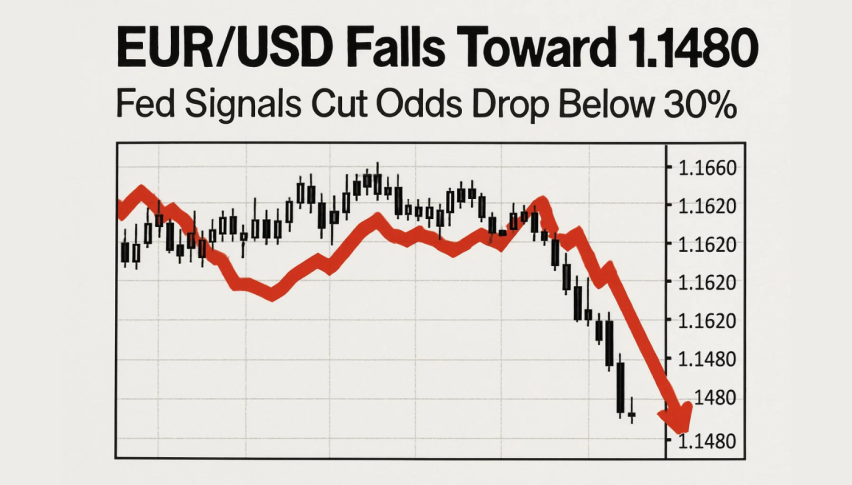

EUR/USD Falls Toward 1.1480 as Fed Signals Cut Odds Drop Below 30%

During the European session, EUR/USD extended its downturn, slipping toward the 1.1520 region as traders positioned for a firmer US dollar.

Quick overview

- EUR/USD continued its decline, approaching the 1.1520 level as traders anticipated a stronger US dollar.

- The latest Federal Reserve minutes indicated a reluctance to cut rates, reducing expectations for a December rate decrease.

- Weak Eurozone data, including a 0.5% drop in construction output, has added to the selling pressure on the Euro.

- Technical analysis shows EUR/USD facing a critical breakdown zone between 1.1510 and 1.1480, with bearish momentum prevailing.

During the European session, EUR/USD extended its downturn, slipping toward the 1.1520 region as traders positioned for a firmer US dollar. The mood shifted after the latest Federal Reserve minutes signaled that policymakers see little urgency to cut rates, effectively cooling expectations for a December move. At the same time, Eurozone data came in soft, leaving the Euro without supportive catalysts.

Fed Signals Reinforce Dollar Momentum

The October FOMC minutes revealed a central bank still wary of easing too quickly. Several officials argued that cutting rates prematurely could undercut inflation progress and damage policy credibility. As a result, the CME FedWatch Tool now shows the probability of a 25-bp December cut below 30%, sharply lower than last month’s near-90% pricing.

This adjustment has strengthened the dollar across major pairs, with EUR/USD absorbing most of the pressure.

Eurozone Weakness Adds to Selling Pressure

Eurozone Construction Output fell 0.5% in September, accelerating from August’s decline. Annual data also reversed gains, slipping 0.3%. With German Bundesbank commentary and the European Commission’s Consumer Confidence Index still ahead, traders remain cautious about Eurozone growth momentum.

The combination of softer regional data and a firmer US rate outlook keeps EUR/USD on the defensive.

Technical Outlook: EUR/USD Approaches Key Breakdown Zone

EUR/USD continues to show structural weakness on the chart. Price remains capped beneath a descending trendline from the October highs, and consistent closes below the 20-EMA reinforce bearish momentum. Recent candles show small bodies with extended wicks — a hesitation pattern that often precedes continuation.

RSI holds in the low-30s with no bullish divergence, confirming momentum still favors sellers. The key zone now sits between $1.1510 and $1.1480, an area with repeated historical reactions. A decisive break below $1.1480 would expose $1.1411, where prior demand last held.

If buyers defend the area, a corrective rebound toward $1.1540, and potentially $1.1598, becomes possible — but only if price closes back above the 20-EMA.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM