XRP Holds Ground Above $2 as Multiple Spot XRP ETFs Hit Market This Week

At the time of writing, XRP is trading above $2, up 2.3% in the last 24 hours. This shows that the cryptocurrency is strong even if a lot of

Quick overview

- XRP is currently trading above $2, showing a 2.3% increase in the last 24 hours despite recent market pressures.

- The New York Stock Exchange has approved several new XRP ETFs, indicating strong institutional interest in the cryptocurrency.

- XRP has experienced a significant drop of almost 18% since early November, even with the launch of new ETFs.

- Technical analysis suggests potential for a recovery rally, with key resistance levels identified around $2.120 and $2.150.

At the time of writing, XRP XRP/USD is trading above $2, up 2.3% in the last 24 hours. This shows that the cryptocurrency is strong even if a lot of institutional products are coming out. The digital currency is starting to bounce back after being under a lot of pressure to go down earlier in November, which happened around the same time that the New York Stock Exchange approved several exchange-traded funds that focus on XRP.

NYSE Greenlights Grayscale’s Latest Crypto ETF Offerings

On Friday, the New York Stock Exchange Arca filed with the Securities and Exchange Commission to get the Grayscale XRP Trust ETF (GXRP) and the Grayscale Dogecoin Trust ETF (GDOG) approved for listing and registration. Both products are set to start trading on Monday. Eric Balchunas, a senior ETF analyst at Bloomberg, said that Grayscale’s Chainlink ETF will be out in about a week. This shows that institutions are still interested in investing in cryptocurrencies.

This certification is a big deal for XRP since it now has to compete with a lot of other spot ETF products. Canary Capital’s XRPC started trading on November 13 as the first spot XRP ETF in the US. On its first day of trading, it brought in more than $250 million. Franklin Templeton is also launching an XRP ETF that will compete with Grayscale’s. WisdomTree’s product is still waiting for final approval.

Spot XRP ETF Surge Hasn’t Translated to Price Gains Yet

CoinGecko data shows that XRP has dropped almost 18% since the beginning of November, even though people usually feel good about ETF debuts. The difference between the growth of institutional products and their price performance shows that the market is unsettled and people are taking profits after XRP’s great success earlier this year.

This month, Bitwise, 21Shares, and CoinShares all launched new XRP ETFs. The SEC has been less strict about cryptocurrency ETFs since the U.S. government shutdown ended, which has made the market full of choices.

XRP/USD Technical Analysis Shows Potential for Recovery Rally

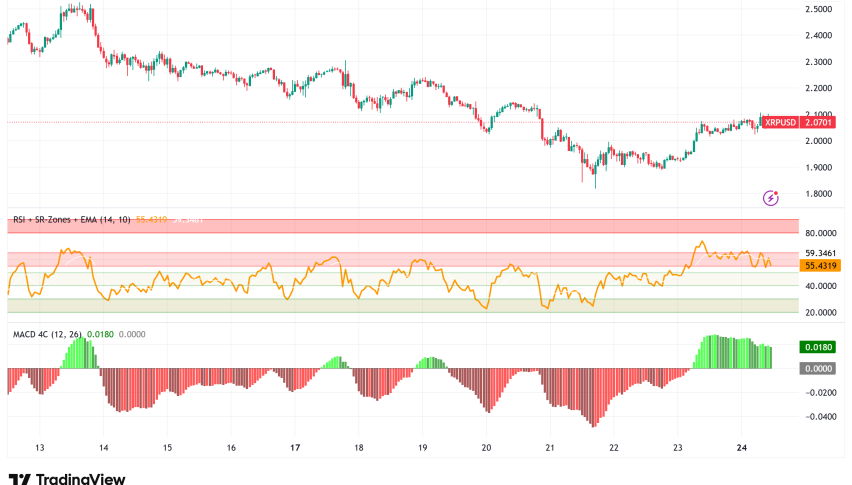

XRP is showing some signals of bullish reaccumulation after finding support at the $1.96 level, at least from a technical point of view. The cryptocurrency dropped sharply, almost 19%, over the course of eight days. It fell from the 50-day exponential moving average of $2.38 on November 13 to a low of $1.82 on Friday.

XRP has broken above a significant negative trend line and is now trading above both the $2.00 level and the 100-hourly simple moving average. The hourly chart shows that $2.00 is a level of resistance. The price has returned to the 76.4% Fibonacci retracement level of the drop from the $2.140 swing high to the $1.817 low, which means that positive momentum is getting stronger.

The Relative Strength Index is now at 41, up from oversold territory last week. This shows that bearish pressure is receding and supports the idea that the market is recovering. At the same time, the hourly MACD is gaining speed in the bullish zone, which is another sign that the market is moving up.

XRP Price Prediction: Key Levels to Watch

If XRP keeps going up, it will hit a wall near the $2.120 level right away, and the first big one will be at $2.150. If XRP closes above $2.150, it might quickly move up to $2.20, which is the next daily resistance level at $2.35. If prices keep going up, they might reach $2.250, $2.320, and finally $2.40.

But if it doesn’t break through the $2.150 resistance zone, it could start to fall again. The first level of support on the downside is close to $2.00, and the next big level of support is at $1.980. If XRP goes below $1.980, it might go back to $1.880 and maybe even test Friday’s low of $1.82 again. If it goes down even more, it could go as low as $1.80.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM