XRP Price Prediction: XRP Slips 13% in a Week: $1.90 Test Puts $115bn Market Cap on Edge

XRP is still going strong at just over $1.90, as it continues to weather a rough patch that's knocked the token down by over 13%...

Quick overview

- XRP is currently priced at over $1.90, despite a recent drop of over 13% in the last week.

- Trading volume remains high at over $3.4 billion in 24 hours, indicating active market participation.

- Ripple's ecosystem is expanding with developments like XRP ETFs and growing institutional interest, but market sentiment remains cautious.

- Technically, XRP is in a descending channel, with key support and resistance levels identified for potential trading strategies.

XRP is still going strong at just over $1.90, as it continues to weather a rough patch that’s knocked the token down by over 13% in the last week. Despite the drop, XRP still manages to come in at number five overall on the crypto leaderboard with a market cap of around $115.7 billion – that’s a lot of XRP in circulation, with 60.8 billion tokens out there now.

Trading activity is still pretty hot, with 24-hour volume over $3.4 billion – that’s a big deal and suggests traders are still really active in the market and not in a rush to get out of their positions. But the bigger picture is looking pretty fragile, with a sag in both Bitcoin and Ethereum keeping investors on the back foot and making them even more cautious.

Fundamentals are Still Looking Up Despite the Current Price Slump

On the surface, the short-term picture for XRP looks pretty gloomy – but it’s a bit of a different story when you look at the bigger picture. Ripple President Monica Long recently touted 2026 as the year crypto really starts to take off, suggesting we can expect more institutions to come on board, real-world use cases to develop, and a big upswing in tokenized assets.

Ripple’s ecosystem is still expanding, with all sorts of interesting developments around XRP ETFs, institutional investors growing more interested in the token, and the RLUSD stablecoin hitting a nice milestone of $1 billion in market cap. But the market still isn’t buying any of this, and instead is focused on the here and now – ie, macro risk, softer ETF demand, and a general feeling of unease in the markets.

So what’s driving sentiment right now? Well, here are a few key things:

- XRP is still a key player in the world of payments, and a lot of people in the industry are watching it

- Despite all the doom and gloom in the short term, there are still people who think long-term adoption is a real possibility.

- The market is currently saying that fundamentals aren’t enough to carry things on their own and need a price boost to really take off.

XRP/USD Technical Analysis: A Descending Channel Keeps the Bears in Charge

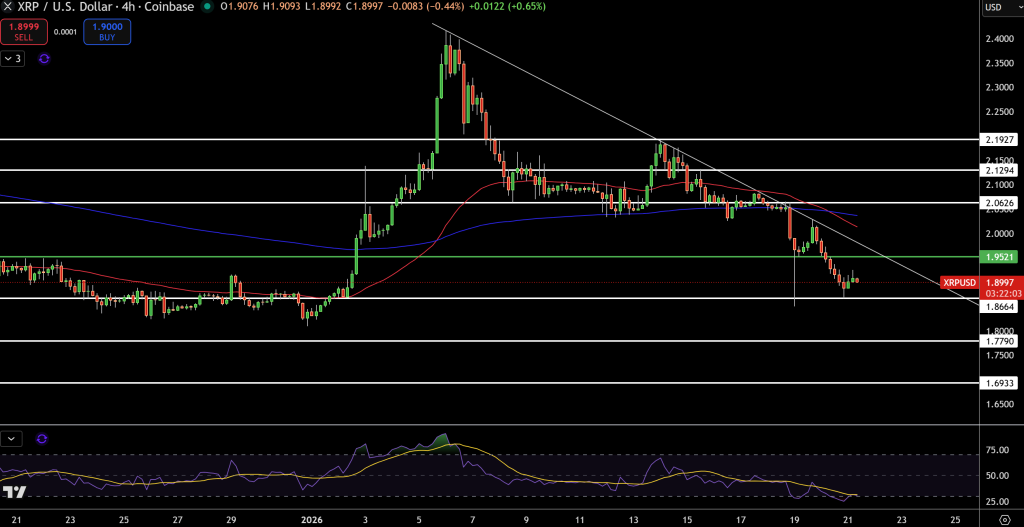

Now, let’s take a look at the technicals on the XRP/USD chart. On the 4-hour chart, price is stuck in a pretty clear descending channel, and after a little rejection at the $2.30 mark earlier in the month, price has actually slipped below both the 50-period and 200-period moving averages – and that’s not a good sign. Those moving averages are now capping any attempts at a rebound near the $2.05-$2.10 mark.

Looking at recent candlesticks, we can see that they’re pretty bearish, with smaller candles starting to form after some pretty strong bearish ones – but downside momentum still hasn’t really started to ease up yet. And on the Relative Strength Index (RSI) front, price is hovering pretty close to oversold territory – which usually means we’re due for a bounce. But does it mean we’re ready to turn the corner and go the other way? Not yet, at least.

So what are the key levels to keep an eye on then?

- If price drops further: look out for the $1.86 and then $1.78 (where the Fibonacci overlap comes in)

- If price decides to go back up, we’ll be looking at $1.95, $2.06, and $2.13 as key resistance levels.

Trading idea? Well, for now, sell rallies below $1.95 and target $1.80, but be prepared to stop out if the price goes above $2.06.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM