact banking sector profitability and foreign investment sentiment.

Rate Cut Speculation and Credit Momentum

Economists polled by Reuters expect SARB to cut by 25bps, citing easing inflation and need to support growth. Liquidity is increasing, M3 money supply up 7.27% in June from 6.86% in May. Credit growth steady at 4.98% supported by lower rates and improving consumer confidence.

According to Nedbank economists, credit growth is picking up:

“Credit growth is starting to recover, reflecting lower interest rates and some improvement in household finances.”

This should be a tailwind for FirstRand’s earnings, offsetting margin compression from lower rates.

Rand Weakness and Bond Market Jitters

The rand weakened today as US trade talks stall. The rand is sensitive to risk and global headlines. ETM Analytics says there is limited negotiation progress and SA may have to accept whatever the US offers.

This uncertainty is also reflected in the bond market where the benchmark 2035 yield rose 2.5bps to 9.825%.

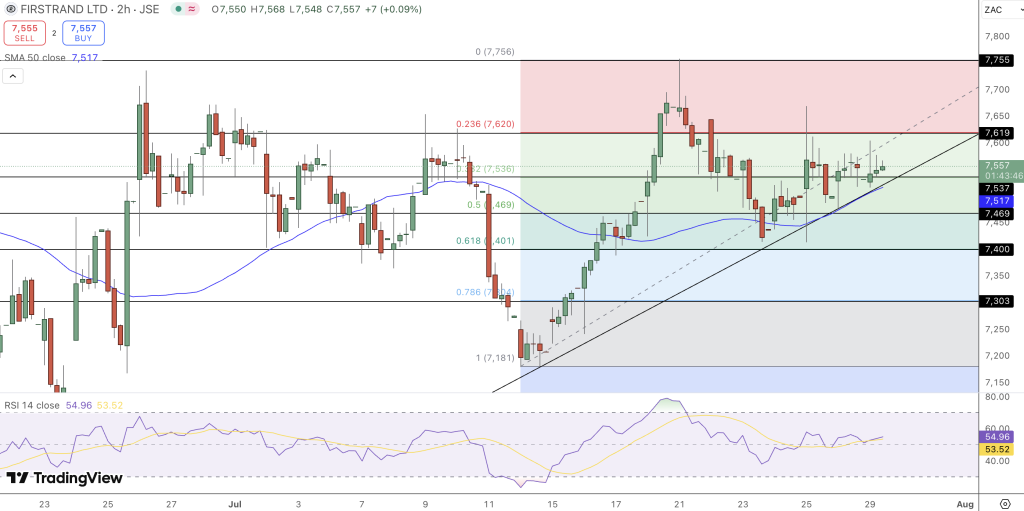

Technical Analysis: Bullish Bias Holds Above Key Levels

Technically FirstRand stock is still bullish, just below 23.6% Fibonacci resistance at 7,619, with short term momentum supported by the rising trendline and 50-SMA at 7,518. RSI at 56 is healthy bullish without being overbought.

Key levels to watch:* Immediate resistance: 7,619

- Breakout target: 7,755

- Support zones: 7,518, 7,469 and 7,401

A close above 7,619 could confirm the bullish move to 7,755, below 7,518 could see a pullback to 7,469.

Quick Points:

- FirstRand up 0.39% to 7,563 ZAC

- SARB to cut by 25bps on Thursday

- 30% US tariff risk on August 1

- Rand weakness and bond yields rising

- Bullish setup if 7,619 is broken

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account