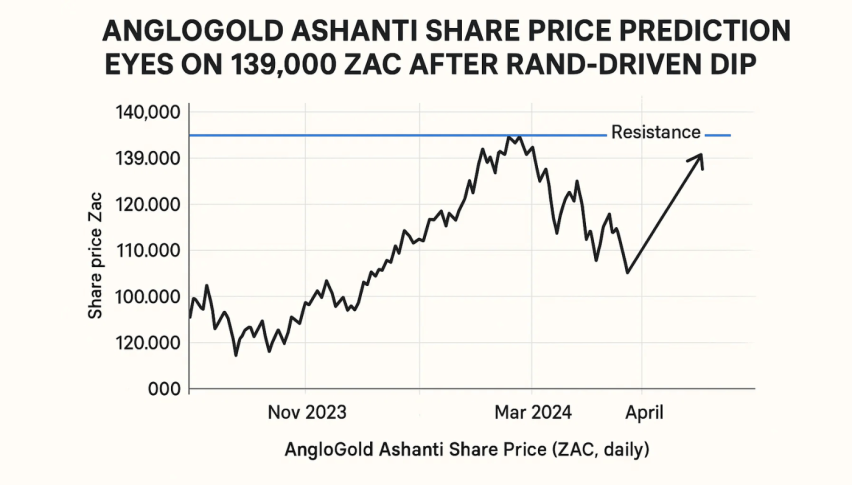

AngloGold Ashanti Share Price Prediction: Eyes on 139,000 ZAC After Rand-Driven Dip

AngloGold Ashanti - the South African mining giant - took a stumble on Monday, falling by 1.1% - or 1,411 ZARS - to 126,589 ZARS.

Quick overview

- AngloGold Ashanti's stock fell by 1.1% to 126,589 ZARS due to profit-taking and a stronger rand.

- The rand's strength has negatively impacted the rand-value of the company's dollar-denominated gold sales.

- Despite currency concerns, gold prices remain stable due to geopolitical tensions and ongoing trade disputes.

- Technical analysis suggests potential upward momentum for AngloGold, with a target of 139,000 ZARS if the price holds above 119,958 ZARS.

AngloGold Ashanti – the South African mining giant – took a stumble on Monday, falling by 1.1% – or 1,411 ZARS – to 126,589 ZARS. Investors ran for the exit in the face of profit-taking and a stronger rand, which is now trading at around R17.30 to the US dollar. And that’s not all – it’s seen the rand-value of the company’s dollar-denominated gold sales take a hit.

Investec’s chief economist Annabel Bishop put her finger on the problem – “The US has been sending mixed messages on tariffs, with threats of higher duties on China going back and forth. This is creating all sorts of uncertainty in global markets”.

Just last week, the rand touched R17.00/USD but then pulled back to R17.50 as US tariff tensions flared up again – but then it stabilised when the US softened its tone.

The ongoing US government shutdown has added to the uncertainty, with investors getting nervous and heading for safe-haven assets like gold.

Gold Keeps On Shining Despite Currency Worries

Despite the stronger rand, gold prices are still being supported by all the geopolitical tension and the ongoing trade dispute between Washington and Beijing. And it’s getting serious – tariffs on certain goods from China are already over 145% – and the threat of 100% duties on some items has only added to the risk aversion.

China is digging in its heels and defending its trade interests – while President Trump has been trying to dial down the rhetoric, easing fears of an immediate escalation. This delicate dance has helped gold prices stabilise, and that in turn has helped cushion AngloGold’s revenues against the impact of the stronger rand.

The governor of the South African Reserve Bank, Lesetja Kganyago, has been singing the praises of the rand’s resilience this year. He points to the fact that inflation is down and policy coordination has improved. The rand is now about 8% stronger than it was at the start of the year, when it was trading at around R18.82/USD. Long-term stability is good news for interest rates – but it means that export profits for resource producers are going to take a hit.

Interesting Facts

- Option-implied rand volatility is near multi-year lows.

- South Africa is aiming to get its inflation rate down to 3% – in line with other countries.

- A stronger rand could see mining-sector earnings in local currency terms take a hit.

AngloGold Ashanti Technical Analysis: Channel Remains Key

Looking at the charts, AngloGold Ashanti is trading at 128,503 ZARS, inside a well-defined rising channel. The 100-period moving average is hovering around 106,735 ZARS, which shows that the trend is still firmly intact. The next key resistance levels are 133,080 ZARS and 139,429 ZARS – and prior rallies have stalled at these levels.

The RSI is at 56.9, which suggests there’s still some momentum – and it’s rebounded from midline territory after Monday’s correction. As long as the price holds above 119,958 ZARS – the bottom of the channel – the trend bias is still positive, and the target is 139,000 ZARS in the coming sessions.

Traders will be watching for higher highs within the channel before a potential test of the 145,927 ZARS ceiling later this quarter. If the price closes below 119,958 ZARS, that would be a problem – and it would leave the 114,495 ZARS support line exposed.

In a Nutshell

AngloGold’s short-term prospects are a bit of a mixed bag – it’s got a strong rand on one hand, but steady gold demand on the other, thanks to the ongoing uncertainty. With technicals pointing upwards and fundamentals favouring safe-haven inflows, momentum traders are looking at further upside to 139,000 ZARS – provided the rand’s strength stays orderly.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM