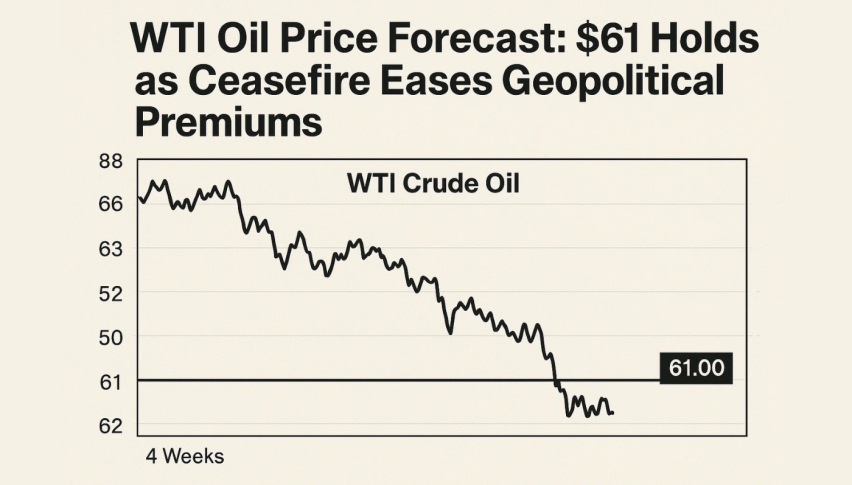

WTI Oil Price Forecast: $61 Holds as Ceasefire Eases Geopolitical Premiums

WTI crude oil futures traded around $61.50 on Friday, down from the previous session as geopolitical risk premiums eased...

Quick overview

- WTI crude oil futures are trading around $61.50, down from the previous session due to eased geopolitical risks following a ceasefire agreement between Israel and Hamas.

- Oil prices remain supported by US sanctions on entities linked to Iran's energy network, despite a rise in domestic crude inventories.

- OPEC+ has opted for a smaller production increase than expected, contributing to market volatility and cautious sentiment.

- Technically, WTI Crude Oil is under pressure, with key resistance at $62.70, and a close above this level could signal a shift in momentum.

WTI crude oil futures traded around $61.50 on Friday, down from the previous session as geopolitical risk premiums eased after a major breakthrough in the Middle East. Israel and Hamas agreed on the first phase of a ceasefire plan in US- and Qatari-brokered talks to end the two-year conflict.

The easing of geopolitical tension took some of the risk-driven buying out of the market. But oil prices are still up for the week, supported by US sanctions on more than 50 individuals, firms and vessels linked to Iran’s energy network, including a major import terminal and a Chinese refinery partner.

Meanwhile, US Energy Information Administration (EIA) data showed domestic crude inventories rose for the second week in a row but were near seasonal lows. Cushing, Oklahoma and refined product inventories continued to decline, indicating underlying demand strength.

OPEC+ Decision Adds to Market Volatility

OPEC+ decided on a smaller production increase than expected, the lowest of the scenarios, and the market was disappointed. The alliance is still cautious about supply stability.

This cautious approach, combined with easing geopolitical risks, has kept oil in a tight range and now sentiment is looking at near-term technicals for direction.

WTI Crude Oil (USOIL) Technical Outlook: Down Below $62.70

From a technical standpoint, WTI Crude Oil (USOIL) is under pressure near $61.38 and can’t get above the descending trendline from the $66.40 high. The price structure shows lower highs and lower lows, a short-term downtrend.

The 50-period SMA ($61.96) and 100-period SMA ($62.57) are above and have repeatedly rejected the bulls. The 38.2% Fibonacci retracement at $62.70 is a key level, unless prices close above it, sellers are in control.

Candlestick patterns show uncertainty with several spinning tops and upper wicks near resistance, fading buying pressure. RSI is at 37, momentum is stretched to the downside but not yet confirmed.

Trade Setup:

- Short: Failed retests between $61.90-$62.30, target $61.00 and $60.40.

- Stop-Loss: Above $62.70 to protect a breakout.

- Reversal Signal: Bullish engulfing or hammer near $60.40 could be a short-term bounce to $63.00.

For now oil is in a controlled downtrend, dips to $60 will test buyers. A close above $62.70 would be the first sign that momentum is shifting back to the bulls, but until then, caution is the name of the game.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM