Ethereum Tumbles to $2,700 as Whales Stake $745M Despite Market Weakness

Ethereum is experiencing rising pressure as the world's second-largest cryptocurrency slips below $2,800, trading around $2,700 with a

Quick overview

- Ethereum (ETH) has dropped below $2,800, currently trading around $2,700, marking a 5.7% decline in the last 24 hours.

- Despite the price drop, institutional players are increasing their long-term commitments, with Bitmine staking an additional 250,912 ETH.

- The divergence between Ethereum's price decline and ongoing staking activity suggests a shift in strategy among major holders towards long-term yield production.

- Technical indicators show bearish trends, with key moving averages acting as resistance and immediate support at $2,700 being tested.

Ethereum ETH/USD is experiencing rising pressure as the world’s second-largest cryptocurrency slips below $2,800, trading around $2,700 with a significant 5.7% decline over the past 24 hours. The decrease continued a sustained period of weakness that has seen ETH struggle to retain the psychologically crucial $3,000 threshold, raising worries about whether the current consolidation will lead to additional downside or constitute a meaningful bottom.

Yet underneath the surface volatility, a startling paradox is emerging. Major institutional players are increasing their long-term commitments while spot prices stumble and technical indications show red flags. According to blockchain analytics firm Arkham, Bitmine has staked an extra 250,912 ETH, valued at about $745 million, over only the past 18 hours. This aggressive move brings the entity’s total staked position to 2,582,963 ETH worth $7.67 billion, representing a staggering 61% of its entire Ethereum holdings.

Divergence Between Price Action and On-Chain Behavior

There has been a fundamental change in the way significant holders are approaching Ethereum, as evidenced by the contrast between the asset’s price downturn and persistent staking activity. Rather than retaining liquidity to benefit on short-term price movements, these well-capitalized participants are prioritizing yield production and long-term network engagement. By locking ETH into staking contracts, they effectively remove supply from circulation, restricting available liquidity even as demand remains subdued.

This conduct is particularly striking given current market conditions. While volatility has increased throughout the larger cryptocurrency market, fresh data indicates that Ethereum leverage is still at record highs, indicating increased risk among short-term traders. Despite this volatile environment, Bitmine’s decision to stake the bulk of its holdings demonstrates trust in Ethereum’s proof-of-stake mechanism and its capacity to deliver sustainable cash-flow-like returns regardless of near-term price volatility.

Adding to the supply-side picture, Ethereum balances on controlled exchanges continue moving lower, reinforcing the image of constrained liquid supply. While diminishing exchange reserves don’t ensure higher price movement, they do signal fewer coins are easily accessible to absorb rapid selling pressure, thus raising market sensitivity to marginal flows in either way.

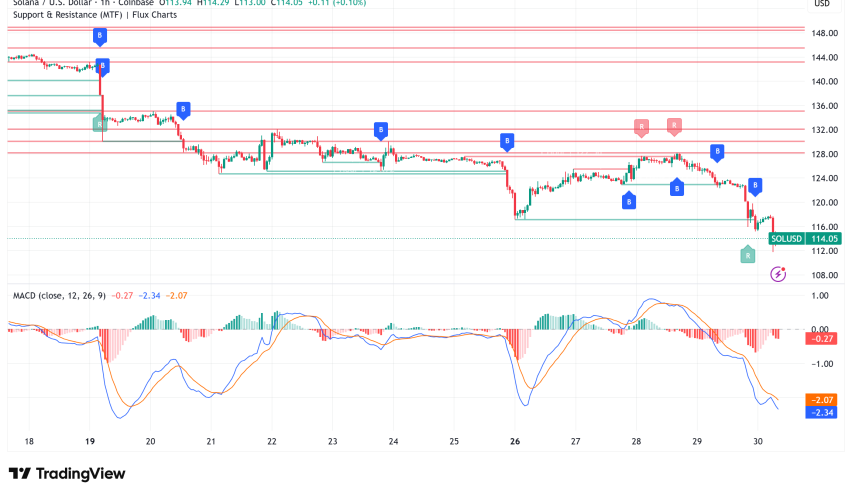

ETH/USD Technical Outlook: Bulls Defend $2,700, MAs Turn Bearish

From a technical perspective, Ethereum’s chart structure remains complex. With the 50-day average rolling over and serving as short-term resistance, ETH is presently trading below all of the key moving averages. The 100-day moving average stands higher between $3,200–$3,300, offering dynamic resistance that has stopped recent recovery attempts. Most notably, after climbing for months, the 200-day moving average, a crucial long-term trend indicator, has started to flatten, indicating that the overall uptrend is waning.

On the hourly period, a steep bearish trend line has formed with resistance at $2,820, while the price trades below the 100-hour simple moving average. Both the MACD and RSI indicators show negative momentum, with RSI sliding below the crucial 50 mark. The immediate support zone at $2,700 is now being tested, with bulls scrambling to protect this level after Wednesday’s failed attempt to shatter resistance at $3,017.

Ethereum Price Prediction: Key Levels to Watch

The present consolidation zone, which lies between $2,700 and $2,900, is a crucial turning point. Ethereum may attempt a comeback toward $2,860, then $2,900, and possibly retest the $3,000 psychological barrier if bulls are able to successfully defend the $2,700 support and push above the $2,820 resistance mark.

If $2,700 is not held, the November 21 low of $2,680 would be revealed, and there would be additional downside risk stretching toward $2,620 and possibly $2,550. A very pessimistic scenario would see ETH close below the 61.8% Fibonacci retracement line at $2,749 on a daily basis, which could drive increased selling into the psychologically crucial $2,500 level or possibly $2,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM