XRP Price Prediction: XRP Holds $1.91 With $116B Market Cap – Is a 2026 Breakout Still in Play?

XRP is trading near $1.91 as of January 24, 2026, showing early signs of stabilization after a volatile start to the year...

Quick overview

- XRP is trading at $1.91, showing signs of stabilization after a volatile start to 2026, with a market cap of $116.5 billion.

- Despite a 19% pullback from January highs, the price movement appears to be consolidation rather than capitulation amid cautious market sentiment.

- XRP Ledger processes 1.5–1.8 million transactions daily, with a fixed supply of 100 billion tokens, contributing to gradual supply compression.

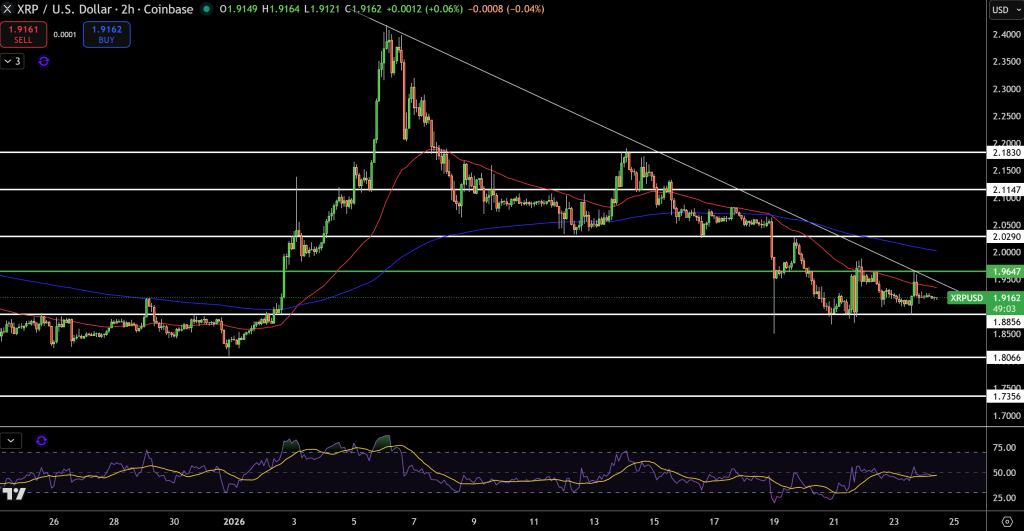

- Technical analysis indicates XRP is range-bound but stable, with key resistance at $1.96 and support around $1.88.

XRP is trading near $1.91 as of January 24, 2026, showing early signs of stabilization after a volatile start to the year. The token is up roughly 0.4% over the past 24 hours, with trading volume holding above $2 bn, signaling that participation remains active even as momentum cools. With a market capitalization of $116.5 bn, XRP continues to rank among the five largest digital assets globally.

While price has pulled back nearly 19% from January highs, this move looks more like consolidation than capitulation. Market sentiment has turned cautious amid delays in US crypto legislation and broader risk-off positioning, but structural demand has not disappeared.

Market Caution Meets Institutional Patience

Short-term pressure has emerged as Washington debates around market structure bills stall in Senate committees. That uncertainty has muted speculative inflows across major tokens, XRP included. Still, institutional framing around XRP remains intact. Ripple leadership continues to emphasize long-term adoption, with CEO Brad Garlinghouse reiterating expectations for new crypto all-time highs in 2026, driven by tokenization and enterprise-grade infrastructure.

Recent discussions at Davos highlighted XRP Ledger’s role in handling trillions in tokenized value, reinforcing its positioning beyond retail trading cycles.

XRPL Usage and Supply Dynamics Matter

XRP’s fundamentals continue to quietly strengthen. The XRP Ledger processes 1.5–1.8 mn transactions daily, with settlement finality measured in seconds and average fees below $0.0002. Unlike inflationary networks, XRP’s supply is fixed at 100 bn, with roughly 60.85 bn in circulation. Transaction fees are burned, and reserves are locked across wallets, liquidity pools, and institutional products, creating gradual supply compression over time.

Ripple’s RLUSD stablecoin expansion, including recent exchange listings and XRPL integration, adds another layer of utility that indirectly supports XRP demand.

XRP/USD Technical Structure Shows Compression, Not Breakdown

From a technical perspective, XRP remains range-bound but stable. Price is holding above the $1.88–$1.90 support zone, an area repeatedly defended by buyers. On lower timeframes, XRP trades within a descending channel, capped by a trendline near $1.96. Momentum indicators are neutral, with RSI hovering near 50, reflecting balance rather than trend exhaustion.

A sustained break above $1.96–$2.03 would signal structural repair and reopen upside toward the $2.10–$2.20 zone.

What to Watch Next

- Regulatory clarity in the US

- RLUSD adoption and XRPL DeFi growth

- Price behavior around the $1.90 support base

Trade idea: Buy a confirmed breakout above $1.96, target $2.08, stop below $1.88.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account