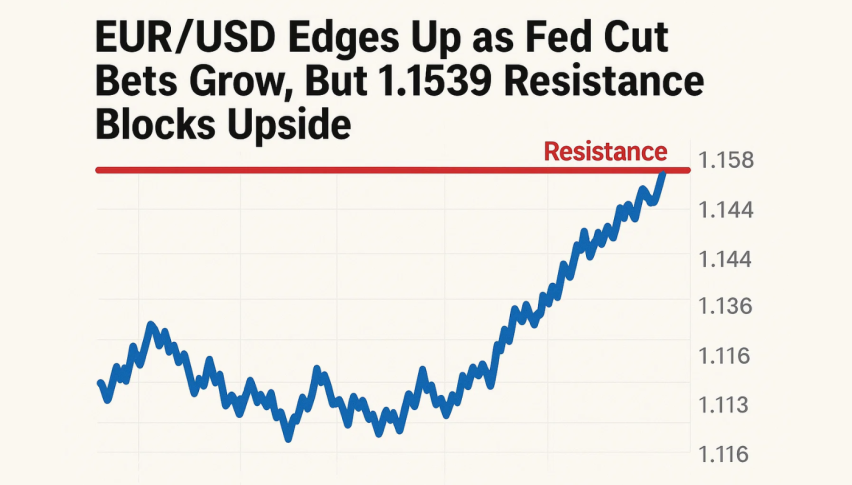

EUR/USD Edges Up as Fed Cut Bets Grow, But 1.1539 Resistance Blocks Upside

EUR/USD pushed modestly higher during the European session, trading around 1.1525 as the US dollar lost momentum...

Quick overview

- EUR/USD has risen to around 1.1525 as the US dollar weakens amid expectations of a Federal Reserve rate cut in December.

- The probability of a 25-bps cut in December has surged to nearly 70%, impacting dollar strength and allowing the euro to stabilize.

- Despite mixed signals from Fed officials, the euro is supported by expectations of stable ECB interest rates until late 2025.

- EUR/USD remains under pressure technically, with key resistance at 1.1539 limiting buyer control.

EUR/USD pushed modestly higher during the European session, trading around 1.1525 as the US dollar lost momentum amid rising expectations of a Federal Reserve rate cut in December. The shift in sentiment followed comments from New York Fed President John Williams, who signaled that policymakers may need to respond sooner rather than later if labor market conditions weaken further.

The probability of a December 25-bps cut has now climbed to nearly 70%, sharply higher from 40% just a week earlier, according to the CME FedWatch Tool. This repricing has placed the dollar under pressure and allowed the euro to stabilize despite mixed economic signals from the Eurozone.

However, not all Fed officials are leaning dovish. Boston Fed President Susan Collins stressed that cuts would require “clear justification,” while Dallas Fed President Lorie Logan said holding rates steady remains the prudent approach until more data confirms a slowdown. These mixed messages have kept the dollar from sliding too far, leaving EUR/USD capped below key resistance levels.

ECB Stability Helps Euro Steady

On the European side, the euro is supported by expectations that the ECB will keep interest rates unchanged until late 2025. Inflation continues to cool, and policymakers have adopted a measured stance. President Christine Lagarde reiterated that the ECB will adjust policy only if inflation strays meaningfully from the 2% target.

This policy stability contrasts with the uncertainty surrounding the Fed, giving the euro a relative advantage in the near term. Still, traders are cautious ahead of US PPI and retail sales data, both of which carry the potential to shift dollar sentiment quickly.

EUR/USD Technical Outlook

EUR/USD remains under pressure on the charts despite today’s bounce. The pair continues to trade below the descending trendline drawn from the September high at 1.1725, a barrier that has consistently rejected upside attempts for nearly two months.

Price action remains soft:

- The pair is trading under the 20-EMA, showing lack of short-term momentum.

- A cluster of long-wick candles near 1.1490 signals dip-buying interest, but with weak follow-through.

- RSI has recovered from oversold territory but remains below 40, showing the bounce is corrective, not trend-changing.

Until EUR/USD closes above 1.1539 — a former support now acting as resistance — buyers have limited control.

Short-Term Levels to Watch

- Resistance: 1.1539, 1.1600

- Support: 1.1490, 1.1468

Trade Opportunity: EUR/USD

Bias: Bearish Below 1.1539

EUR/USD remains inside a clean downward trend structure, making trend-continuation setups more reliable than bottom-picking.

Bearish Scenario (Higher Probability)

If the pair rejects 1.1539 — especially with a bearish engulfing, shooting star, or three black crows formation — sellers may step back in.

Entry: Below 1.1539

Targets: 1.1490 and 1.1468

Stop-Loss: Above 1.1560 (above the EMA cluster)

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM