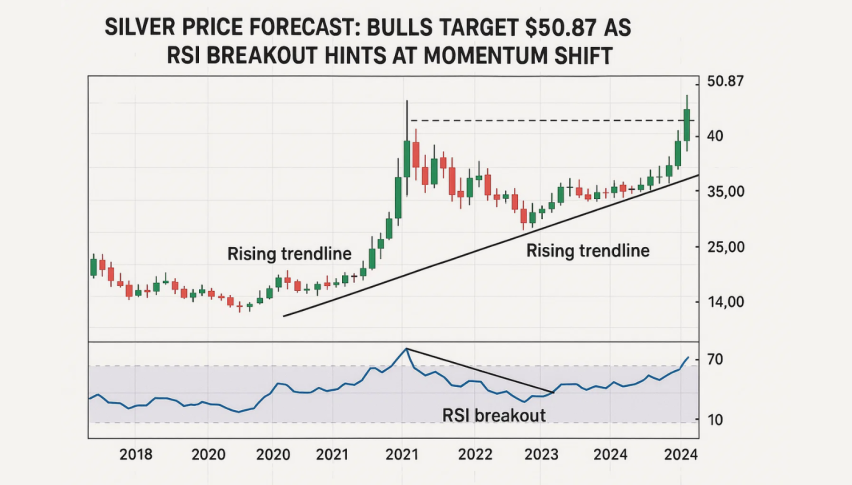

Silver Price Forecast: Bulls Target $50.87 as RSI Breakout Hints at Momentum Shift

Silver - thats currently trading at just north of $49.21 its managed to hold up well above the ascending trendline support at $47.97...

Quick overview

- Silver is currently trading above $49.21, maintaining support at $47.97 after a recent consolidation phase.

- The recent rally in silver is fueled by safe-haven demand and a weak dollar, with traders anticipating increased volatility due to upcoming US economic data.

- Technical analysis indicates a bullish setup, with a potential breakout above $49.33 leading to targets of $50.87 and $52.75.

- Traders should watch for a decisive close above resistance or a pullback to support levels for potential trading opportunities.

Silver – thats currently trading at just north of $49.21 its managed to hold up well above the ascending trendline support at $47.97 – that’s a pretty big deal after that stumble in late October, and now its fallen into a pretty tight consolidation zone just below the $49.33 resistance mark – this suggests to me that a breakout must be on the cards.

The most recent rally is being driven by renewed ‘safe-haven’ demand and a pretty weak dollar – not to mention the looming US inflation and retail sales data thats due later this week – all this is telling traders that they need to be on high alert for higher volatility, and its actually silver that’s been outperforming gold, at least from a short-term perspective.

Silver (XAG/USD) A Very Bullish Technical Setup Forming – Key Resistance Looms

Now, on the 4-hour chart, it’s as bullish a picture as you get—silver’s 20-day Exponential Moving Average is pointing upwards and lined up alongside the trendline at the bottom, which tells us that short-term momentum is gaining strength. And the RSI reading is 62, which I’d say is a pretty clear indication of positive sentiment, but it still has a bit of room to run before things get overbought.

[[XAG/USD-graph]]

Technical analysis shows that there have been multiple higher lows on the ascending trendline, while the repeated knockbacks at $49.33 are actually forming a near-term double-top resistance. A decisive close above this level, and well, that’s a breakout confirmed – with possible targets up at $50.87 and $52.75 – both of these align with previous swing highs.

On the other hand, if silver fails to hold above $47.97, we could see a pullback to $46.85, roughly where you’d expect previous buying interest to resume.

The Levels to Keep an Eye On

- Resistance: $49.33, $50.87, $52.75

- Support: $47.97, $46.85, $45.58

- RSI: 62 – looking pretty positive – but still a way off being overextended

Silver (XAG/USD) and a Key Decision Point – Will it be a Breakout – Or Bounce Opportunity?

Short-term traders – a break above $49.33 and you have a good chance of getting a trade up to $50.87 with a stop loss below $47.97. Or, on the other hand, you could see a pullback down to trendline support, and another buying opportunity could present itself.

At the moment, momentum is building and volatility is on the rise ahead of that US data, so silver’s next move is gonna define its short-term trend—either confirming a bullish run or just setting up another bit of sideways trading.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM