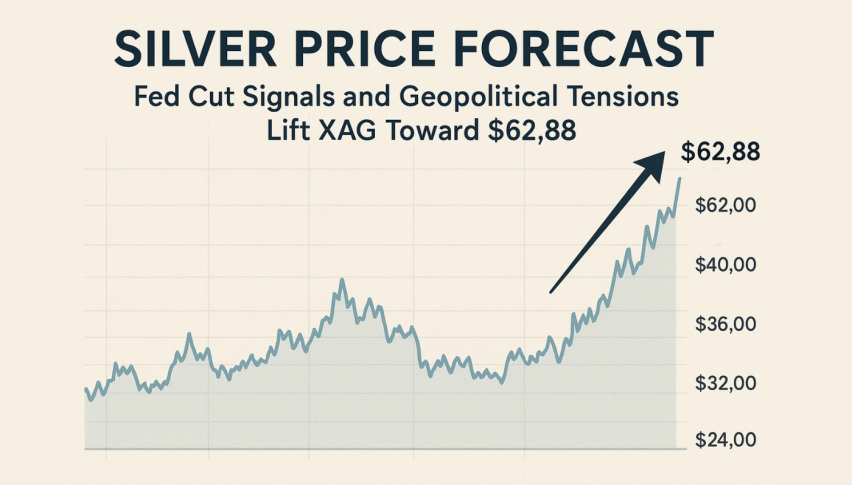

Silver Price Forecast: Fed Cut Signals and Geopolitical Tensions Lift XAG Toward $62.88

Silver kept moving higher this week as traders took another look at the Federal Reserve's latest policy shift. Rates were cut...

Quick overview

- Silver prices increased this week as traders reacted to the Federal Reserve's recent rate cut of 25 basis points and cautious outlook.

- Divergence among Fed members regarding the rate cut indicates uncertainty about future monetary policy, prompting investors to favor safe-haven assets like silver.

- Geopolitical tensions and disruptions in shipping routes are driving demand for silver, which benefits from its dual role as both an investment and a base metal.

- Key economic data releases this week, including jobless claims and trade balance numbers, could influence silver prices and the Fed's future rate decisions.

Silver kept moving higher this week as traders took another look at the Federal Reserve’s latest policy shift. Rates were cut by 25 basis points, with the Fed now projecting just one more cut in 2026, far from what markets had been forecasting. And Jerome Powell was keen to sound a cautionary note, saying the Fed needs to keep supporting hiring without getting ahead of itself by tightening financial conditions too soon.

But a couple of Fed members voted against the rate cut, suggesting the committee is not as united as it was before. All this has made it harder for investors to get a clear read on where the Fed is headed, which is why they are sticking with safe-haven assets like silver, which has a history of doing well when interest rates are uncertain.

A slight dip in the US Dollar also helped stabilise the XAG/USD rate after a bit of a wobble.

Geopolitical Tensions Support Demand for Safe-Haven Assets

It’s not just the rate-cut plan that is causing a fuss – the geopolitical situation is still causing a lot of unease. There’ve been disruptions to shipping routes and worries about energy security, keeping people’s money in safe-haven assets like gold and silver. Silver, in particular, has an extra advantage because it’s both an investment asset and a base metal, giving it dual appeal. And for silver, disruptions in supply or increases in energy costs can directly affect production costs.

[[XAG/USD-graph]]

Even with pockets of positivity in global equity markets, the overall risk profile remains fragile. As a result, investors are keeping a big chunk of their money in hard assets, and silver is doing well out of that because of its dual role. This is what’s keeping the price from falling much and supporting it in any dips we do see.

Key Data Points That’ll Be Worth Watching This Week

A few key data points are coming up this week that the traders will be keeping an eye on – the US weekly initial jobless claims, trade balance numbers, and PMI numbers all have the potential to give us a clearer read on the state of the economy and whether the Fed will have to cut rates further, which is usually good news for silver. The volatility in the energy markets and forecasts for industrial demand are also important indicators for traders trying to work out where the silver price will go over the medium term.

Technical Outlook: XAG/USD Is Still Trading Inside A Rising Channel

Silver is currently trading at $62.04 and remains within a rising trend channel established in mid-November. Bounces back up from $60.12 are continuing to show strong support, while the resistance level near $62.88 is looking more interesting, as there’s been some profit-taking up there. If we get a break above $62.88, the next stop is around $64.47 and then $65.86.

A close below $60.12 would have traders looking to $58.63, and the RSI is currently at 63, suggesting the trend is still moving up, but without getting too carried away.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM