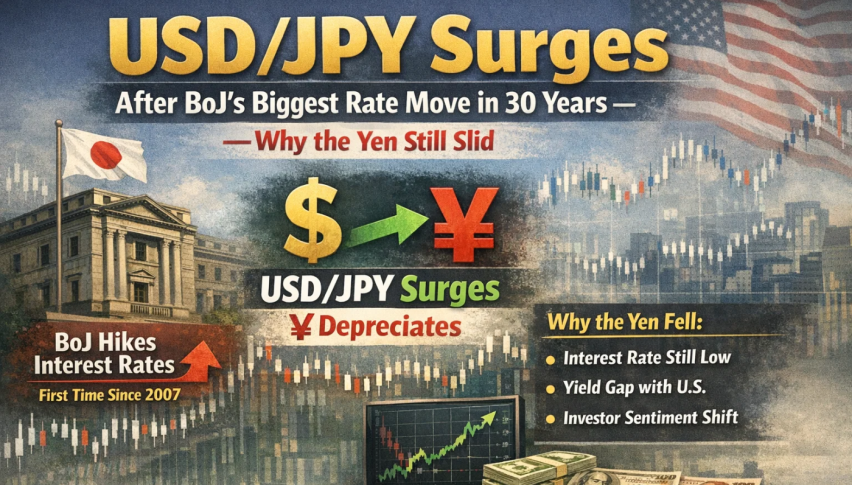

USD/JPY Surges After BoJ’s Biggest Rate Move in 30 Years—Why the Yen Still Slid

USD/JPY has taken off to new heights, near 157.30, after a pretty impressive rally during the European session...

Quick overview

- USD/JPY has surged to around 157.30 following a significant rate hike by the Bank of Japan, indicating a disconnect between policy and market positioning.

- The Bank of Japan raised its short-term policy rate by 25 basis points to 0.75%, marking a 30-year high, but provided no clear timeline for future increases.

- The yen weakened as the BoJ acknowledged uneven economic conditions, while the US dollar strengthened due to resilient risk sentiment and expectations of Federal Reserve maneuverability.

- Technical analysis shows USD/JPY has broken out of consolidation, with bullish momentum suggesting potential targets at 157.88 and 158.60.

USD/JPY has taken off to new heights, near 157.30, after a pretty impressive rally during the European session, despite the Bank of Japan having just delivered its most significant rate hike in decades. The move says a lot about the growing disconnect between what’s really happening with policy and how the markets are positioning themselves – and it’s clear investors aren’t focusing too much on the actual rate hike, more on what comes next.

The Bank of Japan hiked its short-term policy rate by 25 basis points to a new high of 0.75%, pushing borrowing costs to a 30-year record. The decision was a done deal and widely expected – Governor Kazuo Ueda came out to say that any more tightening would depend on how wages and inflation shape up, but offered no clear timeline for any additional increases in 2026.

A very important point was that the BoJ still reckons real interest rates are deeply in the red – and that the overall financial conditions are still pretty accommodative.

That message weighed heavily on the yen, which fell. The BoJ people acknowledged that the economy is going at a pretty uneven pace, and while household consumption is still doing it tough, the labour market is actually pretty tight.

Inflation is still on target, but the lack of any forward guidance on how fast they’ll normalise policy left investors none too convinced that this tightening will actually make a meaningful difference to yield differentials.

Dollar Strength Reinforces the Move

The yen’s weakness came at the same time as renewed demand for the US dollar – the Dollar Index is now up towards 98.65, thanks to pretty resilient risk sentiment and expectations that the Federal Reserve will still have loads of room to maneuver even as US inflation starts to cool. The combination of a firm dollar and what appears to be cautious BoJ guidance is keeping USD/JPY in demand.

USD/JPY Technical Picture Signals Momentum Shift

On the 2-hour chart, USD/JPY has just broken free of short-term consolidation and cleared a trendline that had been capping rallies a bit earlier in the month. Price is now holding above both the 50-day EMA at 155.75 and the 100-day EMA at 155.66, indicating a momentum shift is in full swing. Strong bullish candles with pretty small upper wicks look like they’re controlled buying rather than any exhaustion.

The first target resistance is near 157.88, then 158.60 – but the former resistance at 156.13 has now turned into the first support. Stronger demand is waiting near 155.30 – the RSI near 81 is a clear signal that things are getting overbought, and there’s a risk of consolidation rather than an immediate reversal.

Trade Idea: Buy any pullbacks near 156.20, target 158.60, stop below 155.30.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM