GBPUSD – The UK Economy Moves Out of a Technical Recession!

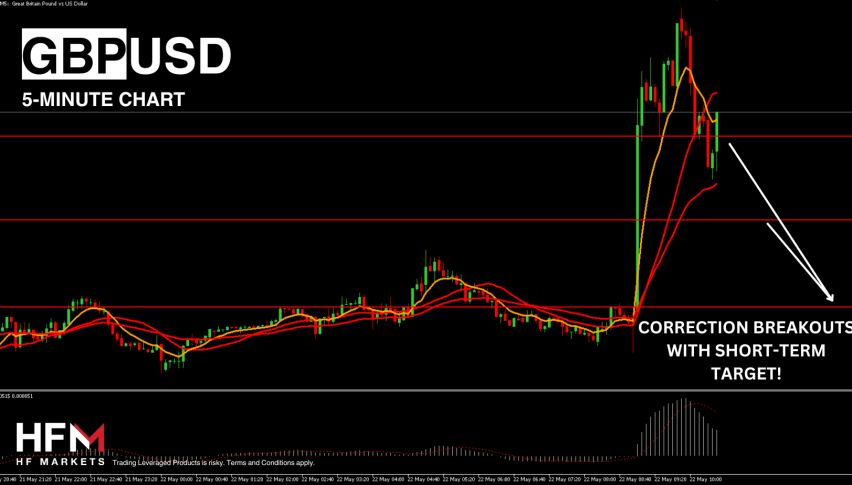

The GBPUSD over the past 24-hours has been influenced by three factors: the monetary committee’s votes, the Governor’s guidance and the UK’s latest GDP figure. The GBPUSD first fell to a 2-week low due to the higher number of votes for an interest rate cute. However, the GBPUSD has since risen 0.77%. Therefore, how can traders view the price movement and the latest developments?

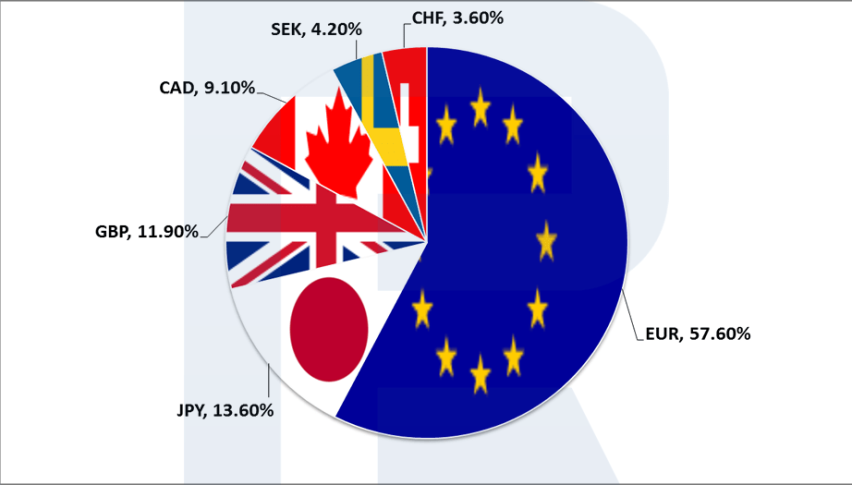

A significant factor influencing pricing is the likelihood of the regulator adjusting its policy in either June or September. A rate cut in September would bolster the GBP, keeping rates higher for a longer duration compared to the Eurozone and other competitors. The Monetary Policy Committee’s votes suggest the BoE is nearing readiness to cut rates. Additionally, the Governor expressed a desire to gradually move away from a restrictive policy, which in the UK is defined as 5.00% and above.

The price increase can be attributed to the Governor’s indication of a higher likelihood of a September rate cut over June. Moreover, the robust economic growth reported this morning diminishes the likelihood of a June cut, as there is less pressure on the BoE to support a stagnant economy. Consequently, a rate cut is now expected in September 2024, aligning with the Federal Reserve’s policy guidance. However, the Governor also suggested that the Central Bank may cut rates more than what the market is currently anticipating.

The Federal Reserve and US Employment Data

The US Dollar on Thursday evening was considerably pressured by the Weekly Unemployment Claims, which normally has a limited affect. The US Unemployment Claims rose to 231,000, higher than predictions of 212,000 and the highest since November 2023. Therefore, the US has seen lower NFP data, higher unemployment rate and now higher unemployment claims. This has investors questioning if the US employment sector may be weakening for the first time since raising interest rates.

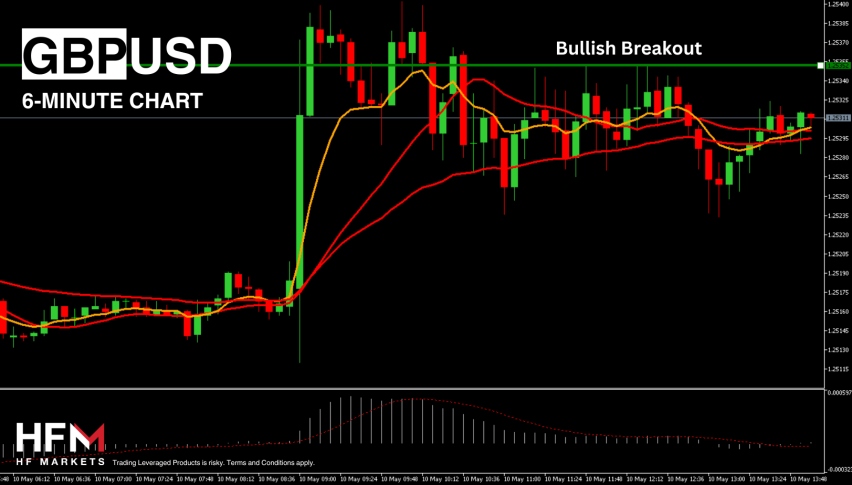

If so, the Federal Reserve may consider a cut in July. Currently, the CM Exchange’s tool shows a 30.8% chance of a cut in July, if this figure rises, the US Dollar could potentially weaken. So far the price is showing a bullish bias but is hovering within a neutral signals. If the price increases above 1.25352, the buy signal is more likely to materialize.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM