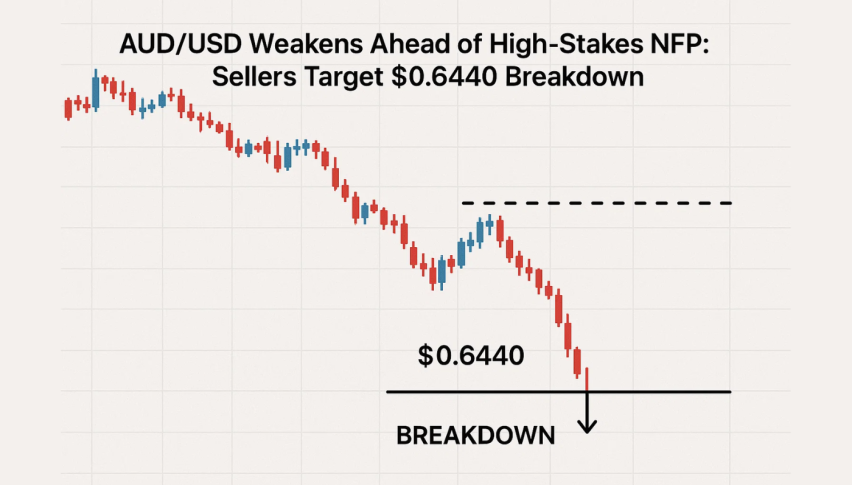

AUD/USD Weakens Ahead of High-Stakes NFP: Sellers Target $0.6440 Breakdown

During the European session, AUD/USD remained pinned near $0.6470, unable to shake off its bearish tone. The Australian dollar continues...

Quick overview

- AUD/USD remains near $0.6470, struggling against a strong US dollar amid reduced rate-cut expectations.

- The probability of a December rate cut has dropped significantly, bolstering the dollar as investors seek safer assets.

- Attention is on upcoming US Nonfarm Payrolls and Australian PMI data, which could influence market sentiment.

- Technical analysis shows AUD/USD under pressure, with a bearish continuation setup favored if it closes below $0.6440.

During the European session, AUD/USD remained pinned near $0.6470, unable to shake off its bearish tone. The Australian dollar continues to struggle as the US dollar holds firm near a five-month high around 100.30, supported by shifting expectations for Federal Reserve policy. With traders dialing back hopes for additional rate cuts this year, demand for the greenback has strengthened noticeably.

Reduced Rate-Cut Bets Lift the Dollar

Fresh CME FedWatch data shows the probability of a 25-basis-point cut in December falling to 32.8%, down sharply from 50.1% earlier this week. The decline came after the Federal Open Market Committee’s October minutes revealed a cautiously hawkish tone. Officials expressed concern that cutting rates too quickly could keep inflation elevated and undermine confidence in the Fed’s 2% mandate.

That message resonated across markets, boosting the dollar as investors favored safer, policy-backed assets. With rate-cut hopes fading, AUD/USD has had little room to recover.

Markets Await US NFP and Australian PMI

Attention now shifts to the delayed US Nonfarm Payrolls (NFP) report due at 13:30 GMT. Economists expect 50K new jobs, more than double August’s 22K reading, while the unemployment rate is expected to remain at 4.3%. Average hourly earnings are projected to rise 0.3% month-on-month, keeping wage trends in focus.

On the Australian side, traders await Friday’s flash S&P Global PMI figures, which will offer a timely read on economic momentum heading into year-end. Stronger-than-expected PMI data could provide temporary support for the Aussie, but the broader trend still favors USD strength unless US data disappoints.

AUD/USD Technical Outlook: Sellers Tighten Grip

AUD/USD remains under firm pressure as price slides back into the $0.6440–$0.6460 demand zone, an area that has consistently attracted buyers over the past two months. This time, however, momentum is noticeably weaker.

The pair continues to trade beneath the descending trendline drawn from September highs, and each attempt to break above it has been rejected. Price also sits below the 20-EMA, showing that short-term sentiment remains bearish. Recent candles display small bodies with long upper wicks, signaling hesitation rather than strength.

The RSI hovers in the low-40s, recovering slightly but showing no bullish divergence, a sign that bounces may remain limited. Structurally, the chart maintains a pattern of lower highs and lower lows, keeping the downtrend intact.

A firm close below $0.6440 would expose $0.6415, with deeper downside risk extending toward $0.6372 if sellers accelerate.

AUD/USD Trade Setup

For traders looking for clarity, the cleanest opportunity lies in waiting for confirmation rather than predicting reversals. A bearish continuation setup becomes attractive if the pair breaks and closes below $0.6440 with strong volume, targeting $0.6415 and potentially $0.6372.

A bullish scenario only takes shape if price forms a clear reversal candle — such as a bullish engulfing or hammer — and closes back above the 20-EMA. That shift would mark the first sign of buyer strength, with $0.6518 emerging as the initial recovery target.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account