CRWV Stock Still Looks Vulnerable Despite the DOE Deal as Debt and Capital Strains Keep Risks Elevated

CoreWeave has staged a sharp rebound after months of heavy losses, but rising leverage, massive funding needs, and fragile AI sentiment...

Quick overview

- CoreWeave has experienced a significant rebound after a steep decline, but ongoing concerns about leverage and funding needs overshadow this recovery.

- The company's inclusion in the U.S. Department of Energy's Genesis Mission has sparked renewed investor interest, although skepticism remains about the sustainability of this momentum.

- Despite impressive revenue growth, CoreWeave faces challenges related to profitability and high capital expenditures, raising questions about its financial stability.

- Investor confidence is further strained by the company's reliance on Nvidia and the potential risks associated with its expansion strategy.

CoreWeave has staged a sharp rebound after months of heavy losses, but rising leverage, massive funding needs, and fragile AI sentiment continue to overshadow the recovery.

From Steep Decline to Sudden Rebound

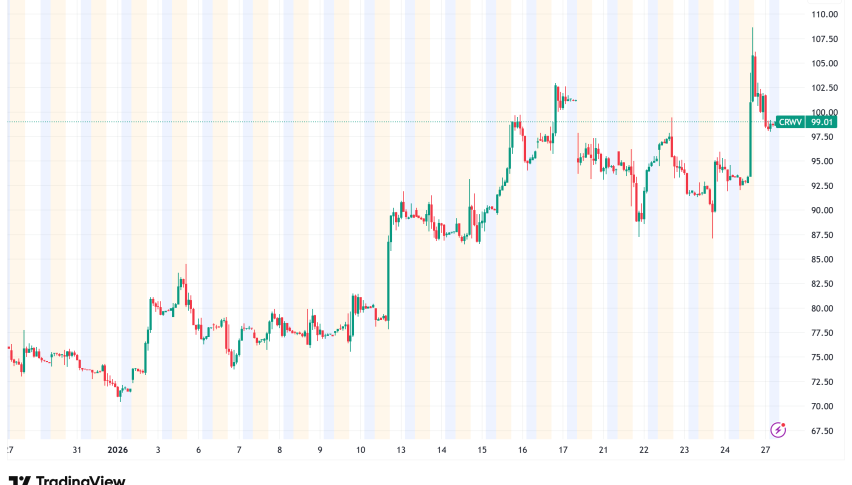

CoreWeave shares have endured a punishing downtrend since June, shedding roughly two-thirds of their value and breaking through multiple layers of technical support. The selloff reflected a combination of company-specific pressures and a broader reassessment of the AI infrastructure trade, where enthusiasm has increasingly collided with concerns over costs, balance sheets, and sustainability.

Late last week, however, sentiment briefly shifted. A U.S. Department of Energy-related development reignited buying interest, triggering a sharp rebound that caught many investors off guard. Despite the dramatic move, the broader outlook remains uncertain, with structural challenges still firmly in place.=

Recovery Attempts Continue to Face Heavy Resistance

CoreWeave’s recent price action once again highlighted how sensitive the stock is to shifts in AI-related sentiment. After several weeks of sustained selling, shares attempted to stabilize earlier this month but quickly slipped below key support levels as concerns over debt levels and earnings quality resurfaced.

The breakdown reinforced fears that the correction was not yet complete. Then, momentum abruptly reversed. On Thursday, buyers stepped in aggressively, lifting shares roughly 5% during the regular session. That move was followed by an additional surge of around 20% in after-hours trading, fueled by commentary linked to the DOE initiative.

The rebound briefly pushed the stock back above the $87 area before renewed selling pressure emerged. By early this week, shares had slipped again, falling more than 5% on Tuesday and underscoring the fragile nature of the recovery.

CoreWeave Joins the DOE’s Genesis Mission

The catalyst behind last week’s rebound was CoreWeave’s inclusion in the U.S. Department of Energy’s Genesis Mission. The initiative brings together scientific institutions, supercomputing facilities, AI platforms, and advanced technology providers to accelerate discovery, strengthen national security, and advance innovation across the U.S. energy ecosystem.

Genesis is designed to connect large-scale datasets, experimental research environments, and high-performance computing infrastructure into a more unified system. By doing so, it aims to increase the speed and impact of scientific research while reinforcing U.S. leadership in critical technologies.

CoreWeave’s participation positions the company as a key provider of AI-focused cloud infrastructure capable of supporting advanced research workloads. The announcement highlighted the growing role of specialized AI compute in national-scale initiatives, lending credibility to CoreWeave’s platform at a time when investor confidence has been strained,

Relief Rally or Temporary Bounce?

Despite the strong reaction, many investors remain cautious about interpreting the move as a true trend reversal. CoreWeave has struggled to establish lasting upside momentum following one of the steepest drawdowns among AI-linked stocks this year.

After plunging more than 60% in November following disappointing earnings and rising skepticism toward its expansion strategy, the stock briefly recovered above $90 last week. That rebound retraced roughly $25 from the lows but quickly lost steam as broader AI infrastructure concerns resurfaced.

CRWV Chart Daily – The 20 SMA Has Been Broken

Weak earnings from Oracle added fuel to those concerns, raising fresh doubts about whether demand growth across the sector can justify the enormous capital commitments being made. Selling pressure intensified again, dragging CoreWeave below $64 midweek before Thursday’s sharp bounce provided temporary relief.

Technical Damage Continues to Undermine Confidence

From a technical standpoint, the picture remains fragile. CoreWeave’s earlier failure to hold above short-term moving averages left a lasting mark on sentiment. The decisive break below the 20-day simple moving average signaled a lack of sustained buyer conviction during prior rebounds.

This technical breakdown echoes earlier patterns seen throughout the year. Previous rallies—most notably those that carried the stock toward $150—ultimately failed, trapping late buyers and reinforcing skepticism toward upside moves not backed by improving fundamentals.

While last week’s rebound has stabilized near-term momentum, the stock remains below key resistance zones. Without a sustained move back above those levels, investors are likely to view rallies as tactical rather than structural.

High-Profile Partnerships Offer Validation—but Not Reassurance

CoreWeave continues to secure large, attention-grabbing partnerships that reinforce its relevance in the AI ecosystem. Its $14 billion agreement with Meta underscored long-term demand for high-performance AI infrastructure and initially helped support the bullish narrative.

More recently, the company announced a collaboration to support Runway’s next-generation AI video models using NVIDIA’s GB300 NVL72 systems. This deal highlights CoreWeave’s positioning in compute-intensive workloads beyond traditional generative AI applications.

However, these agreements have not fully eased investor concerns. The focus has shifted away from headline deal size toward execution risk, funding requirements, and profitability. For many investors, the central question is no longer whether demand exists—but whether CoreWeave can finance growth without further straining its balance sheet.

Debt Raise Rekindles Balance-Sheet Anxiety

Those concerns intensified after CoreWeave announced plans to raise $2 billion through a convertible senior notes offering, with an additional $337.5 million available through an over-allotment option. The notes, set to mature in December 2031, will carry semiannual interest payments in cash.

The timing unsettled markets. With the stock already under pressure, the prospect of additional leverage and potential dilution reinforced fears that capital requirements are accelerating. For investors, the move underscored how dependent CoreWeave’s growth strategy remains on continued access to external financing.

Explosive Growth Comes at a High Cost

Operationally, CoreWeave’s expansion remains impressive. Third-quarter revenue surged 105% year over year to $1.21 billion, reflecting robust demand for AI compute capacity. Yet profitability remains distant. Net losses widened to $290.5 million as the company poured nearly $3 billion into expanding its data-center footprint.=

Looking ahead, analysts estimate annual capital expenditures could reach $20–$23 billion. That scale of investment has raised red flags among ratings agencies and institutional investors, particularly given the mismatch between rapid revenue growth and limited free cash flow.

Reliance on Nvidia Adds Strategic Risk

CoreWeave’s close alignment with Nvidia remains a double-edged sword. Agreements allowing Nvidia to purchase up to $6.3 billion of unused capacity help support utilization and validate CoreWeave’s infrastructure. At the same time, they tie pricing power, margins, and capacity planning closely to Nvidia’s own demand cycles.

Plans to acquire Marimo Inc. further complicate the picture, introducing integration risk and potentially adding to balance-sheet pressure. Even as AI demand expands, investors are increasingly questioning whether CoreWeave can scale profitably without assuming escalating financial risk.

Conclusion: Opportunity Meets Structural Uncertainty

CoreWeave’s late-week rebound offers short-term relief after months of heavy losses, but it does little to resolve the deeper challenges facing the company. The DOE partnership highlights CoreWeave’s strategic importance in the AI ecosystem, yet rising debt, massive capital requirements, and fragile market sentiment continue to loom large.

Until financial pressures ease and confidence in sustainable returns improves, CoreWeave’s rallies are likely to remain volatile and vulnerable to sudden reversals. For now, the stock sits at the crossroads of extraordinary AI opportunity—and equally extraordinary risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM