Bitcoin Crashes to $64,000: 11.5% Daily Plunge Tests Former Cycle Highs as Bearish Momentum Accelerates

Bitcoin (BTC) is currently trading around $64,000, down a terrible 11.5% in the previous 24 hours, as the world's largest cryptocurrency

Quick overview

- Bitcoin is currently trading at $64,000, down 11.5% in the last 24 hours, falling below the critical $69,000 support level.

- The cryptocurrency has dropped approximately 29% since its failed attempt to surpass $90,500 in January, with nearly $10 billion in open interest liquidated recently.

- Technical indicators show Bitcoin is in extreme oversold conditions, suggesting a potential relief bounce, but broader market turbulence and corporate liquidation fears may hinder recovery.

- Current predictions indicate further downside is likely before a sustainable bottom is reached, with significant support expected between $58,000 and $60,000.

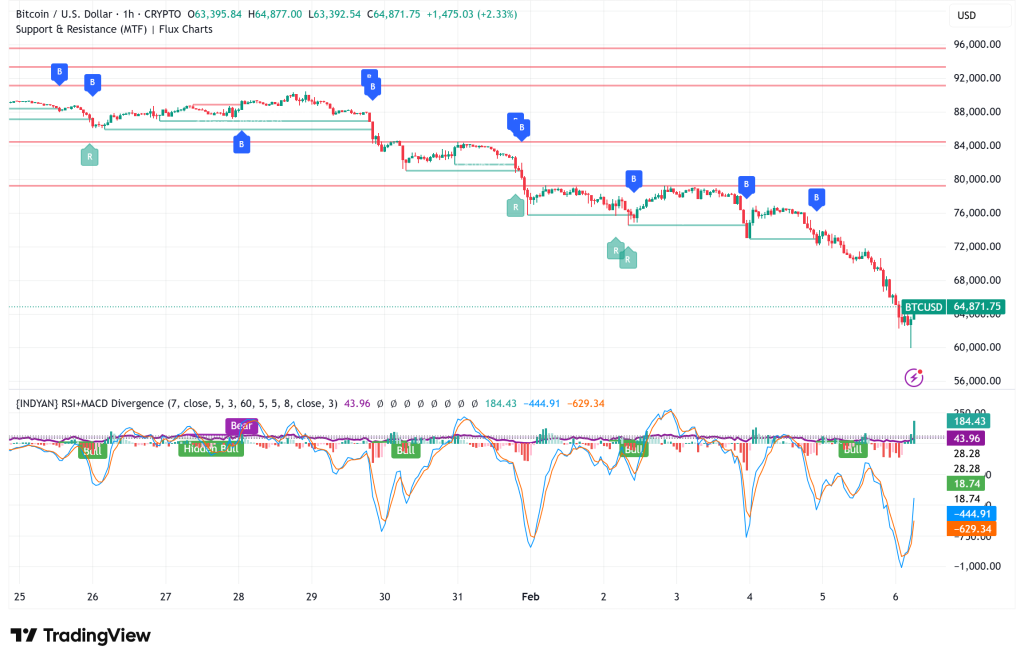

Bitcoin BTC/USD is currently trading around $64,000, down a terrible 11.5% in the previous 24 hours, as the world’s largest cryptocurrency succumbs to rising macroeconomic headwinds and broad deleveraging throughout digital asset markets. The steep dip has brought Bitcoin below the psychologically significant $69,000 level, the previous all-time high from the 2021 bull market, raising concerns that further downside may be imminent.

The cryptocurrency has now fallen around 29% from its failed bid to exceed $90,500 in late January, with futures market data revealing almost $10 billion in open interest liquidated during the past seven days. This enormous unwinding of leveraged positions suggests a fundamental reset in market structure and investor mood.

Critical Support Zone Breached: $69,000 Level Gives Way

Bitcoin’s slide below $69,000 marks a serious technical breakdown. This price point, which represents the cycle peak of 2021, has historically served as a strong level of support throughout corrections. In the previous bear market, Bitcoin hit its bottom near the 2017 high of $19,600 before briefly dropping to approximately $16,000 in November 2022, forming a pattern where former cycle tops provide support.

The current breach shows Bitcoin may be following a similar path, with the potential for additional loss before reaching a lasting bottom. A critical demand zone between $58,000 and $69,000, where significant transaction volume has historically accumulated, has been found by technical expert André Dragosch of Bitwise. This range overlaps with the 200-week moving average near $58,000, which might serve as the next significant support if present levels fail to hold.

In the meantime, order book data examined by cryptocurrency expert exitpump shows substantial bid liquidity between $65,000 and $68,000, suggesting some buyer interest at the current low levels, albeit not enough to buck the current downward trend.

Bitcoin’s Record Oversold Conditions Point to Potential Capitulation

Technical indicators have entered extreme oversold level rarely experienced in Bitcoin’s history. The weekly Relative Strength Index (RSI) for Bitcoin has fallen below 30, a level that has only been seen four times before, according to market expert Subu Trade. In each preceding occasion, Bitcoin rose an average of 16% over the subsequent four days, suggesting a relief bounce may be statistically probable.

The hourly MACD continues gaining bearish momentum, while shorter-timeframe RSI readings have plummeted below 50, confirming poor price activity over various time horizons. Most crucially, the adjusted net unrealized profit/loss (aNUPL) indicator has turned negative for the first time since 2023, meaning the average Bitcoin holder is now underwater on their investment.

Crypto analyst MorenoDV emphasized that comparable aNUPL circumstances in 2018-2019, 2020, and 2022-2023 all followed big price recovery. However, the analyst warns that the present “speed of sentiment deterioration” greatly exceeds prior cycles, potentially indicating a severe sentiment reset rather than progressive decline.

Macro Deterioration and Corporate Liquidation Fears Fuel Selloff

Bitcoin’s collapse matches broader market turbulence fueled by poor US economic fundamentals. Employers announced 108,435 layoffs in January 2026, a staggering 118% increase from January 2025 and the largest January total since 2009, when the economy was emerging from its worst crisis in eight decades.

Corporate Bitcoin investors face rising pressure as company valuations fall below acquisition costs. Strategy (MSTR), the largest publicly listed business with onchain BTC holdings, just witnessed its enterprise value decrease to $53.3 billion while its cost base rests at $54.2 billion. Japan’s Metaplanet confronts a comparable discrepancy, valued at $2.95 billion against a $3.78 billion acquisition cost. Market participants believe that protracted price weakness could force these leveraged corporations to liquidate holdings to fulfill debt obligations, causing additional negative pressure.

The IT sector’s depression worsens Bitcoin’s troubles. Google’s announcement that 2026 capital expenditure will exceed $180 billion, nearly quadruple 2025’s $91.5 billion, has generated concerns about AI industry viability. Qualcomm shares plunged 8% after providing reduced growth guidance, citing supplier capacity shifted toward high-bandwidth memory for data centers. Even silver, considered a safe-haven asset, suffered a 36% weekly fall after reaching all-time highs, demonstrating persistent risk aversion.

BTC Options Market Prices Just 6% Chance of $90K Recovery by March

There is little hope for a short-term rebound in the derivatives markets. On Deribit platform, call options offering the right to acquire Bitcoin at $90,000 on March 27 traded at barely $522 on Thursday. Using the Black-Scholes pricing model, this implies less than 6% possibility of Bitcoin reaching $90,000 by late March, a dramatic contrast to the positive mindset existing just weeks earlier.

On the other hand, put options that offered the opportunity to sell Bitcoin at $50,000 on the same expiration date sold for $1,380, indicating a 20% implied probability of a deeper drop to that level. This asymmetric options pricing suggests market participants hedging defensively for additional downside rather than anticipating recovery.

Bitcoin Price Prediction: Further Downside Likely Before Sustainable Bottom

With Bitcoin currently trading at $64,000, immediate support seems at $63,000, with the important demand zone of $58,000-$60,000 indicating the next significant battleground. Accelerated selling toward the 200-week moving average near $58,000, where significant historical accumulation has taken place, might be triggered by a fall below $63,000.

Although current technical and onchain indicators indicate that capitulation may occur before reaching that extreme, the $50,000 level provides a worst-case scenario consistent with bearish put option posture. On the upside, any recovery attempt faces significant opposition at $69,000, the old 2021 peak that has now switched to resistance, followed by $75,000 and the negative trend line near $75,200.

While extreme oversold situations generally precede relief rallies, the deteriorating macroeconomic backdrop and corporate liquidation risks argue against sustained recovery in the immediate term. A recovery to $90,000 becomes increasingly doubtful before Q2 2026 barring substantial shifts in Federal Reserve policy, employment data, or institutional opinion. Before Bitcoin reaches a stable bottom, investors should get ready for more volatility and possible retests of the $58,000–$60,000 demand zone.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM