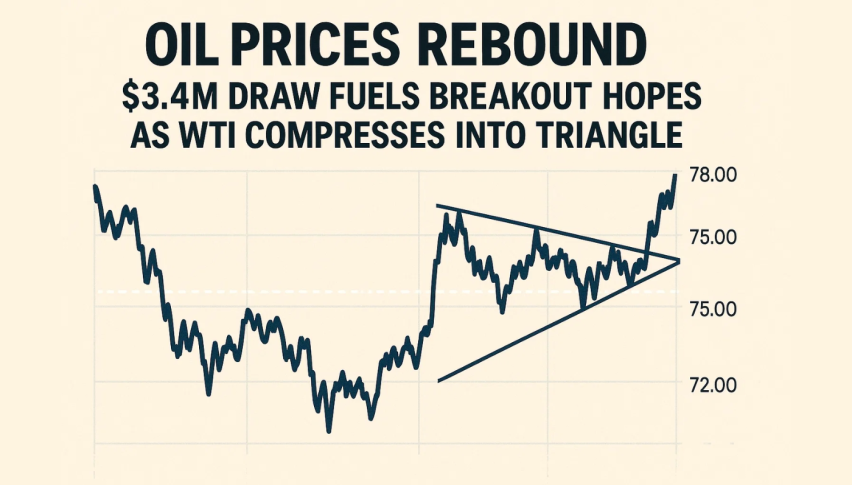

Oil Prices Rebound $3.4M Draw Fuels Breakout Hopes as WTI Compresses Into Triangle

Oil steadied on Thursday after a volatile session, with traders weighing signs of diplomatic movement in the Russia-Ukraine conflict...

Quick overview

- Oil prices stabilized after a volatile session, influenced by diplomatic developments in the Russia-Ukraine conflict and a significant drawdown in U.S. crude stockpiles.

- Analysts warn that Ukraine may reject any peace proposal seen as favoring Moscow, despite the U.S. pushing for negotiations that could ease sanctions on Russian crude.

- The market is supported by a 3.4 million-barrel drop in U.S. crude inventories, although rising gasoline and distillate stocks indicate potential cooling in consumer demand.

- WTI crude is currently in a tightening triangle pattern, with key breakout levels at $60.44 and support at $58.68, indicating potential trading opportunities.

Oil steadied on Thursday after a volatile session, with traders weighing signs of diplomatic movement in the Russia-Ukraine conflict against data showing a sharp drawdown in U.S. crude stockpiles. Both WTI and Brent bounced modestly after Wednesday’s 2.1% slide, a move sparked by a Reuters report that Washington has urged Kyiv to consider a U.S.-drafted peace framework involving territorial concessions.

Such a development could unwind sanctions on Russian crude and send additional supply into an already well-stocked global market. Oil stored at sea continues to rise, and several major producers have quietly increased output, adding to pressure.

Geopolitical Signals Shift Market Mood

Analysts caution that Ukraine is highly unlikely to accept a proposal perceived as favoring Moscow. Still, the U.S.’s renewed push for negotiations has eased fears of tighter sanctions and raised questions about the future enforcement of current restrictions.

Adding to the uncertainty, companies face a November 21 deadline to wind down dealings with Rosneft and Lukoil, Russia’s two largest oil producers and exporters.

Key factors shaping sentiment:

- Possible easing of sanctions if peace framework emerges

- Rising offshore crude storage

- Output increases from major producers

- U.S. deadline for companies exiting Russian oil contracts

U.S. Stockpile Draw Offers Support

The market found a counterweight in new EIA data showing a 3.4 million-barrel draw in U.S. crude inventories—far exceeding expectations of just 603,000 barrels. The drop reflects strong refining margins and steady export demand.

However, gasoline and distillate inventories climbed for the first time in over a month, hinting at cooling consumer demand.

WTI Technical Outlook: Triangle Tightens Ahead of Breakout

WTI crude is trading inside a tightening symmetrical triangle, a classic pattern that often precedes a sharp move once price escapes either boundary. The 2-hour chart shows oil repeatedly holding the rising trendline near $58.70, while every rally is capped below the descending trendline from the $62.46 high.

The latest dip toward $58.90 produced a long-wick rejection—evidence buyers are still active—but momentum remains soft.

The 20-EMA has flattened, signaling hesitation, and RSI near 45 shows neither bullish nor bearish dominance.

A breakout above $60.44 with a strong candle—ideally a bullish engulfing or three white soldiers—would open a path toward $61.48 and $62.46. Conversely, a close below $58.68 risks a slide into $57.93 and $57.01.

Trade Setup to Watch

A clean breakout-retest offers the most reliable opportunity.

A long position activates if WTI breaks $60.44 and retests that level as support, with stops under $59.80 and targets at $61.48 and $62.46.

Aggressive traders could short a rejection at $60.44 using a shooting star or bearish engulfing pattern, targeting $58.70.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM