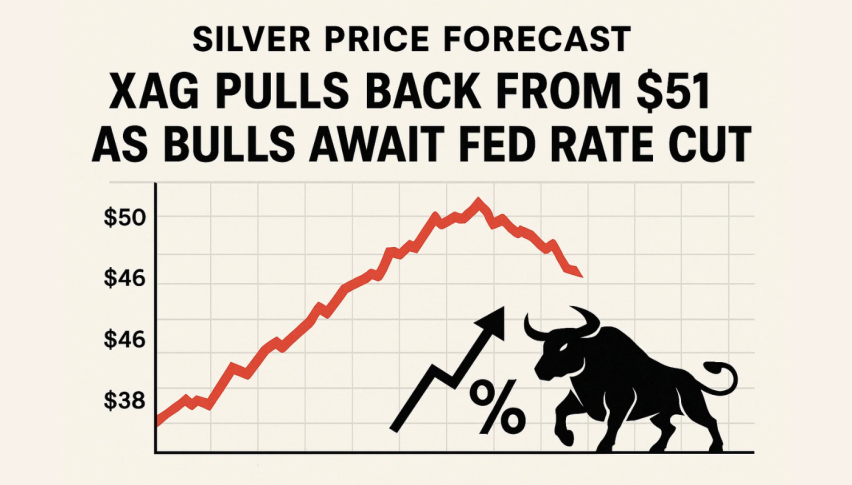

Silver Price Forecast: XAG Pulls Back From $51 as Bulls Await Fed Rate Cut

Silver (XAG/USD) drops back to $51.17 on Wednesday after almost 9% surge over the last two weeks had left it just shy of the $46.85...

Quick overview

- Silver (XAG/USD) has dropped to $51.17 after a nearly 9% surge, influenced by expectations of a Federal Reserve rate cut.

- The Dollar index's slight recovery has put pressure on precious metals, leading investors to hold profits while awaiting new economic data.

- Technical indicators suggest Silver may be overbought, with a potential pull-back towards the $49.40 - $50.10 area before re-entering the market.

- Despite near-term weakness, the broader bullish trend for Silver remains intact, with opportunities for traders to buy on dips.

Silver (XAG/USD) drops back to $51.17 on Wednesday after almost 9% surge over the last two weeks had left it just shy of the $46.85 support zone. This surge was primarily driven by the same momentum as gold, with traders pricing in a higher likelihood of a Federal Reserve rate cut in December – CME Group’s FedWatch Tool suggests a 25-basis-point cut now has a 68% chance, up from 64% the day before.

But the Dollar (DXY) index picked up a bit on Wednesday, snapping a five-day losing streak, which put some pressure on precious metals. Lots of investors are just sitting back and holding on to their profits for now, waiting for new economic data to justify another Fed move.

Silver (XAG/USD) Technical Setup: Could Be a Warning Light Turning On

On the 4-hour chart, Silver’s running up against the top of an upward channel—and a shooting star candle has just appeared. This often means the momentum is about to start fading. The Relative Strength Index (RSI) is still above 72, which just confirms how overbought Silver has become, and it’s not hard to figure it might be due for a bit of a pull-back.

[[XAG/USD-graph]]

If Silver does start going down, a move towards the $ 49.40 – $ 50.10 area is likely. This is also where the channel’s midline and the 20-period EMA meet—a spot where buyers usually re-enter—and was a level where buyers re-entered many times in the past.

Broad Picture Remains Bullish For Silver

Even though we’re seeing some near-term weakness, the bigger picture is still healthy. A higher-high and higher-low structure is in place, indicating the broader trend for Silver remains upwards. And the 20-ema is still holding its own over the 50-ema, which is a clear sign of how strong the momentum is for Silver right now.

For silver traders, this is a really good time to buy on the dips. Getting in near the $49.40-$50.00 mark, with a stop-loss below $48.90, sets you up to catch a ride to $52.75, where the upper channel resistance lies. If you can get past this level, you’re looking at a run to $54.46—but if you go below $49.00, you’re likely to see a re-test of the $46.85 support zone.

Silver Outlook: Just a Breath Before The Next Move

Silver’s pull-back at the moment doesn’t look like it’s going to be a full-on breakdown – with the Fed set to ease monetary policy and industrial demand holding up, this could just be the calm before the storm. If Silver can get through this little correction, it’s likely to give it a chance to test the $52-54 zone again once the momentum is reset.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM