Gold Tops $5,000 as Trump Risk and Dollar Slide Redefine Safe Havens; Price Forecast

Gold futures top $5,000 as Trump policy risk, a weaker dollar, and falling yields drive a structural safe-haven shift.

Quick overview

- Gold futures have surpassed $5,000 per ounce, indicating a significant shift in precious-metals trading driven by institutional demand.

- The price of gold has increased over 16% month-to-date and more than 80% year-on-year, reflecting a repricing of macro risk rather than a temporary spike.

- Political uncertainty surrounding US policies under President Trump has contributed to gold's rise, as it serves as a hedge against market unpredictability.

- The rally in gold is part of a broader trend in hard assets, with significant increases in silver, platinum, and copper prices, alongside a record demand for gold.

Gold futures have decisively crossed the $5,000 per ounce threshold, marking one of the most consequential regime shifts in modern precious-metals trading. As of January 26, 2026, spot gold is trading in the $4,980–$5,050 range, while futures briefly pushed as high as $5,070–$5,080, reflecting sustained institutional demand rather than speculative excess.

This is not a one-day headline move. Gold is up more than 16% month-to-date and over 80% year-on-year, having traded near $2,000 as recently as early 2024. The pace and structure of this rally point to a repricing of macro risk rather than a temporary flight to safety.

Policy Uncertainty Under Trump Revives Structural Demand for Gold

Political uncertainty tied to US President Donald Trump’s renewed policy agenda has emerged as a key catalyst. Recent tensions surrounding trade policy, pressure on the Federal Reserve, and controversial geopolitical positioning have unsettled markets, reinforcing gold’s role as a hedge against policy unpredictability.

Gold briefly surged above $5,026 following reports highlighting investor unease over Trump’s stance on tariffs, Greenland, and central-bank independence, developments that have revived trade-war concerns and weighed on confidence in traditional financial assets. Historically, gold performs best when policy credibility is questioned. This episode fits that pattern closely.

Weak Dollar and Yields Strengthen the Case

Macro conditions are reinforcing the move. The US Dollar Index (DXY) is trading near 97.1–97.2, down roughly 0.8% in recent sessions. A weaker dollar directly supports gold by lowering its cost for non-US buyers and reducing the opportunity cost of holding non-yielding assets.

At the same time, US 10-year Treasury yields have eased toward 4.21–4.24%, retreating from recent highs. Lower real yields reduce competition from bonds, a classic tailwind for gold during risk-off phases. This combination, falling dollar and easing yields, has historically coincided with extended gold uptrends rather than short-lived spikes.

Demand Is Broad, Not Isolated

Importantly, gold’s rally is not occurring in isolation. Silver has surged above $100 per ounce, platinum has climbed toward $2,800, and copper has printed record highs above $13,000 per ton, signaling a broad hard-asset repricing rather than a single-asset bubble.

Gold demand by value rose 44% year-on-year to a record $146 bn in late 2025, according to World Gold Council data cited in recent reports, driven by ETF inflows and persistent central-bank accumulation.

Yet analysts note that official buying alone does not fully explain the speed of the move, pointing instead to rising private-sector hedging against currency debasement.

Gold Price Forecast: Why $5,000 Now Anchors a New Macro Regime

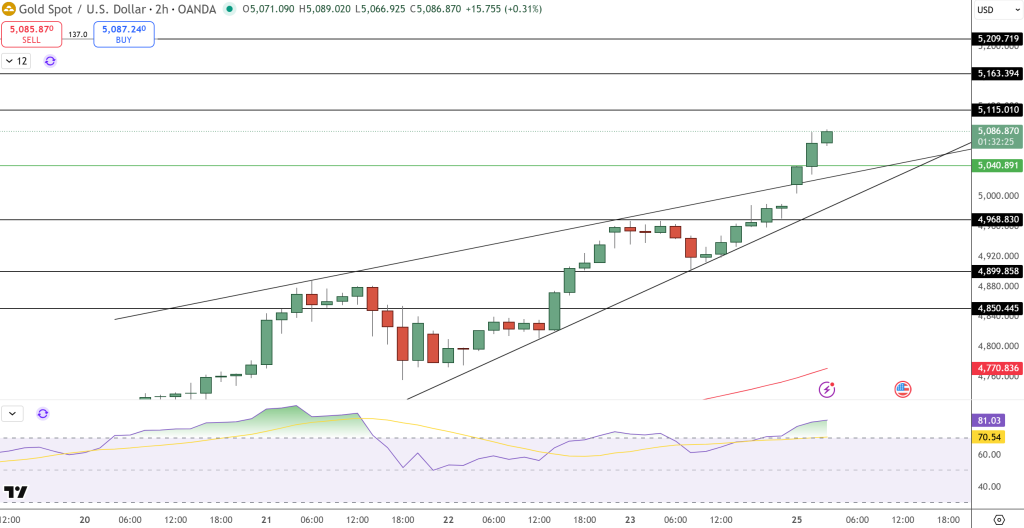

GOLD remains firmly bid on the 2-hour chart, with price holding inside a well-defined rising channel that has guided the advance since the rebound from the $4,770 area. The recent breakout above $5,040 confirms a continuation move rather than a blow-off top, as price continues to respect the channel’s upper and lower boundaries.

Momentum supports the trend. RSI is holding near 80, reflecting strong bullish conditions, but importantly without bearish divergence. In trending markets, elevated RSI readings often persist as long as pullbacks remain shallow and structured, which is the case here.

Former resistance at $5,040 has flipped into first support, while the rising channel base and horizontal structure converge near $4,970–$4,900, marking the key invalidation zone for the bullish setup.

Gold Forecast: As long as gold holds above $4,970, the path of least resistance remains higher. A sustained hold above $5,080 opens the door toward $5,160, followed by $5,300 on extension. A break below $4,900 would signal a deeper consolidation rather than a trend reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account