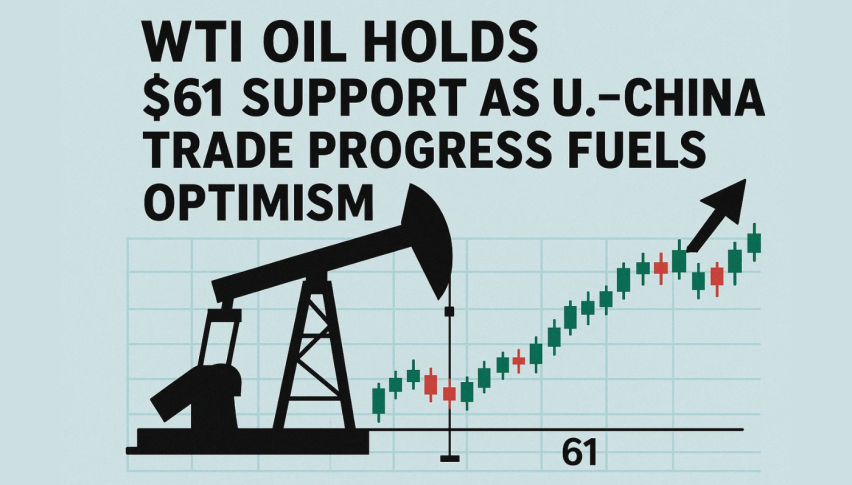

WTI Oil Holds $61 Support as U.S.–China Trade Progress Fuels Optimism

Oil prices got an uplift on Monday thanks to renewed hopes that the US and China are getting their trade act together.

Quick overview

- Oil prices rose on Monday due to renewed optimism about a potential US-China trade deal aimed at preventing further tariffs.

- US Treasury Secretary Scott Bessent indicated that the new framework would halt the 100% tariff increase on Chinese goods and ease restrictions on rare-earth exports.

- Analysts at Haitong Securities noted that easing geopolitical tensions and new sanctions on Russian oil firms have alleviated oversupply concerns affecting crude prices.

- WTI crude is currently trading around $61.50, with key support levels identified and a bullish outlook as long as prices remain above $59.

Oil prices got an uplift on Monday thanks to renewed hopes that the US and China are getting their trade act together. That’s because the two nations’ economic teams have come up with a preliminary framework for a deal that’s supposed to prevent further tariffs and ease export restrictions, helping calm market nerves after the wild ride in October.

US Treasury Secretary Scott Bessent said this framework will stop the 100% tariff hike on Chinese goods and put the brakes on Beijing’s restrictions on rare-earth exports. Meanwhile, President Trump is sounding optimistic about getting this deal done, mentioning possible meetings on both sides of the Atlantic.

The analysts at Haitong Securities reckon that easing geopolitical tensions and slapping new sanctions on Russian oil firms Rosneft and Lukoil have helped counter concerns about oversupply that had been putting the squeeze on crude prices a few weeks ago. However, they’re warning that if those sanctions don’t work out, all that cheap Russian crude could be back, putting downward pressure on the market.

Crude Oil Technical View: The $60 Key Area for Buyers to Make Their Move

On the 4-hour chart, WTI crude is trading around $61.50, consolidating after a strong rebound from October’s low of $55.90. And if you take a close look at the chart, it’s been forming a clear series of higher lows, which is a nice way of saying there’s been sustained buying.

The recent candles on the chart are showing a bit of hesitation near $62.57, which is a support level that’s been in place since early October. And looking at the RSI, it’s at 70, which is about the point where the market usually takes a breather.

The 20 EMA is down near $61.20, which is a strong level of support for WTI, and Fibonacci retracement levels mark deeper buying zones at $60.05 and $59.27.

Crude Oil (USOIL) Trade Outlook: Bullish so long as we stay above $59

- Buy zone: $60- $60.20 – that’s where the trendline and EMA come together to give you some support

- Target: $63.68 – $64.70 – that’s the resistance zone we’re looking to break

- Stop loss: below $58.40

So long as WTI stays above $59, the overall trend remains in our favor, thanks to those rising EMAs and improving market sentiment. And if it can get through the $62.57 level, then it’s off to the races – and it could get back up to those late September highs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account