XRP Price Prediction: XRP Drops Below $2.03 as Trendline Rejection Triggers Sell-Off

XRP slipped sharply on Monday, falling back below $2.03 after a strong rejection at the $2.15–$2.20 resistance zone.

Quick overview

- XRP fell below $2.03 after being rejected at the $2.15–$2.20 resistance zone, indicating continued seller control.

- Ripple secured an expanded Major Payment Institution license from the Monetary Authority of Singapore, enhancing its payment infrastructure in the region.

- The updated license supports faster onboarding and simplified access to blockchain settlement for banks and fintechs using RLUSD stablecoins and XRP.

- Technical indicators suggest a bearish outlook for XRP, with immediate support levels at $2.01, $1.94, and $1.88.

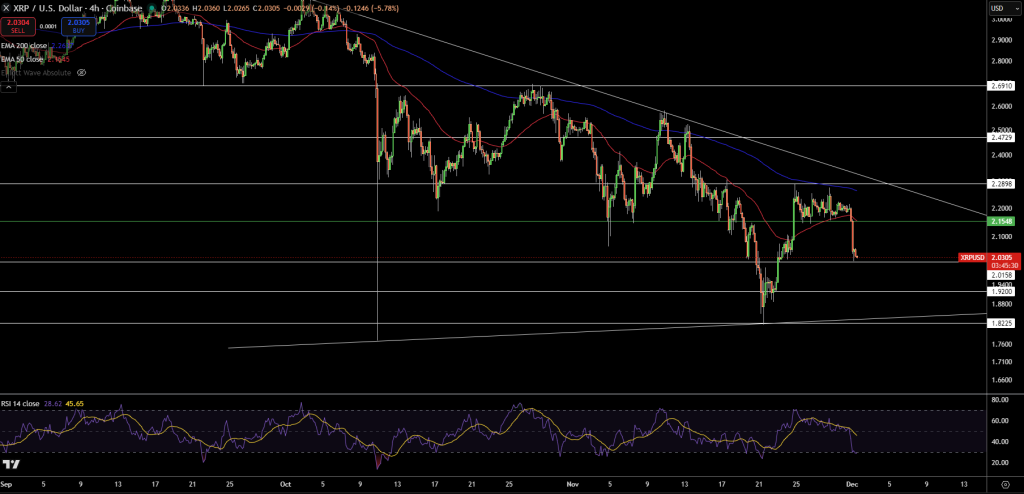

XRP slipped sharply on Monday, falling back below $2.03 after a strong rejection at the $2.15–$2.20 resistance zone. The move came immediately after price tested the descending trendline that has capped every recovery attempt since early September, confirming that sellers still control the broader structure.

Despite the pullback, Ripple made a notable regulatory advance. The company secured an expanded Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS), allowing Ripple Markets APAC to scale its payment infrastructure across the region. The approval strengthens Ripple’s presence in Singapore, one of the fastest-growing digital-asset jurisdictions, and solidifies its long-term strategy of regulated international expansion.

Ripple Expands in Asia-Pacific

The updated MPI license supports Ripple’s cross-border payment services, giving banks and fintechs more tools to settle transactions using RLUSD stablecoins and XRP. Benefits include:

- Faster onboarding for payment providers

- Simplified access to blockchain settlement

- Streamlined infrastructure for digital-asset flows

Asia-Pacific remains one of the strongest regions for crypto adoption, with on-chain activity rising nearly 70% over the past year. Ripple views Singapore as a core hub, supported by partnerships with Mastercard and Gemini for RLUSD-based fiat settlement pilots.

XRP Technical Outlook

The technical picture remains bearish after XRP failed to hold the 50-EMA on the 4-hour chart. Price now sits below both the 50-EMA and 200-EMA—a configuration that typically keeps momentum slanted to the downside. A spinning-top candle near $2.20 signaled hesitation before sellers stepped in, followed by a long bearish candle that confirmed the trendline rejection.

RSI has dropped toward 28, showing oversold pressure but no clear bullish divergence yet. The lower-high, lower-low pattern remains intact, and the entire structure continues to track a descending channel.

Immediate supports sit at $2.01, $1.94, and $1.88, where XRP previously formed strong reaction wicks.

XRP/USD Trade Setup: What Traders Can Look For

A conservative approach is to wait for XRP to retest the broken $2.15–$2.20 zone. A bearish engulfing or a shooting star in this area would reconfirm resistance and offer a cleaner short entry. A protective stop can sit above $2.25, just beyond the descending trendline.

Downside targets remain $2.01, then $1.94, and $1.88 if momentum accelerates.

Aggressive buyers may look for early signs of a reversal, such as a hammer candle or a bullish RSI divergence, near $1.94 or $1.88. A recovery above the 50-EMA at $2.15 is needed to shift short-term bias back to bullish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM