Ethereum Holds $3,150 as Elite Whales Deploy $425M in Long Positions Amid Market Uncertainty

At a very important time, Ethereum is showing strength by staying over $3,100 while the cryptocurrency market goes through a time of great

Quick overview

- Ethereum is currently showing strength above $3,100 amidst market uncertainty, with whale traders holding over $425 million in long positions.

- Notable traders, including BitcoinOG and the Anti-CZ whale, are betting on Ethereum's recovery, indicating institutional confidence in its value.

- Technically, Ethereum is attempting to stabilize above key support levels, with potential breakout zones identified between $3,300 and $3,400.

- Two scenarios are possible: a bullish breakout towards $3,700–$3,800 or a bearish drop back to the $2,800–$3,000 range, depending on price movements.

At a very important time, Ethereum ETH/USD is showing strength by staying over $3,100 while the cryptocurrency market goes through a time of great uncertainty. While the overall mood is still split between bearish continuation and bullish reset stories, a strong signal has come from the depths of on-chain data: some of the market’s most successful whale traders are positioning themselves for upside, with a total long exposure of more than $425 million.

Elite Traders Bet Big on Ethereum Recovery

The most interesting thing happening in Ethereum right now is how well-known market players are working together. Hyperdash data shows that three of the most profitable whale addresses have set up huge long positions, which suggests that institutions are quite confident in ETH’s present value.

BitcoinOG, the trader who became well-known for successfully shorting during the October meltdown, has changed his mind and is now quite positive. BitcoinOG has made and lost a total of $105 million in trades. He presently owns 54,277 ETH, which is worth about $169.48 million. This directional bet has a lot of weight because of his past performance.

The Anti-CZ whale is also interesting since it always takes the opposite side of what Binance founder Changpeng Zhao says. This address, which has made $58.8 million in realized gains, has the biggest holding in the group right now: 62,156 ETH worth $194 million. In the past, this whale’s position has been a sign of bigger changes in the market.

Pension-usdt.eth is the third address in the group. It has made $16.3 million in realized gains and holds 20,000 ETH worth $62.5 million. These holdings show that top-tier traders all agree that Ethereum’s recent price movement represents a chance, not a risk.

This agreement is especially important because retail sentiment is so divided right now. Traders that deal in the market every day are still being careful after the recent volatility, while the most advanced traders seem to be getting ready for a big rise up.

ETH/USD Technical Analysis: Stabilization at Key Support

From a technical point of view, Ethereum’s weekly chart shows that the market is trying to build a base after falling from the $4,500 area. The current rise above $3,150 is a big deal since this level is where the price found support in the middle of 2024 and is just above the 50-week moving average, which has traditionally been a trend-defining area.

During the November sell-off, the asset temporarily broke through this area, but it made a strong weekly rejection wick, which showed that there was a lot of buying at lower levels. But ETH is still below important barrier levels. The 20-week and 100-week moving averages are both above the present price action and getting closer together. This could cause rejection pressure unless momentum picks up.

Volume data backs up a market structure that is changing. Compared to the capitulation phase, selling pressure has gone down. Recent buying activity shows moderate but steady interest, which is more like accumulation than frenzied risk-taking.

Ted Pillows, an analyst, says that $3,300–$3,400 is the most important breakout zone on shorter timeframes. If the price closes decisively above this area, it will probably quickly rise to $3,700–$3,800. But if it doesn’t break through, it might have to test the $3,000 support level again.

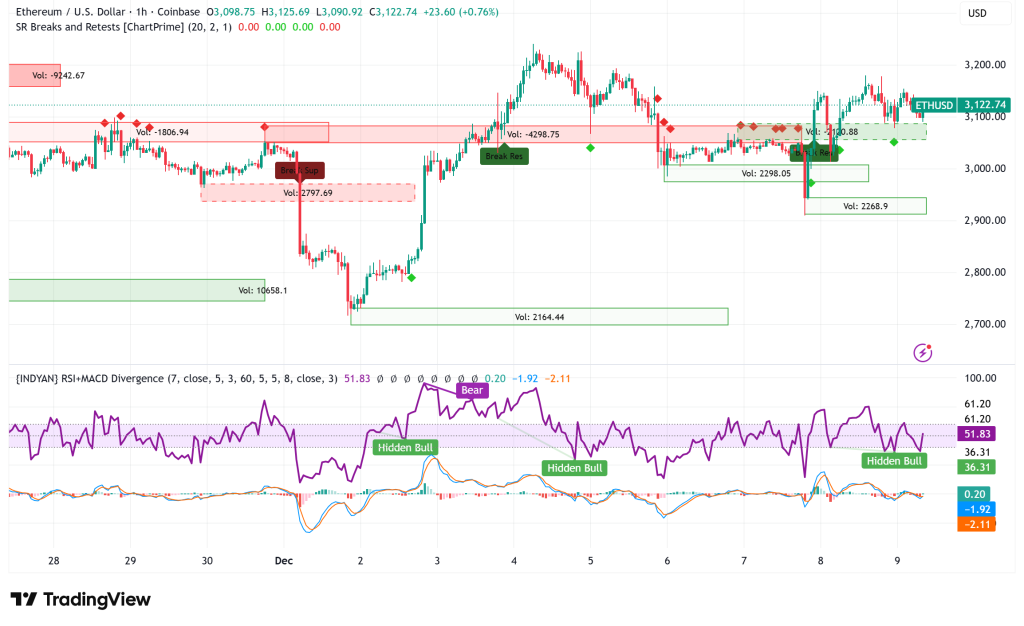

The hourly chart reveals that ETH is trading in a triangle formation that is getting smaller, with resistance at $3,150. The 100-hourly simple moving average is providing support at $3,075, while immediate resistance is near $3,180. The MACD is losing momentum in bullish area, and the RSI has dropped below 50, which suggests that the market will consolidate in the near future.

Ethereum Price Prediction: Two Scenarios in Play

Based on how the market is set up right now and where whales are, there are two basic scenarios that could still happen:

- Bullish Case: If Ethereum closes above $3,200–$3,300 for several weeks in a row and breaks the $3,400 resistance convincingly, the chart structure favors a move toward $3,700–$3,800 in the near term. If prices stay strong above this range, they might go back to $4,000 and maybe even higher levels in early 2026, which fits with the idea of a long bull cycle.

- Bearish Case: If the price doesn’t break over $3,300–$3,400 and the support level at $3,150 is lost, it will probably go down again to the $2,800–$3,000 range. A clear five-wave drop would suggest that the market is still going down and could make fresh local lows.

The way the whale is positioned makes the first possibility more likely. It’s worth paying attention to when traders with proven track records and nine-figure profit history all agree on one side of the market. The technical picture, on the other hand, is still changing, and the market’s preferred direction won’t be evident until prices confirm it.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account