UK Inflation, Retail Sales & PMI: 12 Key Data Shifts Set Up a Big GBP/USD Week

The UK closed out a busy data week with the pound under steady pressure, as most indicators painted a softer economic picture.

Quick overview

- The UK economy shows signs of weakness, with retail sales growth slowing and labor market indicators deteriorating.

- The pound is under pressure as investors reassess the Bank of England's growth outlook amid rising consumer and industry strains.

- Upcoming economic releases, particularly the CPI, are expected to influence market volatility and BoE expectations for December.

- GBP/USD remains in a rising channel but faces resistance, with key support and resistance levels identified.

The UK closed out a busy data week with the pound under steady pressure, as most indicators painted a softer economic picture. Retail activity slowed sharply, with the BRC Retail Sales Monitor rising only 1.5%, well below the 2.4% forecast and down from 2.0% previously, hinting that consumers are pulling back.

Labor-market readings were no better. Claimant Count Change surged to 29,000, far above the 17,600 estimate, signaling weakening job conditions. Earnings growth eased as well, with Average Earnings (3m/y) slipping to 4.8% vs 5.0% expected, while unemployment ticked up to 5.0%, narrowly missing the 4.9% forecast.

Housing sentiment deteriorated again. The RICS House Price Balance dropped to –19%, worse than the –14% consensus and only slightly better than last month’s –17%, reinforcing concerns around affordability and confidence.

Growth indicators delivered a mixed message:

- GDP m/m: –0.1% (forecast 0.0%, previous 0.0%)

- Prelim GDP q/q: 0.1% (forecast 0.2%)

- Manufacturing Production: –1.7% (forecast –0.7%)

- Industrial Production: –2.0% (forecast –0.5%)

One bright spot emerged: the Goods Trade Balance narrowed to –£18.9B, improving from –£19.5B, suggesting slight relief on the external demand side.

Taken together, the data pressured the pound as investors reassessed the Bank of England’s growth outlook and noted rising strains on consumers and industry.

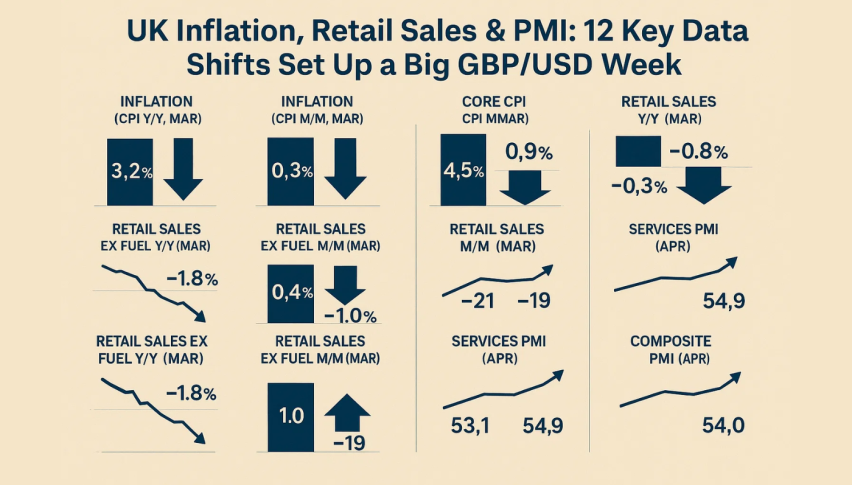

Week Ahead: Inflation, Retail Sales & PMI Take Center Stage

The coming week delivers a dense cluster of market-moving releases—enough to spark wide intraday swings across GBP/USD, EUR/GBP, and UK gilt yields.

The main event arrives Wednesday with the UK CPI print:

- Headline CPI y/y: forecast 3.6%, down from 3.8%

- Core CPI y/y: forecast 3.4%, just below 3.5% previously

This release will heavily influence BoE expectations for December.

Producer-price readings follow:

- PPI Input m/m: 0.0% expected (previous –0.1%)

- PPI Output m/m: 0.0% expected (previous 0.0%)

Housing data stays in focus with HPI y/y forecast at 3.1%, slightly above 3.0%.

Thursday brings business sentiment:

- CBI Industrial Orders: –30 expected (previous –38)

- 10-Year Bond Auction: monitored for shifts in demand

Friday rounds out the week with growth and confidence indicators:

- GfK Consumer Confidence: –18 expected (previous –17)

- Retail Sales m/m: 0.1% forecast (previous 0.5%)

- Flash Manufacturing PMI: 49.3 expected

- Flash Services PMI: 52.0 expected (previous 52.3)

With inflation, activity, and sentiment data all landing in a tight window, GBP volatility is likely to increase—especially around Wednesday’s CPI release.

GBP/USD Technical Analysis

GBP/USD remains within a rising 2-hour channel but continues to meet resistance at the descending trendline that has capped rallies since late September. Price is trading near 1.3170, caught between channel support at 1.3120 and overhead resistance near 1.3188, which aligns with the 38.2% Fibonacci retracement.

The structure stays constructive while higher lows hold, but momentum is soft. The RSI near 55 shows mild strength without strong follow-through.

- Break above 1.3188 → 1.3240 resistance

- Break below 1.3120 → 1.3058, then 1.3012 support

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account