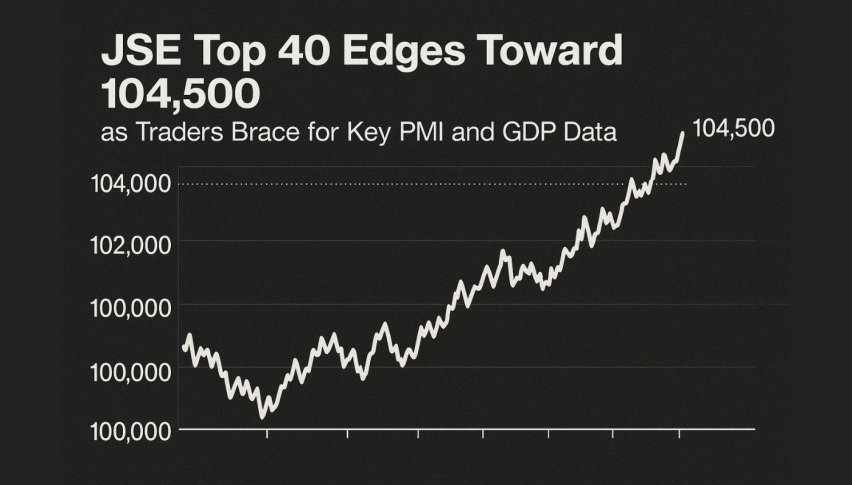

JSE Top 40 Edges Toward 104,500 as Traders Brace for Key PMI and GDP Data

The JSE Top 40 is trading around 104,563 as South African markets try to navigate a busy week of economic announcements.

Quick overview

- The JSE Top 40 is trading around 104,563 as South African markets anticipate a week of significant economic announcements.

- The South African rand has started the week weaker against major currencies, reflecting concerns about sluggish manufacturing activity.

- Key economic indicators, including the Absa Manufacturing PMI and Q3 GDP figures, are set to be released this week, influencing market sentiment.

- The JSE Top 40 remains within a tightening triangle, with potential for upward movement if it breaks above 104,563.

The JSE Top 40 is trading around 104,563 as South African markets try to navigate a busy week of economic announcements. The index is still stuck inside a broad symmetrical triangle that has been shaping price action since early November. We’re seeing some fairly modest gains, but overall sentiment has been supported by the expectation that vehicle sales, which investors like to use as a proxy for consumer demand and the strength of the economy, will be strong.

At the same time, the South African rand started the week a bit weaker against major currencies, reflecting some caution ahead of the latest data. Some strategists are pointing out that the currency’s soft start reflects lingering concerns about sluggish manufacturing activity and uneven export performance.

Manufacturing PMI in the Spotlight

Today’s big release is the Absa Manufacturing PMI, scheduled for 9 am GMT. This is a key gauge of South Africa’s industrial momentum, which took a bit of a hit in October, driven by lower domestic demand and softer export orders.

We’re looking at a bit of a mixed picture:

- Manufacturing sentiment weakened in October.

- November vehicle sales are expected to rise 15.7% on the year, not as high as October’s 16% surge.

- Economists at Nedbank reckon lower interest rates and easing debt costs might support consumer demand.

It all suggests that the market might start to see some sector-specific divergence, with industrial counters potentially taking a hit. At the same time, consumer-linked names do better on the back of improved sales data.

Broader Economic Signals

We’ve got several important indicators coming out this week:

- Q3 GDP figures on Tuesday.

- The current account balance on Thursday.

- South Africa’s foreign reserves report on Friday

In the bond market, government yields actually edged up a bit, with the benchmark 2035 maturity rising 4.5 basis points to 8.54%. And, combined with the weaker rand and the pretty uneven data, traders are expecting some short-term volatility in the equity index.

JSE Top 40 Technical Analysis

The JSE Top 40 continues to trade within a tightening triangle, making the price action a bit more interesting. Price is pulling back from the D-point, where it hit some descending trendline resistance. Now it’s hovering near the 20 EMA at 103,674, which has acted as intraday support in the past.

As long as it stays above 102,604, the short-term structure remains stable. If it breaks below that zone, though, it could expose 100,705 – which is the lower boundary of the pattern. Momentum is pretty neutral at the moment, with the RSI around 54, indicating neither strong buying nor selling pressure.

If we do see a move above 104,563, though, that would be a good sign that the index is looking to continue upwards. If that happens, it might open the path to 106,628 – the next level of resistance. Anything else, though, and the index is just going to stay in consolidation mode until we get a decisive breakout.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM