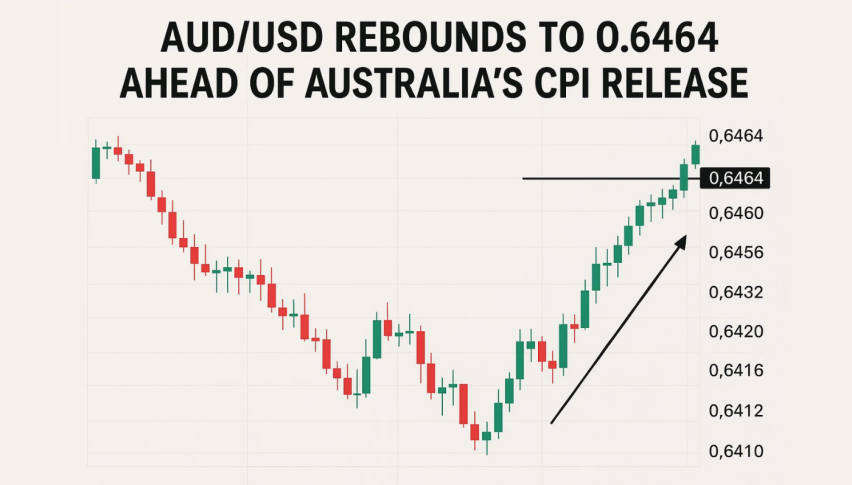

AUD/USD Rebounds to 0.6464 Ahead of Australia’s CPI Release

AUD/USD edged higher toward 0.6464 during the European session as traders positioned for Australia’s October CPI report due Wednesday...

Quick overview

- AUD/USD rose towards 0.6464 as traders awaited Australia's October CPI report, which is expected to influence the RBA's policy decisions.

- The RBA's Assistant Governor indicated that while growth is steady, inflation risks remain, leading to a low probability of a December rate cut.

- The US Dollar Index is under pressure due to rising expectations of a Fed rate cut, with a 69% chance of a 25-basis-point reduction.

- Technical analysis shows AUD/USD is stabilizing near resistance but remains in a bearish trend, requiring careful consideration for bullish trades.

AUD/USD edged higher toward 0.6464 during the European session as traders positioned for Australia’s October CPI report due Wednesday. Markets expect the data to guide the Reserve Bank of Australia’s next move, especially after recent comments hinting at a cautious stance on rates.

RBA Assistant Governor Sarah Hunter noted that while growth remains steady, inflation risks persist, and one month of data won’t dictate policy. Markets now price only a 6% chance of a December rate cut, reinforcing expectations that the RBA will remain on hold.

At the same time, the US Dollar Index (DXY) paused around 100.10, pressured by rising expectations of a December Fed cut. The probability of a 25-basis-point reduction has climbed to 69%, up sharply from 44% last week, weakening USD sentiment ahead of key US PPI and Retail Sales releases.

Improving US labor data and a slight uptick in consumer sentiment helped limit dollar losses, but the broader tone remains soft.

Technical Analysis: AUD/USD Holds Near Resistance

AUD/USD is attempting to stabilize above 0.6450, recovering from a heavy sell-off but still trading within a broader bearish structure. The pair continues to respect the descending trendline from the September high at 0.6613, confirming a sequence of lower highs.

Key observations:

- Price bounced from a 0.6405–0.6440 demand zone, marked by repeated long-wick rejections.

- AUD/USD remains below the 20-EMA and 200-EMA, signaling persistent downside pressure.

- Recent candlesticks show spinning tops and small-bodied indecision candles.

- RSI at 43 shows mild recovery but no bullish divergence.

A break above 0.6475 is needed to shift short-term momentum.

AUD/USD – Trade Opportunity

Bearish Setup (Trend-Continuation Bias)

If AUD/USD rejects 0.6475 with a bearish signal (engulfing, shooting star, or three black crows):

- Sell Entry: 0.6465–0.6475

- TP1: 0.6440

- TP2: 0.6415

- Stop: 0.6495

Bullish Setup (Countertrend – Higher Risk)

If price closes above 0.6475 with strong momentum:

- Buy Above: 0.6480

- TP: 0.6518

- Stop: 0.6450

The broader trend still favors sellers, so bullish trades require caution.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account