Daily Crypto Signals: Bitcoin Slides Below $73K, Ethereum Funding Rates Turn Negative Amid Market Turbulence

The cryptocurrency market experienced severe pressure on Tuesday as Bitcoin fell to a 2026 low of $72,945 and Ethereum plunged to $2,110

Quick overview

- The cryptocurrency market faced significant pressure, with Bitcoin dropping to a 2026 low of $72,945 and Ethereum falling to $2,110 due to declining stock markets and over $2 billion in liquidations.

- Galaxy reported a $482 million quarterly loss attributed to falling digital asset values, while Hyperliquid's HYPE token surged 19.5% following plans for market expansion.

- Ethereum experienced a 28% price correction, leading to substantial liquidations in leveraged positions and a notable decline in institutional demand.

- Analysts suggest that Bitcoin's current price levels reflect historical averages, despite concerns about the cyclical bull market potentially peaking.

The cryptocurrency market experienced severe pressure on Tuesday as Bitcoin BTC/USD fell to a 2026 low of $72,945 and Ethereum ETH/USD plunged to $2,110, driven by declining stock markets, liquidations exceeding $2 billion in leveraged positions, and institutional outflows from crypto ETFs. Galaxy reported a $482 million quarterly loss while Hyperliquid’s HYPE token surged 19.5% on prediction market expansion plans.

Crypto Market Developments

As traditional markets grappled with worries about artificial intelligence infrastructure valuations and impending corporate earnings releases, the larger cryptocurrency market was under tremendous selling pressure. The S&P 500, Dow Jones, and Nasdaq all traded down between 0.70% and 1.77%, with AI majors like Nvidia and Microsoft dropping 3.4% and 2.7% respectively.

Institutional investor Galaxy, founded by Mike Novogratz, revealed a whopping $482 million loss in the fourth quarter, mostly ascribed to deteriorating digital asset values. Despite the adverse market conditions, Novogratz maintained an optimistic outlook, assuring shareholders that the present drop reflected a common part of the crypto market cycle. “Anyone who’s been in crypto for more than five years realizes that part of the ethos of this whole industry is pain,” he noted, implying that Bitcoin is trading at the lower end of its price range.

In unrelated developments, recently released US Justice Department emails revealed that late billionaire Jeffrey Epstein made an early investment in Coinbase, acquiring 195,910 Series C shares for $3.25 million in 2014. Although there is no proof that Coinbase executives had direct contact with Epstein or were aware of the ultimate beneficial owner, the filings indicate that he later sold half of his interest for $15 million in 2018.

Meanwhile, Hyperliquid’s HYPE token resisted general market weakness, soaring 19.5% to $37.14 after the Hypercore team announced support for the HIP-4 proposal to expand into prediction markets. The connection would enable fully collateralized contracts on the decentralized perpetual futures platform, allowing traders to wager on political elections, sports, and other markets.

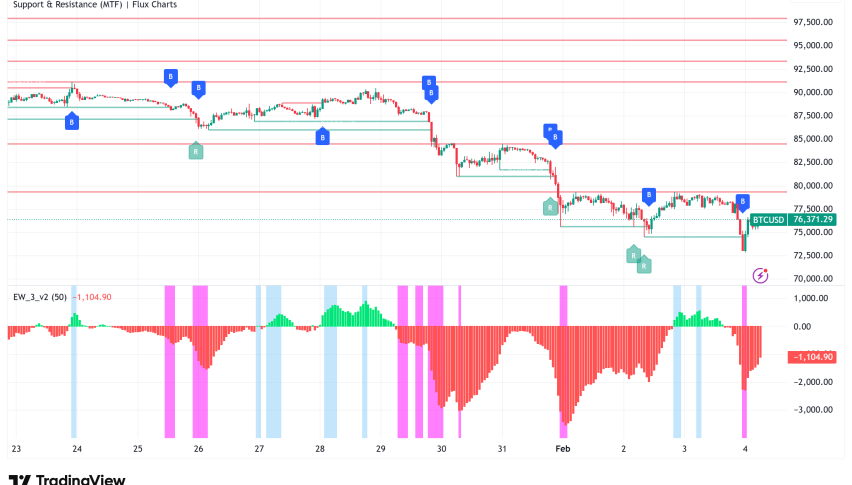

Bitcoin Reclaims $75,000 After a Dip to $72,000

As bulls failed to hold onto the crucial $80,000 support level, Bitcoin fell to a new 2026 low of $72,945 on Tuesday. Investors are worried that the cyclical bull market may have peaked because Bitcoin is currently trading at a 15% loss and is still roughly 45% behind its all-time high of $126,267. As volatility increased, $127.25 million in Bitcoin longs were forced to close due to heavy liquidations of leveraged long positions.

Despite the adverse market action, several analysts think that Bitcoin’s current levels represent historical averages rather than unusual weakness. Joe Burnett, Strive’s vice president of Bitcoin strategy, noted that the “45% Bitcoin drawdown aligns closely with historical volatility” and characterized such price swings as “a symptom of a rapidly monetizing asset.” Current order book data shows bids thickening between $71,800 and $63,000, though whether traders step in at these levels likely hinges on broader macroeconomic conditions and stock market performance rather than crypto-specific considerations.

Ethereum Trades Above $2,200

Ethereum underwent a painful 28% price correction over seven days, dropping to $2,110 on Tuesday as investors retreated to cash and short-term government bonds. The steep decrease prompted the liquidation of nearly $2 billion in leveraged bullish ETH futures positions, with long holdings accounting for $159.1 million in forced closures. ETH has drastically underperformed the larger cryptocurrency market, dropping 10% more than other major digital assets during the past 30 days.

The ETH perpetual futures annualized funding rate turned negative on Tuesday, a rare occurrence signaling that short sellers are now paying costs to maintain their holdings. This measure demonstrates a serious lack of confidence from bullish traders. Institutional demand has also cooled dramatically, with US-listed Ethereum spot ETFs witnessing $447 million in net outflows over five straight days. Trading volumes on Ethereum decentralized exchanges dropped 47% from $98.9 billion in October 2025 to just $52.8 billion in January, lowering incentives for holders as lower network activity decreases the burn mechanism that generally shrinks ETH supply. With onchain metrics continuing to worsen and macroeconomic uncertainty prevailing, economists advise that the negative financing rate should not be taken as an immediate purchase signal for a swift reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM