CRWV Stock Jumps on $2B Debt Offer after Weak Q3, but $100 Remains A Key Test

After a severe selloff, CoreWeave is making a tentative comeback, but the sustainability of the recovery is still questioned due to its...

Quick overview

- CoreWeave is attempting a recovery after a significant selloff, with its stock recently bouncing back above $90 following a 60% decline from earlier highs.

- The company's recent $2 billion debt offering raises concerns about its financial sustainability and ability to meet capital commitments, especially in light of mounting losses.

- Despite impressive revenue growth, CoreWeave's heavy reliance on Nvidia and high capital expenditures have led to skepticism about its long-term profitability.

- Investors remain divided on whether the recent stock rebound signals a genuine recovery or is merely a temporary uptick in a volatile market.

After a severe selloff, CoreWeave is making a tentative comeback, but the sustainability of the recovery is still questioned due to its enormous new debt issuance and growing financial strains.

CoreWeave’s Bid to Regain Momentum

After one of its harshest downturns since going public, CoreWeave Inc. (NASDAQ: CRWV) is attempting to reestablish stability in the market, supported by a sharp bounce that has lifted the stock back above $90 with daily gains exceeding 5%. The revival follows a punishing stretch where shares lost more than 60% from their earlier highs, driven by weak third-quarter results and growing concerns about the company’s breakneck spending.

Last week’s 8% jump — which pushed the stock above $85 — offered the first meaningful sign that sellers may finally be exhausting, but skepticism remains widespread as investors evaluate whether the latest rebound is merely technical or supported by fundamental improvement.

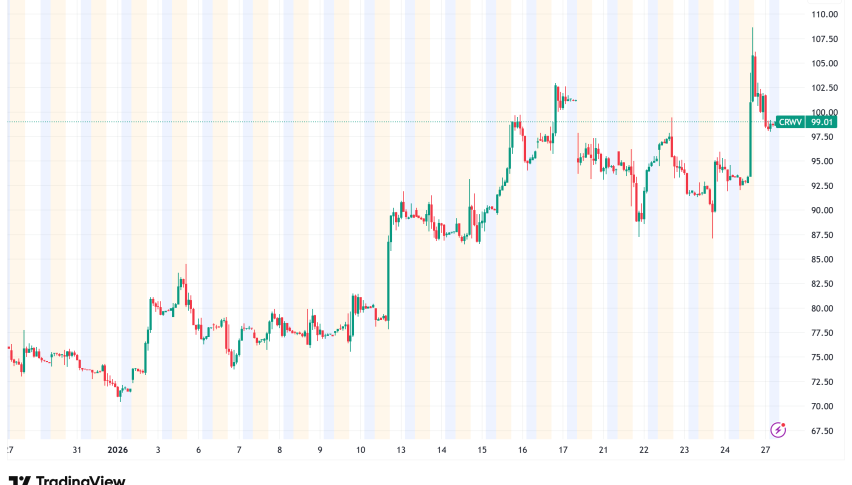

CRWV Chart Daily – The 20 SMA Has Been Broken

CoreWeave’s decline has been closely tied to fading market confidence following its heavily publicized $14 billion partnership with Meta. The deal initially ignited enthusiasm, suggesting long-term demand for CoreWeave’s AI infrastructure, yet the optimism evaporated almost immediately as concerns emerged about the company’s ability to fund the enormous capital commitments the agreement requires. Market participants have not forgotten how quickly the stock’s earlier rally to $150 unraveled, leaving the latest recovery overshadowed by caution.

A Market Defined by Sharp Rallies and Steeper Reversals

The company’s price action throughout the year has been characterized by fast, emotionally charged swings, with each rebound giving way to aggressive selling. September’s surge back above $150 briefly renewed the bullish narrative, but momentum collapsed once again, dragging the share price all the way down to $65. Only after broader equity strength returned did CRWV find support, setting the stage for the recent rally.

CRWV Chart Weekly – Reversing Higher After the Doji

Technical readings illustrate the market’s conflicted outlook. On the daily chart, the stock’s move back above the 20-day simple moving average suggests that short-term buyers are reasserting control. Meanwhile, weekly price action shows the March peak — once a resistance area — now acting as a support zone.

A doji candle forming at that level hints at a potential directional shift. Still, the August resistance band continues to cap gains, and the path toward $100 — where the 20-week moving average sits — remains uncertain. A clear break above that threshold would open the possibility of revisiting the $150 region, but for now, traders remain wary of another sharp reversal.

Debt Offering Deepens Concerns Over Financial Strain

Adding complexity to the situation, CoreWeave announced a $2 billion convertible senior notes offering, with an additional $337.5 million available to purchasers through an over-allotment option. The notes, maturing in December 2031, will pay semiannual interest in cash, though specific details on the rate and conversion terms will be disclosed once pricing is finalized.

The timing of the debt sale unsettled investors, especially with the stock already down 17% across the past month. Many interpret the offering as a signal that CoreWeave’s capital requirements are intensifying faster than previously expected. With spending levels already elevated, the new debt raises concerns about dilution risk and long-term sustainability.

A Growth Story Overshadowed by Mounting Losses

Despite generating 105% revenue growth in Q3 and posting $1.21 billion in sales, CoreWeave remains far from profitability. Losses ballooned to $290.5 million as the company poured nearly $3 billion into data-center development. Analysts now estimate annual capital expenditures could reach between $20 billion and $23 billion, a figure that has triggered alarm among ratings agencies and institutional investors. Weiss Ratings recently issued a bearish stance on the company, emphasizing the mismatch between CoreWeave’s breakneck expansion and its fragile cash flow position.

Meta Partnership Shifts From Catalyst to Liability

The long-term agreement with Meta — originally hailed as a transformational milestone — has become a lightning rod for concerns about overextension. Rather than functioning as a stabilizing anchor, the contract has raised questions about whether CoreWeave is equipped to deliver hyperscale AI infrastructure for nearly a decade without compromising its financial health. The stock’s inability to sustain gains after the Meta announcement reflected a broader fear that the partnership may accelerate spending faster than revenue can offset.

High Costs, Heavy Expansion, and Nvidia Dependence

CoreWeave’s strategic path remains heavily influenced by outsized investments and a close — some say excessive — reliance on Nvidia. The planned acquisition of Marimo Inc. adds another layer of financial burden, while agreements allowing Nvidia to purchase up to $6.3 billion of unused CoreWeave capacity further entangle the two companies. This dependency effectively ties CoreWeave’s financial results to Nvidia’s production cadence and pricing, limiting management’s ability to independently shape margins or scale profitably.

As the stock fights to regain lost territory, investors appear split: some see the recent rebound as the first step in a broader recovery, while others interpret it as another temporary surge in a volatile and over-leveraged equity story.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM