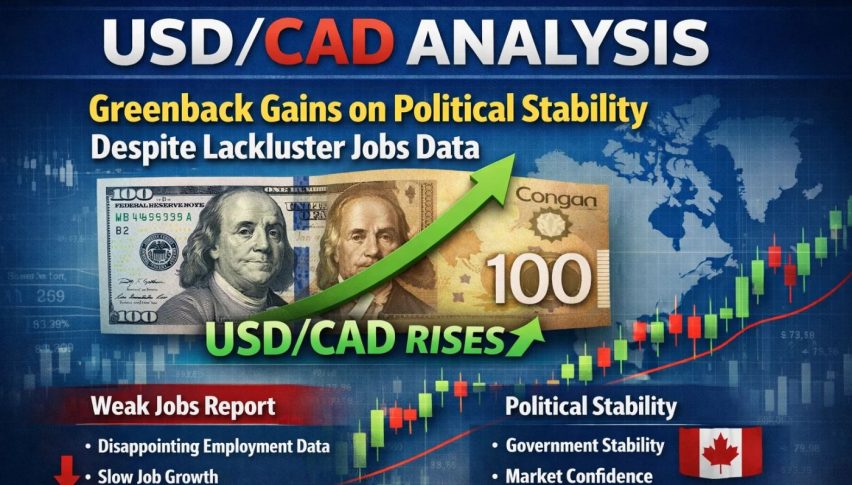

USD/CAD Analysis: Greenback Gains on Political Stability Despite Lackluster Jobs Data

USD/CAD continued to climb in the late European session, staying close to 1.3660. The recent gains are mostly due to renewed strength...

Quick overview

- USD/CAD is climbing towards 1.3660, driven by a stronger US Dollar despite weak ADP employment data.

- The US Dollar's strength is attributed to the resolution of a government shutdown and clearer Fed leadership with Kevin Warsh's nomination.

- In Canada, mixed economic signals are evident as manufacturing shows growth while services slump, leading to uncertainty ahead of a key speech by Bank of Canada Governor Tiff Macklem.

- Technically, USD/CAD is recovering, with analysts suggesting a buy above 1.372 and a target of 1.385.

USD/CAD continued to climb in the late European session, staying close to 1.3660. The recent gains are mostly due to renewed strength in the US Dollar, supported by clearer politics in Washington and a fresh look at US labor data.

US Dollar Defies Weak ADP Report Amid Political Tailwinds

Traders focused on the January ADP Employment Change report, which showed private sector hiring slowed sharply. The US added just 22,000 jobs, well below the expected 48,000 and far less than the 2024 monthly average of 186,000.

Even with this weak data, which usually hurts a currency, the US Dollar stayed strong because of two key developments in the US:

- Government Shutdown Resolved: The quick end to a two-day government shutdown helped restore investor confidence in US fiscal stability.

- Fed Leadership Clarity: Markets see the nomination of Kevin Warsh to replace Jerome Powell as a step toward more predictable policy, even as Warsh faces a challenging economic period.

Canadian Economy: Manufacturing Rebound Meets Services Slump

In Canada, the “Loonie” is showing mixed signals. Monday’s S&P Global Manufacturing PMI brought some optimism, with factory activity growing at its fastest rate in over a year at 50.4.

This was the first time in a year that the sector expanded, helping offset last week’s weak GDP numbers. However, optimism faded quickly as the Composite PMI fell to 46.4, showing a deeper slump in services.

With the Canadian economy facing uncertainty, traders are watching for Bank of Canada Governor Tiff Macklem’s speech later today (February 5) to see if the bank will keep its current rate or change course to address sector weakness.

USD/CAD Technical Outlook: Bulls Eye $1.375 as Momentum Shifts

Technically, USD/CAD is starting to recover after the sharp drop in late January, showing signs of returning to its average level.

Key Levels to Watch:

Support Zone: The 1.364 to 1.368 range has shifted from being a resistance area to now acting as short-term support.

Resistance Levels: The first resistance is at 1.375, which matches the 50-EMA, with a stronger barrier at 1.386.

Momentum Indicators: The RSI is close to 60, which means the recovery looks solid and there is still room for further gains before the pair becomes overbought.

Trade Idea: Analysts recommend buying above 1.372, aiming for 1.385, and setting a stop-loss below 1.364 to manage possible volatility during Governor Macklem’s speech.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM