Gold Price Forecast: Fed Rate Cut, Cooling CPI, and $4,200 Resistance Test

Last week’s U.S. economic data painted a mixed but cautiously optimistic picture. Core CPI rose just 0.2%, below expectations of 0.3%...

Quick overview

- U.S. economic data showed mixed signals, with core CPI rising 0.2% and headline CPI slowing to 0.3%, easing inflation concerns.

- Housing data remained stable, while President Trump's comments introduced volatility in the markets.

- Flash PMIs indicated uneven growth, with Manufacturing PMI increasing to 52.2 and Services PMI decreasing to 55.2.

- Gold prices are rangebound near $4,114, facing resistance at $4,200, as traders anticipate a pivotal week ahead.

Last week’s U.S. economic data painted a mixed but cautiously optimistic picture. Core CPI rose just 0.2%, below expectations of 0.3%, signaling easing inflation pressures. The headline CPI slowed to 0.3% month-over-month and 3.0% year-over-year, both below forecasts, sparking hopes that the Federal Reserve might soon take a softer stance.

Housing data came broadly stable, with Existing Home Sales holding at 4.06 million, while President Trump’s remarks on trade and fiscal policy injected volatility into late-week sessions.

Meanwhile, Flash PMIs showed a two-speed economy—Manufacturing PMI ticked up to 52.2, while Services PMI slipped to 55.2, suggesting steady but uneven growth across sectors. Overall, the data mix eased pressure on the Fed’s tightening outlook heading into its upcoming meeting.

Key Economic Events Ahead

Markets now turn to a pivotal week of data and policy cues that could steer sentiment into November.

Top U.S. events to watch:

- Oct 29: Fed expected to cut rates to 4.00% from 4.25%, with Powell’s comments likely shaping near-term dollar trends.

- Oct 30: Advance GDP (Q3) projected at 3.0%, down from 3.8%, suggesting moderating growth.

- Oct 31: Core PCE forecast steady at 0.2%, confirming a gradual disinflation trend.

Consumer confidence (forecast: 93.9) and housing indicators, such as Pending Home Sales (1.7%), will offer further insight into household and real estate conditions.

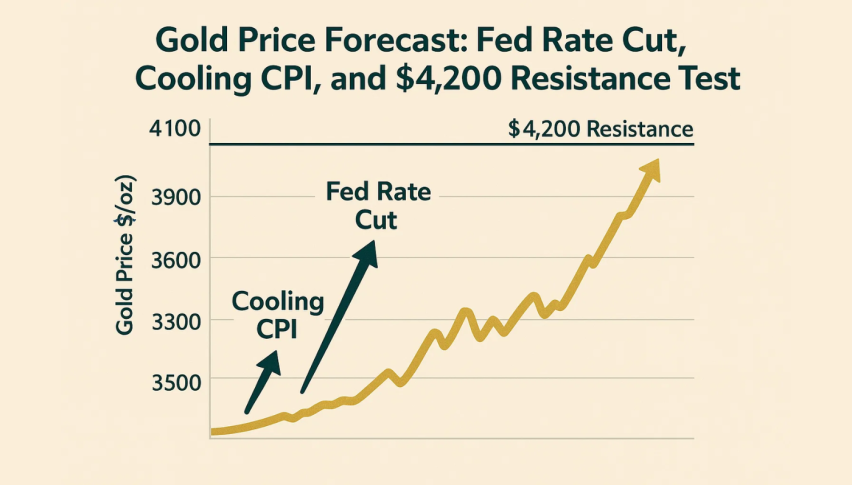

Gold Price Outlook: $4,200 Caps the Bulls

Gold (XAU/USD) remains rangebound near $4,114, weighed by a firm dollar and cautious sentiment ahead of the Fed’s decision. The metal’s rebound from $4,009 faces stiff resistance at $4,200, aligning with the 61.8% Fibonacci retracement of the last downswing.

On the 4-hour chart, gold trades below the 20-EMA ($4,127) and 50-EMA ($4,142), confirming near-term bearish control. Candlestick formations—spinning tops and Doji candles around $4,130—reflect indecision.

The RSI at 46 indicates neutral momentum with mild bullish divergence, suggesting weakening downside pressure.

Trade Setup:

- Bullish scenario: A breakout above $4,200 could open targets at $4,270 and $4,383.

- Bearish scenario: Failure to break resistance may drag prices back toward $4,009–$3,906.

Market Outlook

With inflation cooling and a potential Fed rate cut on deck, gold traders are eyeing a pivotal week. A confirmed break above $4,200 could spark a recovery rally, while another rejection risks extending gold’s sideways drift, leaving markets balanced between monetary optimism and technical caution.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account