On the weekly chart, the technical indicators present a mixed outlook. The RSI remains in neutral territory, offering no immediate directional bias. The MACD, however, signals bullish momentum, with the MACD lines maintaining a bullish crossover and the histogram trending higher. Despite this upward momentum, the EMAs continue to exhibit a death cross, confirming that the mid-term trend remains bearish for now. A resolution of this divergence between momentum and trend structure will be critical in determining Boeing’s next directional move.

Boeing (BA) Stock Skyrockets 62% in Just Six Weeks – What’s Fueling the Rally?

•

Last updated: Wednesday, June 4, 2025

Quick overview

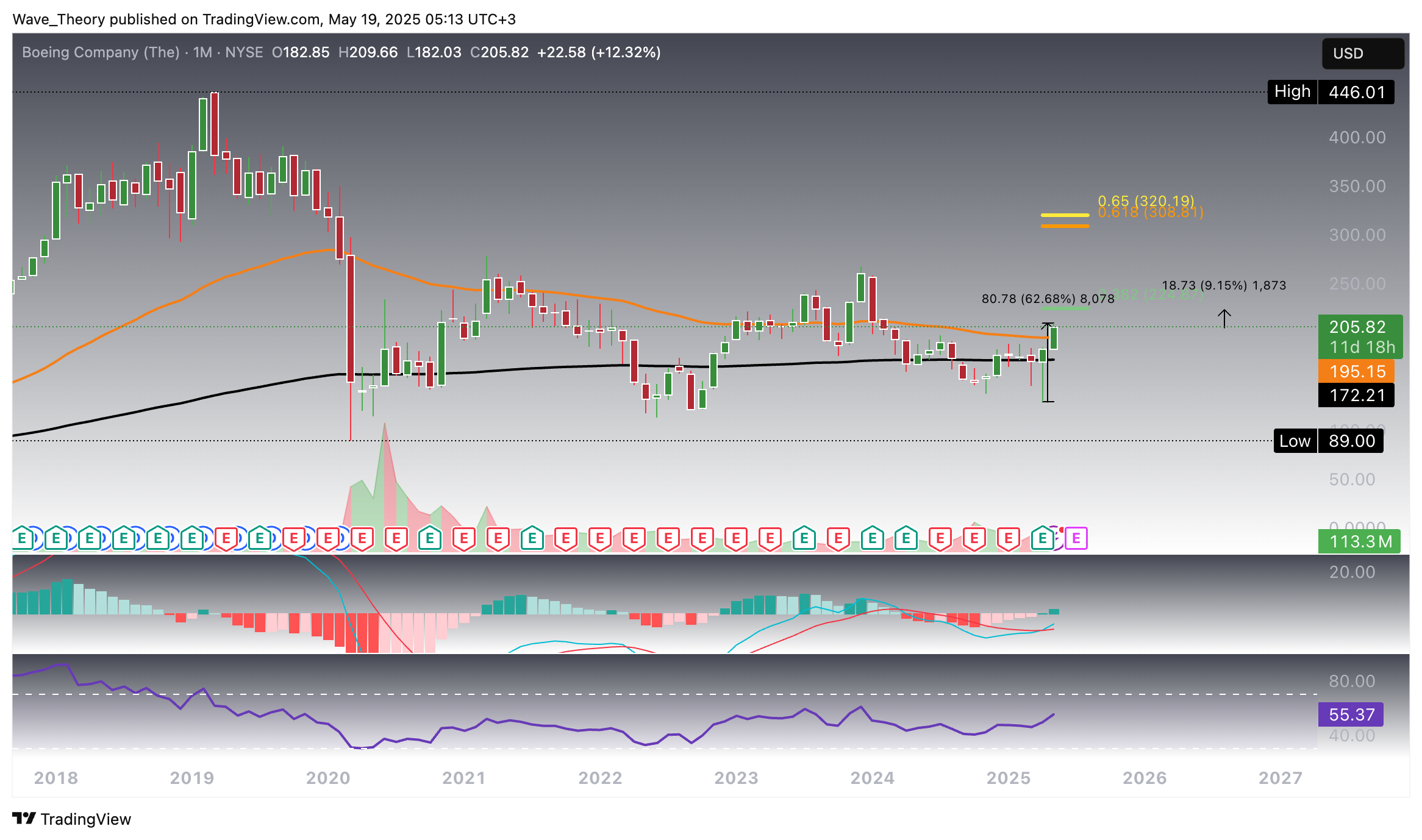

- Boeing (BA) stock has surged over 62% in six weeks, breaking above the 50-month EMA and nearing Fibonacci resistance at $225.

- A successful breakout above $225 could lead to a target of $320, while a rejection may result in a pullback to support levels at $179 and $158.

- Technical indicators show bullish momentum on longer timeframes, but short-term signals indicate potential consolidation or pullback.

- The mixed signals on various charts highlight the uncertainty in Boeing's next directional move.

Boeing (BA) stock has posted an exceptional gain of over 62% within the past six weeks, rebounding sharply from recent lows and reclaiming key structural levels. With momentum accelerating into potential resistance zones, the critical question now arises: is this the beginning of a sustained bullish breakout, or is a corrective retracement imminent as overbought signals start to surface?

Boeing (BA) Stock Surges Over 62% In Six Weeks: More Upside Ahead?

Following a remarkable 62% rally over the past six weeks, Boeing (BA) stock has decisively broken above the 50-month EMA at $195. A sustained monthly close above this key moving average would constitute a significant long-term bullish signal, potentially setting the stage for a continued move toward the 0.382 Fibonacci resistance at $225 — implying further upside of approximately 9.15%.

From a technical perspective, the indicators reinforce the bullish outlook. The exponential moving averages (EMAs) and MACD lines remain bullishly crossed, affirming the strength of the prevailing uptrend on the macro timeframe. Additionally, the MACD histogram is ticking higher, signaling increasing bullish momentum, while the RSI trends within neutral territory, offering room for further price appreciation before approaching overbought conditions.

Looking ahead, the next major structural resistance lies at $320. Only with a decisive breakout above the golden ratio at that level would Boeing fully re-enter a long-term uptrend. marking a true macro reversal in the broader picture.

Boeing (BA) Bullish Indicators On The Weekly Chart

Golden Crossover On The Boeing (BA) Stock’s Daily Chart

On the daily chart, Boeing has just confirmed a short- to medium-term bullish trend with the formation of a golden crossover in the EMAs. The MACD lines remain bullishly crossed, supporting the upward momentum. However, caution is warranted as the MACD histogram has begun to tick lower since yesterday, and the RSI has entered overbought territory — both early signs of potential exhaustion. Should Boeing face rejection at the 0.382 Fibonacci resistance at $225, or initiate a correction phase, the next significant support levels lie at $179 and $158. A move toward these levels would imply a potential downside of approximately 13.6%.

Should Boeing succeed in breaking above the 0.382 Fibonacci resistance at $225, the next major target lies at the golden ratio level around $320. A breakout of this magnitude would not only reaffirm the strength of the current bullish momentum but also unlock further upside potential of approximately 37% from the 0.382 Fib level at $225.

Mixed Signals On The 4H Chart

On the 4H chart, the EMAs have also confirmed the short-term bullish trend with the establishment of a golden crossover. However, momentum is beginning to show signs of weakening. The RSI has entered overbought territory, while the MACD lines are on the verge of a bearish crossover. Additionally, the MACD histogram is already exhibiting signs of exhaustion, suggesting that a short-term pullback or consolidation phase may be imminent.

Boeing

Summary

Boeing (BA) has rallied over 62% in six weeks, breaking above the 50-month EMA and approaching key Fibonacci resistance at $225. A breakout above this level could open the door toward $320, while rejection may trigger a pullback to support zones at $179 and $158. Momentum remains bullish across higher timeframes, though short-term signals suggest the potential for consolidation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.