Forex Signals Brief for June 23rd – Monotonous Buck Going Nowhere!

We finally made it through the week, regardless of the fact that the financial markets were incredibly quiet due to the absence of major economic events this week. The lack of trading volume was a bit boring, especially in comparison to the very volatile week that followed caused by the FOMC and Fed Fund Rate Hike. Additionally, the market hasn't shown much interest in trading the dollar as there has not been a new reason to go long or short on it. Let's have a quick look at the market recap.

Forex Market Recap

- Canadian retail sales rose from 0.3%, forecast in April, to 0.8%. Core retail sales soared to 1.5% from a forecasted 0.6%.

- US unemployment claims were in line with the 241K forecast, however, the number was higher than the previous figure of 238K. Regardless, it failed to push the US dollar either way. The US house price index rose to 0.7% as opposed to the forecasted 0.4%.

- EU consumer confidence index improved from 3 to 1.

- Crude oil extended its bullish momentum throughout the session while helping the commodity currency loonie to strengthen against the dollar.

- Gold remained supported by a weaker dollar and the haven appeal hike lead by China.

Daily Highlights

Today, investors are recommended to focus on the following fundamentals, with inflation figures from Canada & New Home Sales from the United States requiring the most attention.

- EUR – French Flash Manufacturing PMI and French Flash Services PMI are due to be released at 7:00 (GMT) with a mixed forecast.

- EUR – German Flash Manufacturing PMI and German Flash Services PMI are expected to be released at 7:30 (GMT) with a negative forecast.

- EUR – Flash Manufacturing PMI and Flash Services PMI are likely to be released at 8:00 (GMT) with a negative forecast. All the economic events from the Eurozone may have a mild impact unless they surprise the market with an unexpected surge or dip in figures.

- CAD – CPI m/m is due to be released at 12:30 (GMT) with an expectation of 0.2% which is much lower than the previous forecast of 0.6%. I think the dip in inflation is due to the falling oil prices.

- US New Home Sales is expected to be released at 14:00 (GMT) with a positive forecast of 599K, compared to 569K previously. New Home Sales helps us understand consumer confidence in regards to jobs, business and ultimately, the economy. The increased figure reflects more demand and increased demand is a signal of economic growth. This increased demand causes the US dollar to surge.

EUR/USD – The Choppy Trader

The EUR/USD continues to trade the narrow range of $1.1120 – $1.1170 as investors are struggling to find the right direction. The disappointing economic figures from the United States, particularly the jobless claims, failed to extend proper direction to the pair.

Today, the Eurozone PMI data will be vital, although the consolidation phase is expected to continue in the short term, until and unless we have any major fundamental intervals. For a better understanding of EUR/USD, refer to the article here.

Forex Trading Signal – Idea

Today, traders are recommended to wait for the many economic releases, especially from the Eurozone. It's best to stay out of the market in order to avoid unpredictable fluctuations. But stay tuned for live market updates, as we may have a trade in the European/ US sessions.

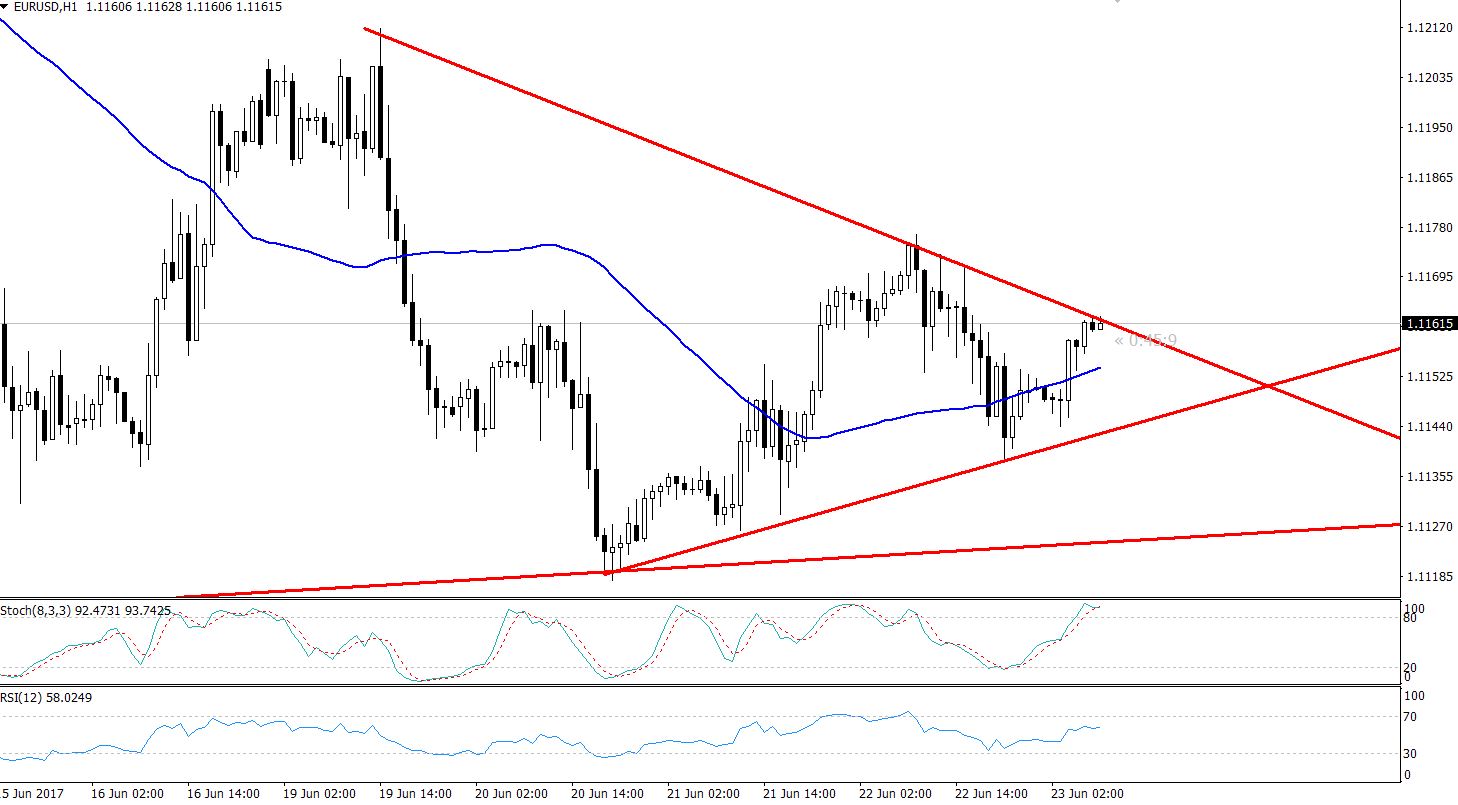

EURUSD – Symmetric Triangle Pattern – Hourly Chart

EURUSD – Symmetric Triangle Pattern – Hourly Chart

Technical Outlook – Intraday

The technical side of the market has remained intact, as the market hasn't moved a lot in the last couple of days. In the hourly chart, we can observe a bullish crossover in the 20 & 50 periods moving averages, which signifies the beginning of a bullish trend.

Moreover, the RSI and Stochastic are bullish above 50, supporting a bullish trend in the EUR/USD.

Most importantly, the EUR/USD has formed a symmetric triangle pattern which can be seen in the hour timeframe. The bearish trend line is extending a solid resistance around $1.1160, whereas the lower edge of the triangle is proving support at 1.1140. The range is quite small, so get ready to trade the breakout. For more about symmetric triangle trading strategy, refer to the article here.

Support Resistance

1.1139 1.1170

1.1129 1.118

1.1113 1.1195

Ending Remarks

As we are approaching the weekend, most investors are likely to settle into their earlier position. Especially considering that the US economy does not have much to offer us today. The idea is to look for a short-term intraday trade in order to avoid weekend gaps. Happy weekend traders, hope you enjoy it to its fullest!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account