From Panic to Power Bounce: Equities Surge, Bitcoin Reclaims $70K After $1B Washout

On February 6, 2026, global financial markets bounced back after a tough three-day sell-off hit key support levels. As stocks...

Quick overview

- Global financial markets rebounded on February 6, 2026, following a three-day sell-off, with the S&P 500 rising 1.97% and the Dow Jones Industrial Average surpassing 50,000 for the first time.

- Bitcoin experienced a significant recovery, climbing nearly 15% to reclaim the $70,000 mark after a leverage washout cleared weak positions from the market.

- US Consumer Sentiment Index reached a six-month high of 57.3, leading to lower short-term Treasury yields and increased expectations for a Federal Reserve rate cut.

- Analysts warn that the recent market rally may be temporary, urging caution due to ongoing volatility from AI spending concerns and interest-rate uncertainties.

On February 6, 2026, global financial markets bounced back after a tough three-day sell-off hit key support levels. As stocks, cryptocurrencies, and commodities became oversold, institutional investors and automated rebalancing sparked a broad recovery in risk assets.

S&P 500 Defends the 100-Day Moving Average

The S&P 500 rose 1.97% to close at 6,932.30, holding above its 100-day moving average. This level has been a key support since mid-2025. Traders watched it closely, as a drop below could have signaled a shift from a bullish to a bearish market.

The Dow Jones Industrial Average added to the rally, jumping over 1,200 points to close above 50,000 for the first time. Tech giants such as Amazon and Alphabet faced pressure from high 2026 spending forecasts, but the Philadelphia Semiconductor Index (SOX) climbed 5.7%, driven by gains in AI hardware companies like Nvidia.

Bitcoin Reclaims $70,000 Amid Leverage Reset

Bitcoin (BTC) made a strong intraday comeback, rising almost 15% from a 16-month low of $60,017 to regain the $70,000 mark. This jump was mainly caused by a large leverage washout.

- Forced Liquidations: Over $1 billion in long positions were wiped out during the initial drop to $60,000, effectively clearing the “weak hands” from the market.

- Funding Rate Stabilization: As derivatives markets cooled, spot buyers stepped in to capitalize on the 0.236 Fibonacci retracement level near $64,400.

- Institutional Rebalancing: Mechanical buying from crypto-exposed funds helped sustain the bounce as they rebalanced risk exposure for the month.

US Consumer Sentiment Hits Six-Month High

The University of Michigan’s Consumer Sentiment Index rose to 57.3 in February, beating market expectations. Although this is still low compared to past years, it was the third monthly increase in a row and the highest reading since August 2025.

The data had a cooling effect on bond markets:

- Bond Yields: Short-term Treasury yields dipped as the data lowered immediate fears of a hard economic landing.

- Fed Expectations: Market participants increased bets on a near-term Federal Reserve rate cut, providing a tailwind for non-yielding assets.

- Precious Metals: Gold and silver posted sharp recoveries, reclaiming ground lost during the peak of the week’s liquidity stress.

Technical Outlook: Can the Rally Sustain?

Even with excitement over the Dow reaching 50,000 and Bitcoin’s $10,000 jump, analysts caution that this could be just a temporary relief rally, not a lasting change in trend.

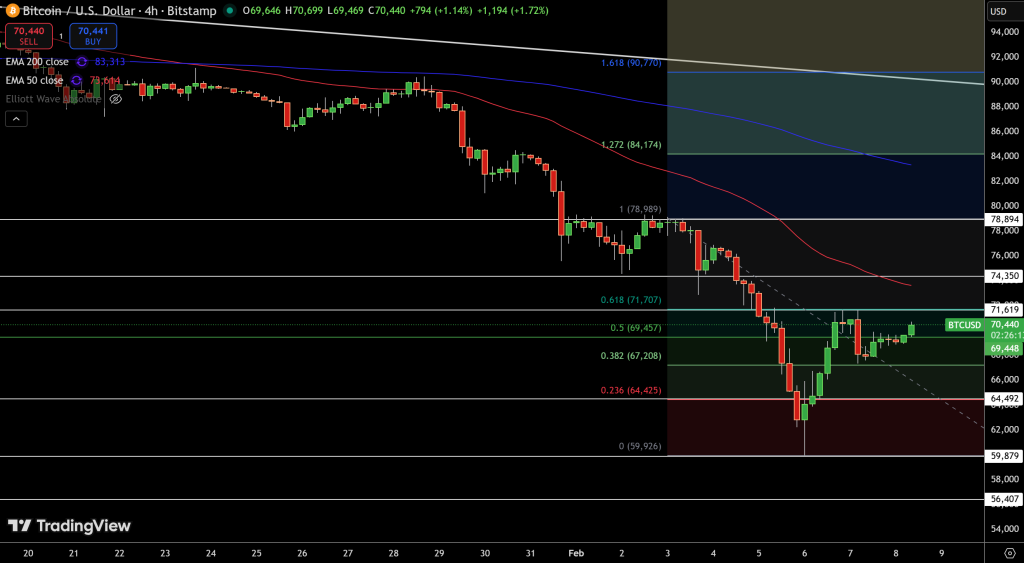

Bitcoin (BTC/USD) 4H Analysis

Bitcoin is now testing the 0.5 Fibonacci resistance zone between $69,450 and $71,700. Although recent trading shows strong dip-buying, the price is still below its 50-day EMA and a downward trendline.

For aggressive traders, buying on pullbacks near $69,400 could target a move toward $73,000. A stop-loss should be set just below $67,200 to protect against another sharp drop.

Market Conclusion

The events of February 6 show how important it is for markets to reset positions. By reducing excess leverage and reaching long-term moving averages, the market has found a short-term bottom. Investors should stay cautious, since volatility from AI spending worries and interest-rate uncertainty will likely continue this quarter.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM