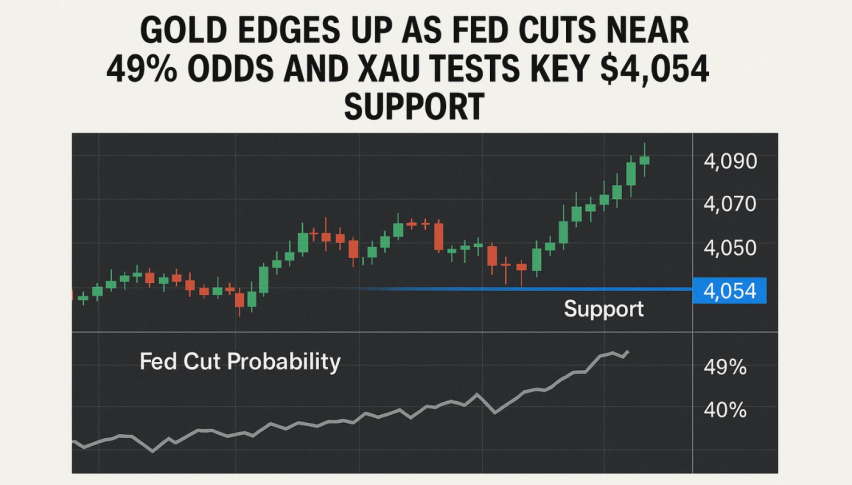

Gold Edges Up as Fed Cuts Near 49% Odds and XAU Tests Key $4,054 Support

Gold prices inched higher on Wednesday as traders positioned for two key U.S. releases: the Federal Reserve’s latest meeting minutes...

Quick overview

- Gold prices rose slightly as traders awaited key U.S. economic reports, including the Federal Reserve's meeting minutes and the September Nonfarm Payrolls.

- Despite a stronger U.S. dollar, gold remains a defensive asset, stabilizing prices amid uneven risk appetite.

- U.S. unemployment claims reached a two-month high, raising concerns about the labor market and influencing rate cut expectations for December.

- Technically, gold is showing signs of a potential rebound, with key resistance levels to watch for a bullish continuation.

Gold prices inched higher on Wednesday as traders positioned for two key U.S. releases: the Federal Reserve’s latest meeting minutes and the delayed September Nonfarm Payrolls report. Both updates are expected to shape expectations for the Fed’s next policy move, especially after last month’s 25-basis-point rate cut.

Risk appetite remains uneven. Investors continue to treat gold as a defensive asset, which has helped stabilize prices despite a slightly stronger U.S. dollar. The dollar index was up 0.1%, making bullion marginally more expensive for buyers using other currencies.

Fresh labor data also added tension to the macro picture. U.S. unemployment benefit claims climbed to a two-month high in mid-October, raising new questions about the strength of the labor market. Traders now assign a 49% probability to another rate cut at the December 9–10 meeting, according to CME’s FedWatch tool.

Rate Expectations Lift Market Focus

Even with mixed economic signals, the broader narrative remains the same: gold tends to benefit from a softer rate environment and periods of economic uncertainty. Chair Jerome Powell has signaled caution, noting the lack of dependable data during the recent government shutdown. That uncertainty keeps gold firmly in view for investors balancing risk and opportunity.

Key drivers this week include:

- Fed meeting minutes

- September NFP (Thursday)

- U.S. labor-market softness

- Shifting December rate-cut odds

Gold Technical Outlook: XAU Tests a Reversal Zone

Gold is showing the first signs of a technical rebound after last week’s sharp decline. Price is holding above the $4,054 support area and challenging a short-term descending trendline. A series of higher lows has emerged on the two-hour chart, with recent candles forming Doji and spinning-top patterns—signals that selling pressure is easing.

The RSI has recovered to 55, indicating improving momentum without entering overbought territory. Price is also testing resistance formed by the 20-EMA and the descending trendline. A clean break above this confluence, ideally confirmed by a bullish engulfing candle, would strengthen the case for a near-term reversal.

Fibonacci levels outline the next upside checkpoints: $4,120 (38.2%), $4,150 (61.8%), and $4,204—the prior swing high and 1.0 extension. A move through $4,149 would signal a broader continuation of the rebound. If gold slips back below $4,054, the bias shifts toward $3,997.

Gold Trade Setup: Early Signs of Strength

If gold closes above the descending trendline and holds above $4,068, a long position becomes attractive. Initial targets sit at $4,120, followed by $4,149. A protective stop under $4,030 keeps risk defined. This environment remains tactical, but the chart is beginning to show the early structure of a bullish rotation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account