eth-usd

GBPUSD Climbs For A 5th Consecutive Day, Eyes On ECB and NFP!

Michalis Efthymiou•Thursday, March 7, 2024•2 min read

- The US Dollar declines against all currencies as investors increase exposure in alternative safe haven assets.

- Safe haven assets growing in demand this week include the Japanese Yen and Gold.

- The Pound rises against the Dollar but declines against the Yen, Euro and Australian Dollar over the past 24-hours.

- How will the Chancellor’s new Budget influence the UK economy and the Pound?

GBPUSD

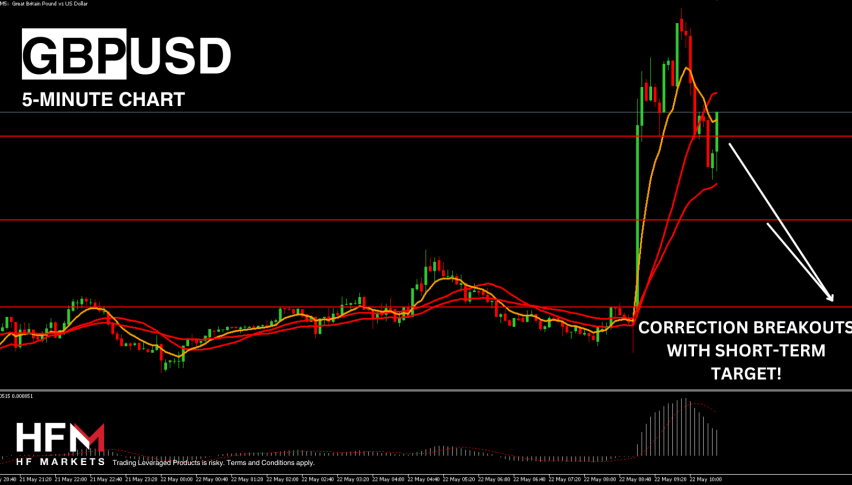

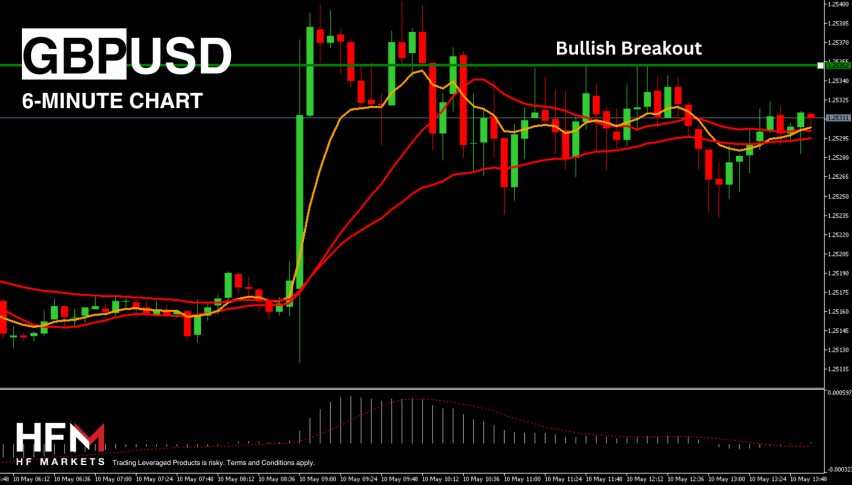

The cable exchange rate continues to trade within a bullish trend which is forming higher highs and higher lows. However, questions remain over the performance of the Pound over the short-term. The Pound over the past two days has weakened against most currencies. Therefore, the bullish price movement is largely being driven by the Dollar. The US Dollar Index is trading lower for a third consecutive day and if the price falls below 103.19, the GBPUSD is also likely to continue forming higher impulse waves.

The US Dollar is not yet particularly pressured by economic data even though economic data is weakening. Yesterday’s JOLTS Job Openings were as expected as was the ADP NFP Employment Change. Last month’s NFP data added a further 353,000 more employed individuals and salaries rose by a whopping 0.6%. In addition to this, US inflation continues to remain stickier than the Federal Reserve would like. So, we can see here that there is not yet economic data signalling major weaknesses which have been the UK and EU.

Nonetheless, the price of the Yen and Gold are significantly rising in value indicating investors may look to ditch the USD in favor of alternative safe haven assets. However, this is a concern but not yet a fact or reality. If ECB are unable to persuade investors, they will not cut rates before the Federal Reserve, the US Dollar potentially may again rise against many currencies including the Pound. Also, if tomorrow’s employment data beat analysts’ expectations, the US Dollar again can witness gains. Investors will particularly be interested in seeing the Average Hourly Earnings and NFP Change.

In regard to the UK budget, investors mainly paid attention to certain reductions announced by the Chancellor of the Exchequer Mr Hunt. In particular, the draft budget provides for a reduction in contributions to the social insurance fund by 2%, as well as a temporary freeze of excise taxes on alcohol and fuel. There were no major surprises in the budget, but for the GBP and the UK this is a positive. Previous surprises and major fiscal changes in the UK budget have caused a significant collapse in the Pound at times.

Technical analysis indicates buyers are currently controlling the exchange rate. The price trades above the 75-bar EMA and above the Neutral on the RSI and Stochastic Oscillator.

Michalis Efthymiou

HFM’s Market Analyst

Michalis Efthymiou brings over 9 years of extensive experience in the financial services industry across the United Kingdom and Europe. Initially serving as a financial advisor in London for 5 years, he has transitioned into the field of market analysis over the past 4 years.

2 mo ago

Save

Save

3 mo ago

Save

Save

4 mo ago

Save

Save