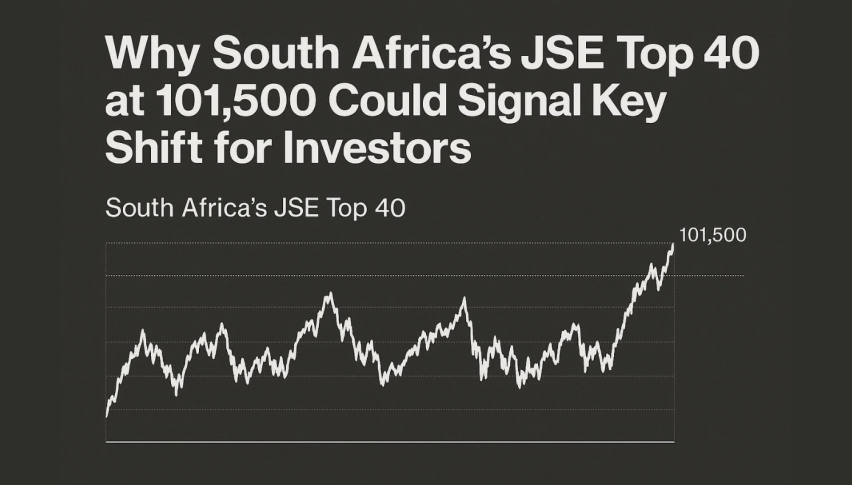

Why South Africa’s JSE Top 40 at 101,500 Could Signal Key Shift for Investors

The South Africa JSE Top 40 Index is holding near 101,500 after bouncing sharply from the 100,100 support zone — a move suggesting...

Quick overview

- The JSE Top 40 Index is stabilizing near 101,500 after a rebound from the 100,100 support level, indicating a potential trend reversal.

- South Africa's PMI fell to 48.8 in October, signaling the first contraction in seven months and reflecting weaker private-sector activity.

- While new orders have declined sharply, improvements in supplier delivery times and easing input cost inflation suggest better supply-side conditions.

- The South African rand's 7% year-to-date strength is helping to reduce import costs and inflation pressures, fostering cautious optimism among firms.

The South Africa JSE Top 40 Index is holding near 101,500 after bouncing sharply from the 100,100 support zone — a move suggesting the formation of a higher low and potential trend reversal. Despite a softer economic backdrop, investors appear cautiously optimistic, rotating into select stocks while monitoring signs of recovery.

According to the latest S&P Global data, South Africa’s Purchasing Managers’ Index (PMI) slipped to 48.8 in October from 50.2 in September, marking the first contraction in seven months. A reading below 50 indicates slower private-sector activity, underscoring weaker demand conditions.

Demand Weakens but Supply Chains Ease

New orders dropped at their fastest pace since March 2024, and export activity softened as global demand cooled. Yet, the report noted bright spots: supplier delivery times improved to a 14-year high, and input cost inflation eased to its weakest pace in over five years. Firms cited improved logistics and lower raw material prices as key factors supporting smoother operations.

While these trends suggest better supply-side conditions, the decline in new business orders points to cautious consumer spending amid elevated living costs and policy uncertainty.

JSE Top 40 Rand Strength Cushions Inflation

The South African rand has strengthened roughly 7% year-to-date, offering some relief by curbing import costs and tempering inflation pressures. This currency resilience has been particularly supportive for manufacturing and trade-linked sectors. About one-third of surveyed firms still expect activity to improve over the next year, reflecting cautious optimism despite slowing domestic growth.

JSE Top 40 Technical Outlook: Breakout Zone Ahead

On the 2-hour chart, the JSE Top 40 recently broke out of a descending triangle but failed to sustain momentum above 102,600. The 20-EMA crossing above the 50-EMA hints at a potential bullish reversal, while RSI near 57 shows moderate strength without entering overbought territory.

A decisive close above 102,600 could trigger a rally toward 103,950 and 105,000, whereas a break below 101,200 risks a pullback to 100,100. For traders, this remains a classic pre-breakout setup, where patience and discipline may define the next profitable move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account