Oct.11: Two Things To Know To Trade Gold Today

What’s up fellas. The Gold trading signal shared on Oct.10: Gold Completes 61.8% Retracement is yielding profits now. The idea was to sta

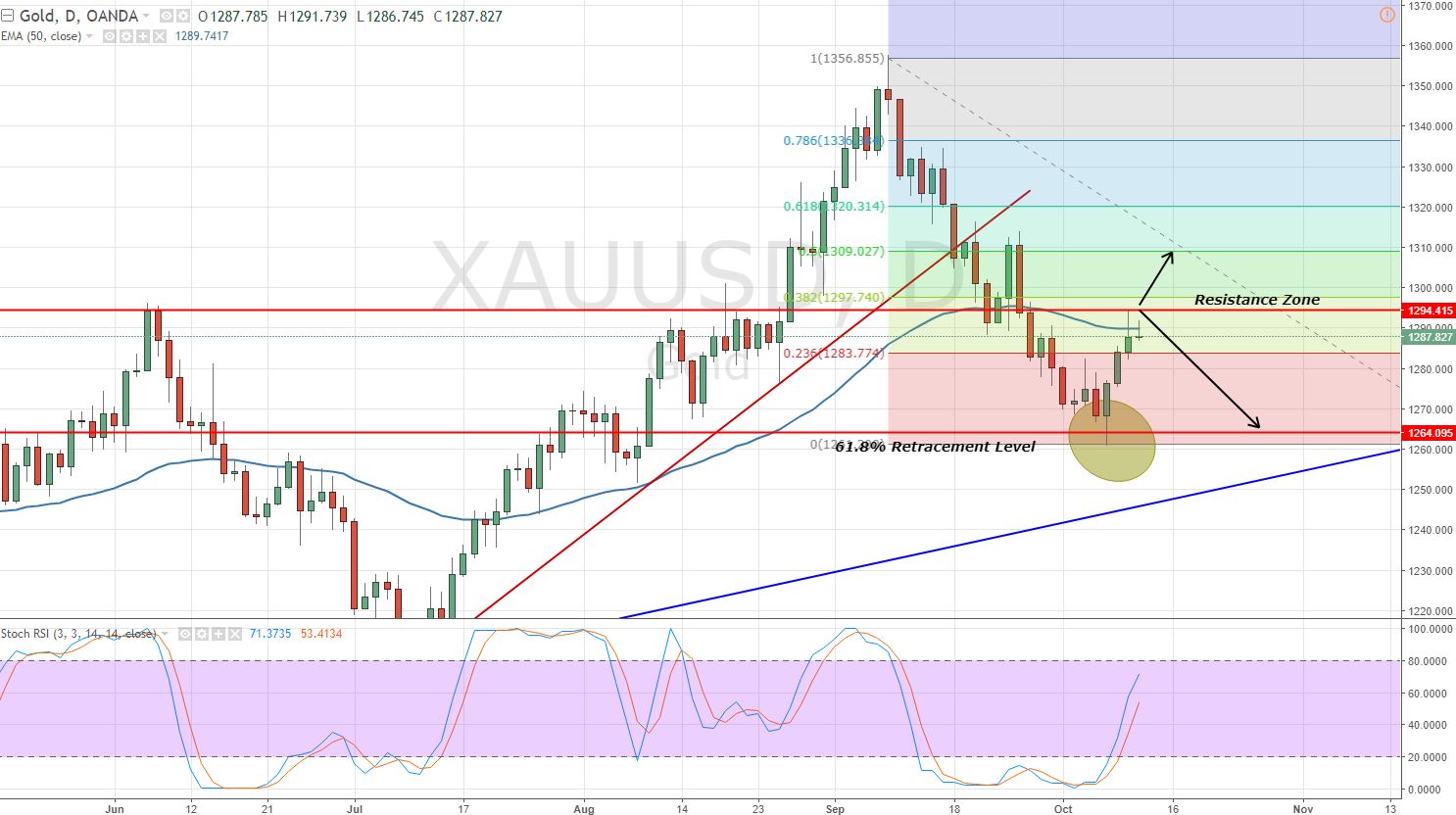

What’s up fellas. The Gold trading signal shared on Oct.10: Gold Completes 61.8% Retracement is yielding profits now. The idea was to stay in sell below $1,294 and that was exactly the level of reversal for Gold yesterday. Today, we need to consider two things to trade Gold.

Firstly – FOMC Meeting Minutes

Today, the FOMC meeting minutes are highly significant to trade Gold. These are coming out at 18:00 (GMT). It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates. Normally, we don't see much surprises in it.

I'm expecting FED (Federal Reserve) to focus the unexplained weakness in inflation. Perhaps, it can be due to Hurricane Harvey as the economy would face a slowdown recovering from shock.

Secondly – Technical Side – Moving Average Retest

Guys, in addition to FOMC, let me draw your attention towards the daily chart of Gold. Undoubtedly, the precious metal has moved exactly as suggested in our previous update. But now, the situation is a bit fundamentals dependent.

Gold – Daily Chart

Gold – Daily Chart

Looking at the daily chart, the Gold has closed the daily candle which is half bullish and half bearish. It's signaling half of the traders were trading with the bullish mindset while the other half continues to trade bearish. Isn't this causing confusion? Yes, it is.

So, let us focus on the technical levels. The immediate resistance is at $1,294. It's the same level where we recommended a sell position a day before. While $1,287 is a support zone for the Gold. Check out the trade idea.

Gold // XAUUSD – Trading Plan

For now, $1,287 is a crucial trading level. Above this, the metal can target $1,294 again while the break below this can lead the Gold towards our previously suggested target level of $1,280. Good luck.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Gold – Daily Chart

Gold – Daily Chart