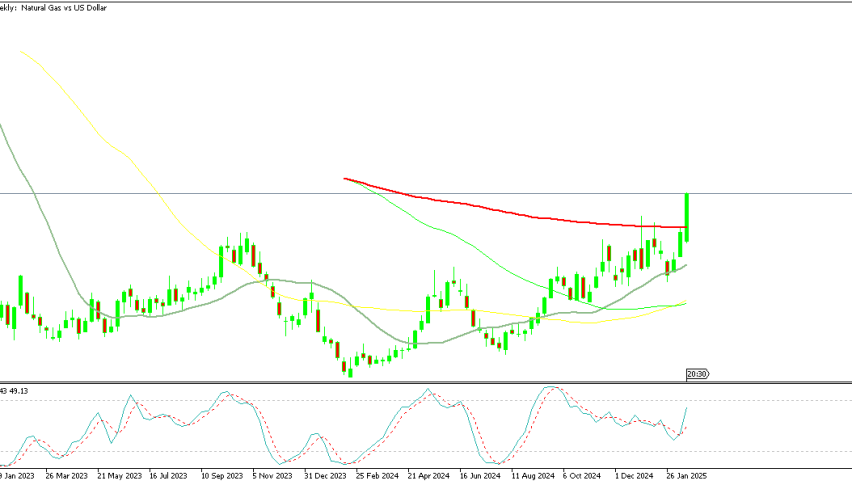

Natural Gas Prices Spike on Arctic Forecasts—Relief Rally or Selling Opportunity?

Natural gas prices have rebounded sharply on colder weather forecasts and renewed LNG demand, but the move appears driven by short-term...

Quick overview

- Natural gas prices have sharply rebounded due to colder weather forecasts and renewed LNG demand, but this is likely a short-term reaction.

- Prices fell significantly from around $5.00/MMBtu to near $3.00/MMBtu before surging over 20% in a single session.

- The rebound is primarily driven by short covering as traders react to increased heating demand and stable LNG exports.

- Despite the recent rally, market fundamentals indicate that a lasting trend change is unlikely, suggesting it may be a good time to sell.

Natural gas prices have rebounded sharply on colder weather forecasts and renewed LNG demand, but the move appears driven by short-term factors rather than a lasting trend change.

Sharp Sell-Off Sets Up a Volatile Bounce

Natural gas has been under heavy pressure since early December, sliding from around $5.00/MMBtu to near $3.00/MMBtu by the end of last week—a decline of roughly 45%. While the drop has been positive for consumers, it left the market deeply oversold and positioned for sharp counter-trend moves.

Natural Gas Price Chart Daily – Stalling at MAs

That setup was exposed today as prices surged more than 20%, lifting futures above $3.70/MMBtu in a single session.

Colder Weather Reignites Heating Demand

The primary catalyst behind the rebound has been a shift in U.S. weather forecasts. Reports suggest an Arctic blast could arrive around January 26, bringing colder temperatures across large parts of the country and boosting expectations for heating demand. This has supported front-month prices, where sensitivity to weather is highest.

Geopolitical tensions linked to Greenland have added a mild risk premium, increasing overall market volatility.

LNG Demand and Short Covering Amplify the Move

Support also came from signs that Asian demand for liquefied natural gas is picking up, helping stabilise U.S. export flows. However, the strength of the rally has been driven more by short covering than by aggressive new buying.

After weeks of declines, the market was heavily short, and the combination of colder weather and steady LNG demand forced traders to cover positions, accelerating the price move.

Fundamentals Still Argue Against a Trend Reversal

Crucially, there have been no supply disruptions, and production remains steady. From a technical perspective, prices have already stalled below key daily moving averages, suggesting resistance remains strong.

Taken together, today’s rally looks like a bounce, not a trend change—and may offer an opportunity to sell natural gas rather than chase the upside.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account