Nvidia Partner CoreWeave Stock Plummets after Reporting Losses

CoreWeave may hold Nvidia's computing chips, but they cannot hold a candle to Nvidia's profits, as they reported recently

Quick overview

- CoreWeave's stock fell 9% after announcing lower than expected operating income for the third quarter.

- The company adjusted its operating income forecast from $192 million to between $160 million and $190 million.

- CoreWeave anticipates spending $350 million to $390 million on interest, contributing to a significant stock decline.

- Analysts warn that CoreWeave's struggles could negatively impact the broader AI market and tech companies reliant on AI.

After announcing lower than expected operating income for the upcoming third quarter report, CoreWeave (CRWV) saw its stock fall 9% on Wednesday.

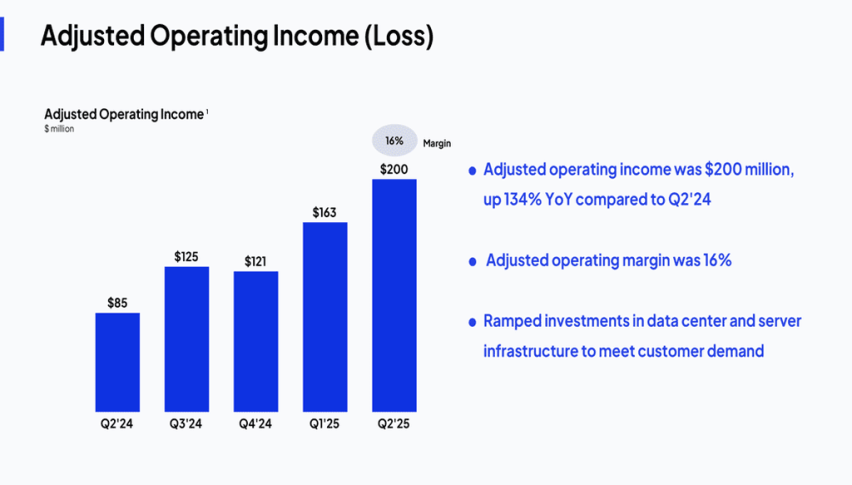

CoreWeave stock is in sharp decline, falling 10.79% over the last 24 hours and adding to Wednesday’s decrease. The stock drop is due to the company adjusting their operating income numbers for the third quarter. Analysts on Wall street had previously predicted that the company’s operating income for that quarter would be around $192 million, but the company adjusted that down to somewhere between $160 million and $190 million.

CoreWeave also anticipates that they will spend anywhere from $350 million to $390 million on interest for their third quarter. These numbers have proven to be dire for the company’s stock performance, knocking the value down from $148 per share to $105 in a matter of hours.

CoreWeave functions as a data center that is partnered with Nvidia (NVDA), and they hold more of Nvidia’s AI chips than any other company. They also provide data center services to Microsoft, Google, and Meta Platforms.

Why CoreWeave’s Stock Drop Cold Be Disastrous for AI

Many analysts use CoreWeave’s performance as a way to measure the AI market. If that company cannot keep afloat in the current market that seems to be so AI driven, then that may be disastrous for the rest of the tech companies that rely on AI for business.

CoreWeave is having trouble earning profit adequate to pay back all of the lenders they owe. That may be bad news for the rapidly expanding AI market. With so many major companies relying on AI to drive their future technological advances, this could be a blow to their investor support.

CoreWeave is expected to be bullish since it plays such an integral role in the growth of artificial intelligence, but if they cannot make a tidy profit in the AI business, their performance may signal to other tech companies that the money is simply not as abundant as they think it is. CoreWeave is guilty of borrowing money at very high interest rates, adding to its massive debt at an appreciable rate and creating a debt hole they have little hope of digging their way out of.

The last earnings report showed that they did not meet expectations, with losses calculated at $0.27 per share. That is higher than the anticipated loss of $0.19. However, the company did earn more revenue than expected, pulling in $1.21 billion for the quarter compared to the expected $1.08 billion. The demand for their services is obviously there, but CoreWeave has to figure out how to meet that demand without adding to their mountain of debt,

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM