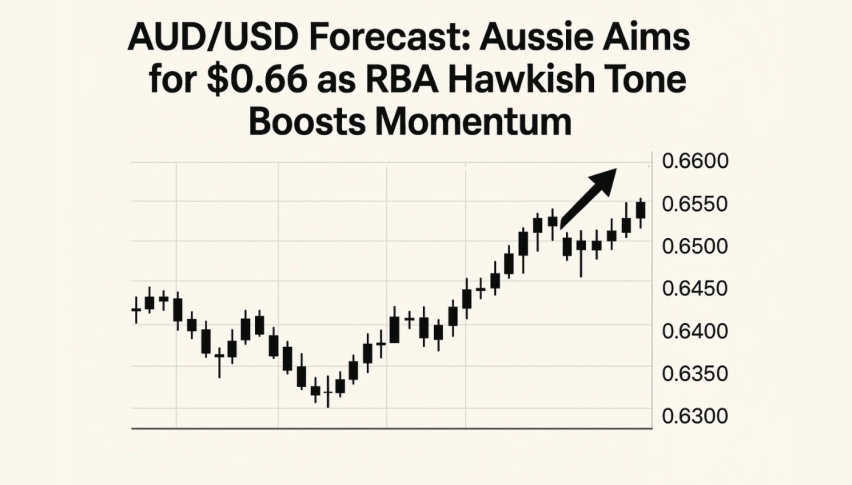

AUD/USD Forecast: Aussie Aims for $0.66 as RBA Hawkish Tone Boosts Momentum

The Australian Dollar found its footing in early European trading, pushing AUD/USD up to $0.6520 as markets responded positively...

Quick overview

- The Australian Dollar is gaining strength against the US Dollar, reaching $0.6520 due to hawkish signals from the Reserve Bank of Australia.

- RBA officials express confidence in the economy and rising inflation expectations, suggesting that rate cuts may be further away than anticipated.

- In contrast, the US Dollar is under pressure as traders bet on deeper Federal Reserve rate cuts amid softer economic data.

- Technical indicators show potential for AUD/USD to break above $0.6560, which could signal a sustained recovery despite challenges from China's economic weakness.

The Australian Dollar found its footing in early European trading, pushing AUD/USD up to $0.6520 as markets responded positively to some surprisingly hawkish signals from the Reserve Bank of Australia.

What’s driving this move?

It’s a combination of RBA officials sounding more confident about the economy and rising inflation expectations that suggest rate cuts might be further away than many expected. Meanwhile, the US Dollar continues to feel pressure as traders increasingly bet on deeper Federal Reserve rate cuts, fueled by softer economic data and growing global uncertainty.

RBA Assistant Governor Sarah Hunter delivered some noteworthy comments that caught the market’s attention. She pointed out that recent economic data has been “stronger than expected” – always music to a currency’s ears – and suggested that inflation could actually rise above current forecasts in the third quarter. Her emphasis on the tight labor market conditions reinforces the idea that the RBA isn’t in any rush to ease monetary policy.

This matters because it sets Australia apart from many other central banks currently leaning toward cuts. Adding fuel to this narrative, inflation expectations in Australia climbed to 4.8% in October, marking the highest level since June and reinforcing concerns that consumer prices may stay stubbornly elevated.

Governor Michele Bullock’s focus on persistent services inflation sends a clear message to markets: rate cuts remain premature for Australia. This hawkish stance got an additional boost from Canberra’s announcement of a A$1.2 billion ($776 million) strategic reserve for critical minerals. While this might seem like a policy detail, it actually signals strong government confidence in Australia’s long-term economic prospects – the kind of forward-thinking investment that typically supports currency strength.

US Dollar Weakens on Rate-Cut Bets

Across the Pacific, the US Dollar story continues to evolve in the opposite direction. Fed Chair Jerome Powell’s recent signals pointing toward another quarter-point rate cut this month have kept selling pressure on the greenback.

The numbers tell the story clearly: the CME FedWatch Tool shows a 94% chance of an October rate cut and a 93% probability of another reduction in December. When the market is this confident about the Fed’s direction, it typically shows up in currency movements.

Other Fed officials are singing from the same songbook. Philadelphia Fed President Anna Paulson has warned about growing downside risks in the US job market, while the latest FOMC minutes revealed a strong inclination toward further easing.

Despite the Dollar’s traditional safe-haven appeal during uncertain times, this monetary policy divergence is proving more powerful than flight-to-quality flows. The result? A gradual erosion of the greenback’s strength as markets price in a more dovish Fed path.

However, not everything is pointing toward AUD strength. Weaker inflation readings from China – Australia’s largest trading partner – have put a cap on the Aussie’s gains. China’s CPI actually fell 0.3% year-over-year, missing expectations, while the Producer Price Index declined by 2.3%.

These numbers paint a picture of soft domestic demand in China, which naturally flows through to Australian exports. Combined with a smaller trade surplus and ongoing US-China tensions, this China weakness continues to weigh on regional risk appetite and limits how far the AUD can realistically climb.

AUD/USD Technical Setup: Bulls Eye $0.66 Breakout

From a technical perspective, AUD/USD is showing encouraging signs of life after bouncing from $0.6440 – a level that proved its worth as strong support back in late September. The pair has managed to form what technical analysts call a higher low, which suggests that the intense selling pressure we saw earlier is starting to fade. This is often one of the first signs that a currency might be ready to turn the corner.

The immediate challenge for bulls lies in a resistance zone between $0.6530 and $0.6560, where the 100-period simple moving average meets previous consolidation highs.

Think of this as a test – if AUD/USD can break cleanly above $0.6560, it would validate what could be the beginning of a more sustained recovery pattern. Success here opens the door toward $0.6600 and potentially $0.6635, levels that would represent a meaningful shift in market sentiment.

The candlestick patterns add another layer of confidence to this bullish scenario. A classic three white soldiers formation emerged from the recent bottom, signaling that buyers are stepping back into the market with conviction.

However, the most recent spinning top candle suggests some short-term hesitation – not unusual before a decisive breakout attempt. The RSI sitting at 57.2 provides additional support, showing growing momentum without flashing any overbought warnings that might concern bulls.

Trade Setup Summary

- Entry: Above $0.6560 (confirmed breakout)

- Targets: $0.6600 and $0.6635

- Stop-Loss: Below $0.6470

- Bias: Cautiously bullish above $0.6480

Summary

With the RBA maintaining its hawkish edge while inflation expectations firm up, AUD/USD appears well-positioned for further recovery. The key catalyst to watch is a clean break above $0.6560, which could mark the beginning of a medium-term uptrend – especially as Fed rate-cut expectations continue to undermine US Dollar strength.

While China’s economic softness provides a headwind, the fundamental divergence between Australian and US monetary policy creates a compelling backdrop for AUD strength, provided the technical breakout materializes as expected.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account