Ripple Expands $4B Push with Palisade Deal as XRP Eyes $2.19 Support

Ripple has made another massive leap in its drive to become a $4 billion global player, with the acquisition of Palisade, a crypto...

Quick overview

- Ripple has acquired Palisade, a crypto custody provider, to enhance its blockchain finance offerings for corporations.

- The integration will provide banks and enterprises with secure multi-blockchain support and automated tools for managing digital assets.

- Despite Ripple's strategic acquisitions, XRP's market is experiencing a downturn, with sellers currently in control.

- The outlook suggests potential price corrections for XRP, even as institutional interest in blockchain continues to grow.

Ripple has made another massive leap in its drive to become a $4 billion global player, with the acquisition of Palisade, a crypto custody and wallet infrastructure provider. The deal shows just how serious Ripple is about getting top corporations on board with blockchain finance, as these same corporations are now getting deeper into it.

Ripple’s President, Monica Long, said, “The deal’s all about how corporations will be the driving force behind the next massive wave of crypto adoption.”

The integration and deal announced on Monday will see Palisade’s wallet-as-a-service tech integrated into Ripple Custody, giving banks and enterprises a super-secure way to manage their digital assets across multiple chains.

Key Integration Features:

- This will give multi-blockchain support and the ability to convert between crypto and fiat currencies

- Institutional-grade DeFi wallets – the whole shebang

- Automated billing and settlement tools.

Ripple’s Institutional Strategy Accelerates

Ripple’s acquisition of Palisade follows a string of high-profile deals, including its $1.25bn acquisition of Hidden Road and its $1bn acquisition of GTreasury. They’ve also got a $200mn deal lined up to buy the stablecoin firm Rail, which will help them further beef up their cross-border payments ecosystem.

Ripple wants to be the go-to outfit for corporates looking to get into blockchain – and bridge the world of traditional finance with these new, decentralized systems.

XRP Price Analysis: Sellers Regain Control

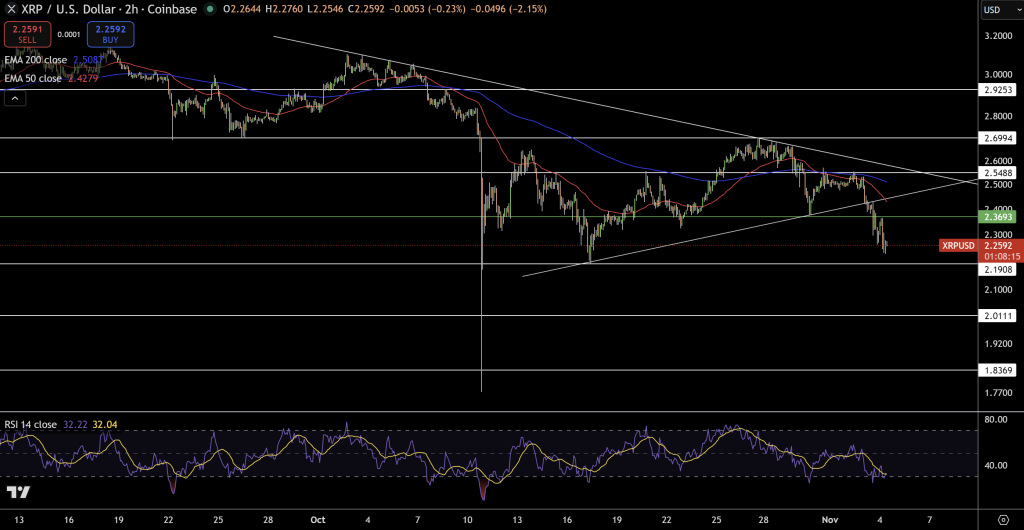

XRP’s market has been in a bit of a downturn, and the token has broken below both the 50-EMA ($2.42) and the 200-EMA ($2.50), forming a bearish crossover. The breakdown from a rising wedge pattern shows that there’s not much going for the bulls at the moment, and sellers are really in the driving seat.

The RSI is down near 32, which is a classic oversold signal, but there’s no confirmed divergence yet—and all this suggests the price may actually go down a bit before turning around. The bottom at $2.19 is the next level to look at, followed closely by $2.01. If we were to break below $2.19, then the correction could get a lot worse, while a nice big bullish candle above $2.42 may just signal that things are turning around.

Trade idea: Short entry near $2.30 with stop-loss above $2.52, target $2.19 and $2.01 – if you’re feeling a bit more cautious, you should wait for confirmation before getting back in.

Outlook: Corporate Growth Meets Market Pressure

On the one hand, Ripple is gaining ground in the infrastructure space; on the other hand, XRP’s price is down a bit, and there are plenty of reasons to think a correction is coming. Even as institutions enter the blockchain by the day, Ripple’s price remains volatile for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM