JSE Top 40 Faces Technical Exhaustion as Markets Eye SARB Decision

SA equity markets are supported by steady investor sentiment even as technicals on the JSE Top 40 Index are showing signs of fatigue.

Quick overview

- SA equity markets are experiencing steady investor sentiment despite signs of fatigue in the JSE Top 40 Index.

- The rand remains stable as investors anticipate upcoming CPI data and the SARB's policy decision, with inflation expectations at record lows.

- Bond markets are supportive, with the 2035 yield rising slightly, while the US dollar weakens, potentially boosting risk appetite in emerging markets.

- Technical indicators suggest caution for the JSE Top 40, with immediate support levels identified and a bearish pattern forming.

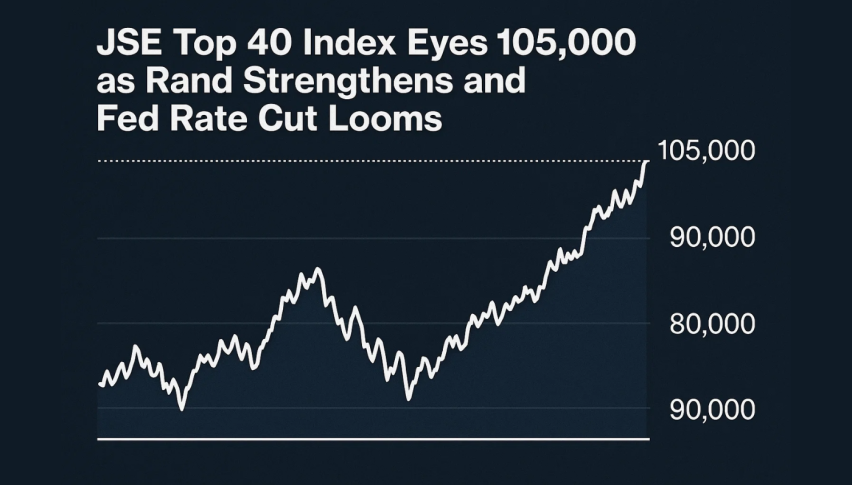

SA equity markets are supported by steady investor sentiment even as technicals on the JSE Top 40 Index are showing signs of fatigue. The benchmark slipped back to 97,050 on Wednesday as investors weighed local inflows, rand stability and upcoming policy catalysts.

Rand steady ahead of CPI and SARB call

The rand was steady in early trade as investors waited for CPI data and SARB’s policy decision later this week. Analysts note that inflation expectations have eased to record lows after SARB reaffirmed its commitment to price stability, which is encouraging selective bond inflows.

Bond markets are also supporting sentiment. The 2035 yield rose 1 basis point to 9.225% after a 12-point drop on Monday that left yields at their strongest levels since 2018. ETM Analytics says the rand is directionally dependent on foreign demand for SA bonds and is sensitive to domestic CPI and global interest rate signals.

Globally, the US dollar was 0.3% weaker against a basket of currencies as markets expect a Fed rate cut, which should improve risk appetite across emerging markets, including SA. Analysts say a dovish Fed and SARB’s steady hand could further strengthen the rand and support local shares.

JSE Top 40 Technicals

While fundamentals are constructive, the JSE Top 40 Index is looking tired after the big run. The chart shows a rising wedge, a technical pattern that often means a reversal when momentum fades.

Price tested the upper wedge boundary at 98,000 before retreating, leaving long upper wicks behind which is selling pressure. The latest candle sequence is a bearish engulfing pattern, which is bearish for the short term.

Immediate support is at 96,787 and 96,244. A close below these levels would confirm the wedge breakdown and 95,640 is next. Above 97,800 would invalidate the bearish setup and 98,500 is next.Indicators are also warning of caution. The RSI has rolled over from overbought and multiple spinning top candles at the highs are showing indecision. The 50-day EMA is above the 200-day EMA, which keeps the bigger trend intact but shows momentum is cooling.

JSE Top 40 Outlook

In the short term, traders are waiting to see if CPI and SARB will validate the JSE’s move or trigger consolidation. Aggressive traders can short below 96,780 to 96,240-95,640, while conservative investors can wait for a close above 97,800 to 98,500.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account