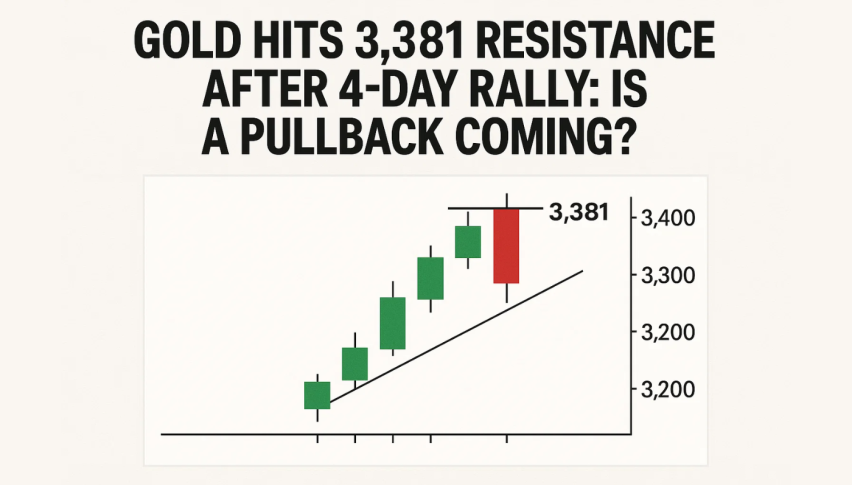

Gold Hits $3,381 Resistance After 4-Day Rally: Is a Pullback Coming?

Gold is up again, 4 days in a row and $3,381. 100% retracement of the recent decline. After weaker US jobs number, expectations...

Quick overview

- Gold has risen for four consecutive days, reaching $3,381, following weaker US jobs data that has led to expectations of earlier Fed rate cuts.

- Despite positive fundamentals, gold faces resistance at $3,381, with indecisive candles indicating potential buyer fatigue.

- Technical indicators like RSI suggest caution, as it approaches overbought levels, hinting at a possible short-term reversal.

- Traders are advised to wait for a clear price decision, with potential targets for retracement set at $3,343 and $3,331.

Gold is up again, 4 days in a row and $3,381. 100% retracement of the recent decline. After weaker US jobs number, expectations are that the Fed will cut rates sooner than expected. With lower yields and a softer dollar, gold is back in the spotlight for safe haven investors.

But while the fundamentals look good, the chart tells a different story. Gold is into a big resistance zone defined by the July highs trendline and the 0% Fib at $3,381. The candles are getting indecisive – upper wicks and narrow bodies suggest buyers are running out of steam.

RSI is also flashing caution, just under 70, which is overbought for many technical traders. This is often a signal to look for a short term reversal or at least a pause before the next leg up.

What the Charts Are Saying

From a pure charting perspective, the rally has been clean. Gold has a bullish EMA crossover on the 2 hour chart and reclaimed the 50 SMA at $3,326. More importantly the sequence of higher lows is bullish short term.

But prices are stalling just below resistance. If bulls can’t get through here, the market may retrace to:

- $3,343 – 38.2% Fib

- $3,331 – 50% Fib and SMA

- $3,303 – previous consolidation base

A close above the trendline and $3,381 would be strong and open up $3,406 and $3,443.

Trade Setup: Wait for Price to Make the Decision

If you’re new to trading, this is one of those times where you wait for price to make the decision for you. Right now gold is either going to break out or pull back.

Trade Plan:

- Entry: Look for a bearish candle near $3,381 (shooting star or bearish engulfing candle)

- Target 1: $3,343 (first major support)

- Target 2: $3,331 (confluence of support zones)* SL: $3,406 (trendline break)

Notes:

- If gold closes above $3,381 with volume, reverse the bias and look for more upside.

- Don’t jump in, wait for the market to show its hand.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account