Forex Signals Feb 4: Google, Eli Lilly, Qualcomm, ABBV and Mitsubishi Earnings Preview

Wednesday’s earnings lineup featuring Alphabet, Eli Lilly, AbbVie, Mitsubishi UFJ, and Qualcomm will give investors fresh insight into...

Quick overview

- Wednesday's earnings reports from major companies like Alphabet and Eli Lilly will provide insights into AI monetization and drug demand.

- The market experienced significant volatility, with sharp price swings and a notable rebound in precious metals, particularly gold and silver.

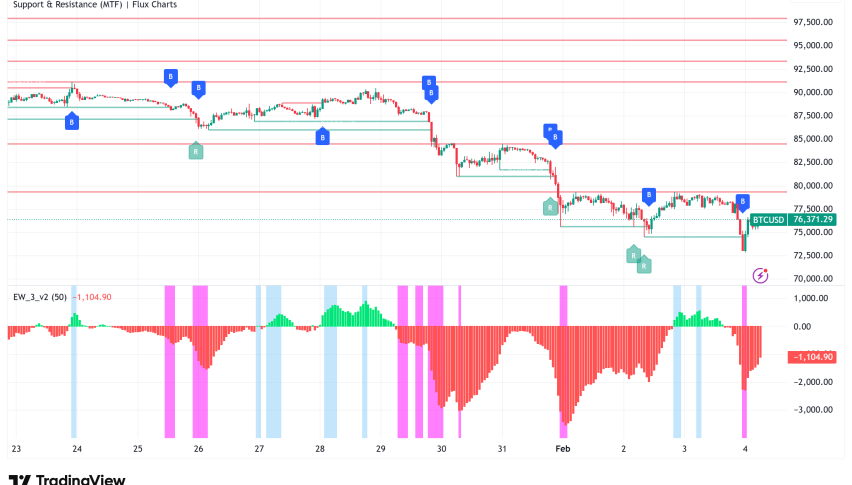

- Technology stocks and cryptocurrencies faced pressure, with Bitcoin hitting a low not seen since 2025 before a late recovery.

- The Australian dollar strengthened following a rate hike, while energy markets remain cautious amid rising geopolitical tensions.

Live BTC/USD Chart

Wednesday’s earnings lineup featuring Alphabet, Eli Lilly, AbbVie, Mitsubishi UFJ, and Qualcomm will give investors fresh insight into AI monetisation, drug demand, and global financial conditions.

Broad Market Volatility Returns

It was another session marked by sharp price swings and elevated volatility across asset classes. Markets struggled to find stable footing as investors rotated aggressively between perceived safe havens and prior high-flyers, underscoring fragile risk sentiment.

Precious Metals Lead Early

The day began with a powerful rebound in precious metals. Silver surged more than 10% at its peak before paring gains later in US trading, still closing up close to 7% around $85/oz. Gold was comparatively steadier near $4,920, yet its roughly $275 advance marked the largest one-day nominal gain on record. The move highlights ongoing demand for hedges amid macro and geopolitical uncertainty.

Tech and Crypto Under Pressure

In North America, volatility was most visible in technology stocks and cryptocurrencies. US equity futures started higher but quickly reversed as selling hit software names, megacap tech, and Nvidia. Notably, more than half of S&P 500 constituents finished higher, suggesting a concentrated sell-off in prior AI-driven winners rather than broad-based risk aversion.

Bitcoin fell to its lowest level since President Trump’s re-election at $72,903, before staging a late $3,000 rebound. That recovery may hint at tentative stabilisation in risk appetite. Nvidia and OpenAI also appeared to soften recent narratives, walking back reports that had weighed on sentiment.

FX Divergence and AUD Strength

In foreign exchange, the Australian dollar held firm after a rate hike and hawkish guidance from the RBA. Signs of domestic acceleration lifted AUD to highs near 0.7050, closing around 0.7020. The yen, however, failed to attract haven flows, reinforcing shifting correlations and central bank divergence.

Energy Markets and Geopolitical Risk

Energy markets remain uneasy as concerns over US–Iran tensions resurface. Oil prices remain sensitive to headlines, with traders cautious ahead of planned negotiations, leaving near-term direction highly uncertain.

Key Market Events to Watch: Earnings Reports Wednesday

In today’s earnings, AI monetisation remains under scrutiny, especially for Alphabet and Qualcomm. Healthcare earnings could set the tone for pharma valuations in 2026. Global financial signals from MUFG may offer clues on rate and currency trends. Guidance quality matters more than beats, given elevated expectations.

Alphabet Inc. (GOOGL) – Q4 2025 Earnings | AMC | EPS Est. $2.64

- Focus on AI monetisation, search advertising trends, and YouTube revenue growth

- Cloud margins and capital expenditure levels will be closely scrutinised

- Investors will watch for commentary on competitive pressure from AI-driven search alternatives

Eli Lilly and Company (LLY) – Q4 2025 Earnings | BMO | EPS Est. $6.93

- Demand trends for GLP-1 weight-loss and diabetes treatments remain central

- Margin sustainability amid heavy R&D and manufacturing investment is a key question

- Any update on supply constraints or pricing strategy could move the stock

AbbVie Inc. (ABBV) – Q4 2025 Earnings | BMO | EPS Est. $2.65

- Continued transition away from Humira dependence remains in focus

- Performance of newer drugs like Skyrizi and Rinvoq will be critical

- Dividend stability and cash-flow strength remain supportive factors

Mitsubishi UFJ Financial Group (MUFG) – Q3 2025 Earnings | TNS | EPS Est. $0.22

- Investors will assess exposure to global rate trends and Japan policy shifts

- Loan growth, net interest margins, and currency impacts will be closely watched

- Any guidance on capital returns could influence sentiment

QUALCOMM Incorporated (QCOM) – Q1 2026 Earnings | AMC | EPS Est. $3.40

- Smartphone demand recovery and AI-on-device strategy will be key themes

- Licensing revenue stability remains a core valuation driver

- China exposure and OEM inventory trends may shape near-term outlook

Last week, markets were quite volatile again, with gold soaring to $4,550 and then retreating but finding support at $4,300. EUR/USD climbed above 1.18 while main indices closed the week higher at new records. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 28 winning signals and 9 losing ones.

Gold Reaches $5,000 Again After the Flush

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate cut comments, as profit-taking was prompted by Powell’s cautious tone. In December, gold jumped above $4.3800 following the Federal Reserve’s announcement of a 25 basis point rate decrease. But the impetus soon waned, and prices dropped back to $4,004. The 20 daily SMA (gray) held as support last week and buyers returned and pushed XAU above the $5,000 mark for the first time during Asian hours and extended the rally in New York, printing a fresh record high near $5,111 before retreating below $5,000 late in the session. But buyers returned into Asian session and XAU climbed to $5,598 but pulled back below $5,000 and rebounded back up in the most volatile day ever.

USD/JPY Rebounds Above 155

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. However, the new BOJ governor the JPY has weakened and USD/JPY soared to 154 and we decided to close our buy signal for more than 80 pips as the pair found support at the 20 daily SMA (gray) and has rebounded more than 200 pips off that MA but reversed after the 25 bps rate cut from the FED. The price approached $160 but reversed after the BOJ meeting and fell 8 cents but found support at $152 at the 100 daily SMA (red) and rebounded above 155.

USD/JPY – Daily Chart

Cryptocurrency Update

Bitcoin Fall Stalls at 2025 Lows

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $80K before finding support at the 100 weekly SMA (green). A rebound followed, sending BTC near $100 is the first major text for Bitcoin buyers. However BTC returned lower and fell below $80K, breaking below the but the 100 weekly SMA (green) but the decline stopped at the support and resistance zone above $65K.

BTC/USD – Weekly Chart

Ethereum Heads to $2,000

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. Last week we saw a dive below $2,500.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM