Bitcoin Consolidates Above $91K as Market Braces for Critical Fed Decision

Bitcoin (BTC) is currently trading above $91,000, which is around 2.5% more than it was yesterday. Traders are dealing with more volatility

Quick overview

- Bitcoin is currently trading above $91,000, reflecting a 2.5% increase from yesterday amid heightened volatility ahead of the FOMC meeting.

- Recent price fluctuations have established $87,000 as a key support level, with $86,000 being critical for bulls to maintain the current uptrend.

- Analysts predict that if Bitcoin surpasses the $92,000 resistance, it could quickly approach the psychological $100,000 mark within the next couple of weeks.

- A decline in spot trading volume raises concerns about market dynamics, indicating a shift towards speculative trading rather than natural accumulation.

Bitcoin BTC/USD is currently trading above $91,000, which is around 2.5% more than it was yesterday. Traders are dealing with more volatility as they prepare for Wednesday’s Federal Open Market Committee (FOMC) meeting.

Snap Volatility Tests Bulls’ Resolve Ahead of FOMC

Bitcoin dropped sharply into the weekly close on Sunday, momentarily falling below $88,000 and challenging support near $87,000. The unexpected changes made an otherwise boring weekend exciting, with BTC/USD losing $2,000 in only two hourly candles. This price movement has started up talks about possible CME gap forms and set the ground for what could be a very important trading week.

Trader Killa says that historical trends show that Monday’s price action is very important. He said, “Pivot highs and lows usually happen on Mondays, and the price action over the weekend is a big part of that.” “If the weekend doesn’t pump, the chances of a pivot low forming on Monday go up.” With Bitcoin’s performance on the weekend still weak, people in the market are keeping a careful eye on whether the leading cryptocurrency can stay above important support levels.

Federal Reserve Decision Takes Center Stage

This week, Bitcoin traders are mostly interested on the Federal Reserve’s decision on interest rates, which is set for Wednesday. The CME Group’s FedWatch Tool shows that most people think there will be a 0.25% rate cut. But the tone and forward instructions from Fed Chair Jerome Powell could be the most important things for Bitcoin’s short-term path.

Peter Tarr, a private investment manager, said, “The rate call is easily the #1 event of the week. It affects liquidity, risk appetite, and positioning.” Historically, Bitcoin prices go down before FOMC announcements because traders try to figure out what the Fed policymakers are saying about possible changes to policy.

Michaël van de Poppe, a crypto analyst, said that uncertainty before the FOMC meeting might cause the price to drop down to $87,000. He told his followers on X, “After that, bounce back up quickly, which confirms the uptrend for Bitcoin and gets it ready to break $92K and start the run toward $100K in the next week or two.” Van de Poppe said that $86,000 was the most important line in the sand for bulls.

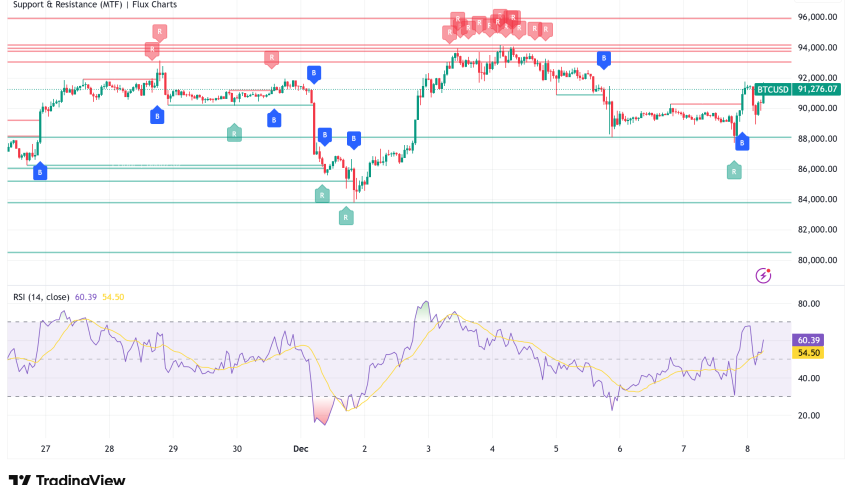

BTC/USD Technical Analysis: Critical Support and Resistance Levels

Bitcoin is at a very important point in its technical development. The recent ups and downs have made $87,000 a definite support level, and $86,000 a stronger support level. To keep the overall upswing that has been going on for the past few months, bulls need to protect these levels.

On the upside, $92,000 is the first level of resistance. If the price breaks through this level, it would clear the way for the psychologically important $100,000 mark. Analysts think that if momentum keeps up, this level might be reached in 1–2 weeks. If the asset can get back over $92,000 and stay there, it would confirm that the positive trend that started after the rate cuts in September is still going strong.

Technical indicators give us a mixed picture. Both the 50-day and 200-day moving averages are going up, which is good for Bitcoin’s long-term trend. The Relative Strength Index (RSI), on the other hand, is currently at 43.04, which means that it is neither overbought nor oversold. Because of its neutrality, Bitcoin might swing strongly in either direction based on outside factors, especially the Fed’s pronouncement.

Declining Spot Trading Volume Raises Concerns

Even if prices have gone up, market data shows that traders are acting differently. Analyst Darkfost’s study says that Bitcoin spot trade volume on Binance fell by 21% in November, from $198 billion to $156 billion. This is a worrying trend. Other big exchangers, like Gate.io and OKX, had similar drops.

The drop in spot volume has caused the spot-to-futures volume ratio to drop to a low of 0.23. This means that futures trading now makes up more than 75% of all trading. The fact that derivatives are so popular right now shows that the market is mostly driven by speculation and hedging, not by natural spot accumulation. High interest rates on futures can cause prices to rise quickly, but they also make the market more sensitive to leverage flushes and higher volatility if support levels collapse.

Bitcoin Price Prediction

If Bitcoin can break through and stay above the $92,000 resistance level in the next few days, analysts say it will quickly move toward the psychological $100,000 mark in the next week or two. The “Santa Claus rally” effect and the confirmation of Fed rate reduction would probably drive this move. But traders need to be careful about the negative invalidation point: if the $86,000 support level is broken, it might mean a larger downturn that could bring prices down below $80,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM