IFX Brokers Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an iFX Brokers Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- iFX Brokers Partnership

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About IFX Brokers

- Employee Overview: What It’s Like to Work There

- Pros and Cons

- In Conclusion

iFX Brokers is a regulated South African platform offering a streamlined interface and competitive trading conditions. The Financial Sector Conduct Authority regulates it with a Trust Score of 93 out of 99.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Overview

iFX Brokers combines traditional values with innovative technology to deliver a secure and seamless trading experience. With headquarters in 🇿🇦 South Africa, the broker serves clients worldwide while maintaining strong regulatory compliance, transparent operations, and customer-focused service that builds trust and long-term relationships.

Frequently Asked Questions

Is iFX Brokers regulated and safe to trade with?

Yes. iFX Brokers operates under the Financial Markets Act in 🇿🇦 South Africa and is a licensed Authorised Financial Services Provider and OTC/ODP Derivative Provider. This ensures strict compliance, transparent operations, and a trustworthy trading environment for all retail clients.

What account types and platforms does iFX Brokers offer?

iFX Brokers provides Standard, Premium, VIP, and Islamic accounts. Traders can use the MetaTrader 4 and MetaTrader 5 platforms, which feature advanced charting, one-click execution, technical indicators, and live analytics, catering to both beginners and experienced traders.

Our Insights

iFX Brokers provides a reliable and transparent trading environment with advanced platforms, multiple account options, and responsive support. Its strict regulatory compliance in 🇿🇦 South Africa ensures fund security, while innovative onboarding and mobile access make it a strong choice for both new and experienced traders seeking a trustworthy broker.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Fees, Spreads, and Commissions

We provide tight spreads, transparent commissions, and market execution that gives traders full control over costs. Our MT4 and MT5 platforms support all trading strategies, while swap and margin policies help clients manage risk efficiently and implement strategies confidently.

| Account Type | Spreads From | Commission From | Leverage |

| iFX Standard | 1.3 pips | No commission | Up to 1:500 |

| iFX Premium | 1 pip | No commission | Up to 1:500 |

| iFX VIP | 0.5 pips | USD 6 | Up to 1:500 |

| iFX Raw | 0 pip | USD 6 | Up to 1:500 |

Frequently Asked Questions

Does iFX Brokers charge hidden fees?

iFX Brokers maintains full transparency with no hidden costs. Spreads, commissions, and swap fees are clearly outlined, and market execution ensures traders only pay what they see, creating a predictable and fair trading environment.

Which accounts offer zero commission trading?

iFX Brokers provides zero commission trading on Standard, Premium, Islamic, and Cent accounts. Only VIP and Raw accounts charge commissions, but these accounts give raw spreads and competitive execution for traders seeking precise cost control.

Our Insights

iFX Brokers provides competitive spreads, transparent commissions, and flexible trading conditions. Traders benefit from clear costs, efficient market execution, and multiple account options, making iFX Brokers ideal for both beginners and experienced traders seeking predictable trading expenses.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Minimum Deposit and Account Types

iFX Brokers provides a wide range of account types and flexible minimum deposits to suit every trader. Our accounts include Standard, Premium, VIP, Islamic, Cent, and Raw. Clients can access MT4 and MT5 platforms, all trading instruments, and demo accounts to practice strategies before trading live.

Frequently Asked Questions

What is the minimum deposit for a live account?

iFX Brokers offers minimum deposits from USD 10 for Standard, Cent, and Islamic accounts up to USD 1000 for VIP accounts. This flexibility allows traders to select an account that fits their risk tolerance and trading goals.

Are demo accounts available for practice?

Yes. iFX Brokers provides demo accounts that replicate live trading conditions without risking real money. Traders can test MT4 and MT5 platforms, try strategies, and gain confidence before opening a live account.

Our Insights

iFX Brokers offers flexible account types and low minimum deposits, making global markets accessible to all traders. Demo accounts and multiple platform options allow traders to practice, strategize, and trade with confidence while enjoying transparency and convenience.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

How to Open an iFX Brokers Account

Opening an account with iFX Brokers is a simple process. Here’s a step-by-step guide to help you get started:

1. Step 1: Visit the iFX Brokers Website

Go to the official iFX Brokers site and click the “Open Account” button on the top right of the homepage.

2. Step 2: Choose Your Account Type

iFX offers various account types: Standard, Premium, VIP, Cent, Islamic, and Raw. Pick the one that suits your trading goals.

3. Step 3: Provide Personal Information

Fill in your details, including your name, email, phone number, and country of residence. Make sure the information is accurate for smooth verification.

4. Step 4: Verify Your Identity

Upload identification documents (e.g., passport, national ID, or driver’s license) and proof of address (e.g., utility bill). Clear, legible documents will speed up the process.

5. Step 5: Select Your Trading Platform

Choose between MT4 and MT5 based on your preference. Both platforms are supported by iFX Brokers.

6. Step 6: Make Your Initial Deposit

After verification, deposit funds into your account. The minimum deposit varies by account type, starting from USD 10 for a Standard account and USD 250 for Premium accounts. iFX accepts bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

7. Step 7: Start Trading

Once the deposit is complete, download MT4 or MT5, log in with your credentials, and start trading. You can also use demo accounts to practice before live trading.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Safety and Security

iFX Brokers offers robust safety measures, ensuring client funds are fully protected at all times. Operating under 🇿🇦 South Africa’s FSCA regulations, the broker maintains segregated accounts, negative balance protection, and fidelity insurance. Clients can trade confidently, knowing that compliance, risk management, and fund security are top priorities.

| Feature | Description | Protection Level | Availability |

| Segregated Accounts | Funds kept separate from company assets | High | All clients |

| Negative Balance Protection | Prevents losses beyond deposited funds | High | All accounts |

| Fidelity Insurance | Professional indemnity and insurance coverage | Medium-High | All clients |

| iFX Wallet | Central wallet for instant deposits and transfers | High | All clients |

Frequently Asked Questions

How does iFX Brokers protect client funds?

iFX Brokers safeguards client funds by holding them in segregated accounts, implementing negative balance protection, and maintaining statutory fidelity insurance. These measures ensure funds remain secure and are only used as intended, giving traders peace of mind while trading.

What happens if the market causes significant losses?

iFX Brokers applies negative balance protection, meaning clients cannot lose more than their deposited funds. This policy, combined with secure wallets and insurance, ensures that traders’ capital remains safe even during volatile market conditions.

Our Insights

iFX Brokers prioritises client fund safety through strict compliance, segregated accounts, negative balance protection, and fidelity insurance. Combined with the iFX Wallet and robust risk management, the broker offers a secure trading environment that lets clients focus on strategy and growth with full confidence.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Trading Platforms and Tools

iFX Brokers provides access to both Metatrader 4 and Metatrader 5 platforms, renowned for advanced features and multi-asset trading. Traders can analyse markets with customizable charts, technical indicators, live analytics, and one-click executions. Desktop and mobile apps ensure seamless access on Windows, iOS, and Android devices.

| Feature | MT4 | MT5 | Suitable For |

| Timeframes | 9 Timeframes | 21 Timeframes | Beginners to Advanced Traders |

| Pending Orders | 4 Types | 6 Types | All Traders |

| Technical Analysis | 30 Indicators 2000+ Custom Indicators | 38 Indicators 33 Analytical Objects | All Traders |

| Tradeable Instruments | Forex Indices Metals Commodities | Forex Indices Metals Commodities Shares | All Traders |

Frequently Asked Questions

What are the main differences between MT4 and MT5?

MT4 offers simplicity, ease of use, and comprehensive Forex trading tools. MT5 adds advanced functionality, including access to shares, futures, extra timeframes, and an integrated economic calendar. Both platforms support desktop and mobile devices, allowing traders flexibility in accessing markets.

Can I use MT4 and MT5 on mobile devices?

Yes, iFX Brokers provides fully functional MT4 and MT5 mobile apps for iOS and Android. Traders can execute orders, manage positions, and access live charts from anywhere. This ensures continuity and convenience, keeping trading seamless whether at home or on the move.

Our Insights

iFX Brokers equips traders with MT4 and MT5, offering powerful technical tools, multi-asset trading, and mobile accessibility. MT4 is ideal for beginners, while MT5 suits advanced traders seeking additional timeframes, futures, and share trading. Together, these platforms provide flexibility, precision, and a professional trading experience.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

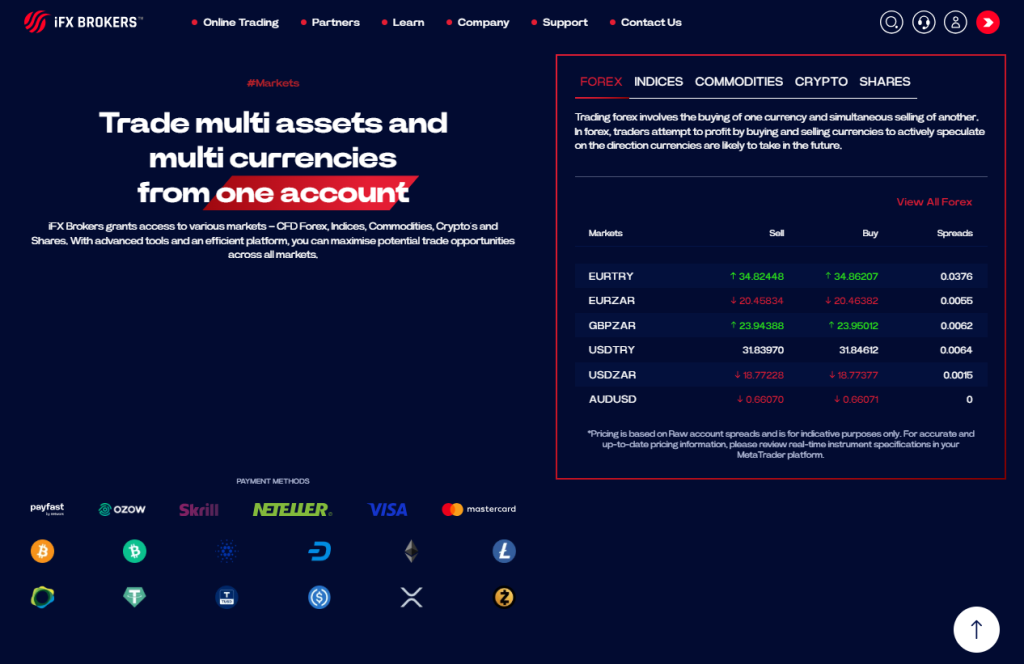

Markets available for Trade

iFX Brokers offers traders access to CFD Forex, Indices, Commodities, Cryptocurrencies, and Shares from a single account. The platforms provide advanced tools and fast execution, allowing traders to capitalise on opportunities across multiple markets efficiently while managing trades conveniently from desktop or mobile devices.

| Feature | Details | Platforms | Suitable For |

| Markets | Forex Indices Commodities Cryptocurrencies Shares | MT4 MT5 Mobile App | All Traders |

| Trade Execution | Fast and efficient | MT4 MT5 Mobile App | Active Traders |

| Spreads | From 0 pips (Raw Account) | MT4 MT5 | All Traders |

| Mobile App | Deposits withdrawals internal transfers trade history review | iOS Android | Traders on the Move |

Frequently Asked Questions

Can I trade multiple assets from one account?

Yes, iFX Brokers allows trading across Forex, Indices, Commodities, Cryptocurrencies, and Shares from a single account. This unified access simplifies portfolio management, providing flexibility to respond to market conditions and diversify strategies efficiently without needing multiple accounts.

Does iFX Brokers provide a mobile app for trading?

Yes, the iFX Mobile app enables deposits, withdrawals, internal transfers, and trade execution. It offers a user-friendly interface with seamless access to trading accounts, ensuring traders can manage their positions and monitor market movements anytime and anywhere.

Our Insights

iFX Brokers empowers traders with a single account to trade Forex, Indices, Commodities, Cryptocurrencies, and Shares. The mobile app and MT4/MT5 platforms ensure convenient access, fast execution, and smooth portfolio management. This makes iFX Brokers suitable for traders seeking efficiency, versatility, and control over their trading journey.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Deposits and Withdrawals

iFX Brokers provides instant deposits and quick withdrawals with zero deposit fees. You can fund accounts using OZOW, PayFast, Skrill, Neteller, or digital currencies like Bitcoin and Ethereum. Withdrawals are processed promptly, ensuring smooth access to funds while maintaining full compliance with anti-money laundering regulations.

| Feature | Details | Currency | Processing Time |

| Instant Deposits | No deposit fees | ZAR USD | Instant |

| Digital Currency Funding | Bitcoin Ethereum Cardano Tether and others | USD | Instant |

| Bank Transfers | Secure wire transfers | ZAR | 24-48 Business Hours |

| Withdrawals | Fast and secure via myiFXBrokers | ZAR USD | 2-4 Hours (SA clients), up to 5 days (International) |

Frequently Asked Questions

Are there fees for deposits with iFX Brokers?

No, iFX Brokers covers all transaction fees for instant payment deposits. You can fund your account with various methods, including OZOW, PayFast, Skrill, Neteller, and digital currencies, ensuring a convenient and cost-free funding experience.

How long do withdrawals take?

Withdrawals for South African clients are typically processed within 2-4 hours, while international withdrawals can take up to five working days due to banking processes. All withdrawals are processed via the secure myiFXBrokers client area.

Our Insights

iFX Brokers makes funding and withdrawing funds simple, fast, and secure. With instant deposits, multiple payment options, and rapid withdrawals, traders can focus on trading without worrying about delays or extra costs. This efficiency ensures a smooth and reliable trading experience for all account holders.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

iFX Brokers Partnership

iFX Brokers lets partners introduce clients and earn competitive referral fees. You gain access to high-quality trading products, marketing resources, and technical support. The program rewards successful partners with tiered commissions, extended performance fees, and real-time analytics, creating a seamless path to growing your trading network.

| Feature | Details | Access | Payment Frequency |

| Referral Program | Earn commissions for active client trades | All partners | Daily, weekly, monthly |

| Tiers and Weighting Factor | Referrer to VIP, determined by lots traded and clients referred | Automatic upgrades | Instant on trades |

| Performance Fee | Extra rewards for Platinum and VIP partners based on deposits | Eligible tiers only | Paid per reporting period |

| Marketing Support | Banners, brochures, templates, and social media resources | All partners | Ongoing |

Frequently Asked Questions

How do referral fees work at iFX Brokers?

Referral fees are earned when your referred clients become active traders. The amount depends on trading volume and your tier, which increases with successful client acquisition. More trades mean higher commissions, and Platinum or VIP partners can receive additional performance-based rewards.

What marketing resources are provided to partners?

iFX Brokers supplies partners with banners, brochures, templates, social media tools, and educational content. These resources simplify client acquisition, support retention, and help partners maximize commissions without any upfront investment.

Our Insights

iFX Brokers’ partnership program offers a flexible and rewarding way to earn from introducing clients. With tiered commissions, performance bonuses, and extensive marketing support, partners can grow their business efficiently while benefiting from a trusted and well-established broker.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Customer Support

iFX Brokers offers responsive, human support for all trading and account-related queries. You can contact the team via email at [email protected] or submit a ticket through the secure client portal. Our goal is to respond quickly and ensure your trading experience remains smooth and hassle-free.

Frequently Asked Questions

How can I contact iFX Brokers for account support?

You can reach iFX Brokers via email at [email protected] or submit a ticket from your secure client portal. The team is available six days a week and responds promptly to trading or account-related queries.

Can I visit iFX Brokers’ office directly?

Yes, the company is located at 32 Blaaukrans Street, Fountains Business Estate, Jeffrey’s Bay, 6330. For account-specific matters, prior contact via email or ticket is recommended to ensure smooth assistance.

Our Insights

iFX Brokers provides efficient, human-driven support across multiple channels. With email, phone, and secure portal options, clients can access help quickly, ensuring a seamless trading experience. The clear office location adds trust and transparency for all users.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Insights from Real Traders

🥇 Fast and Reliable Withdrawals.

I’ve been using iFX Brokers for a few months now, and I’m impressed with how quickly they process withdrawals. Within just a few hours, my funds are in my bank account. Excellent service! – Peter

⭐⭐⭐⭐

🥈 Great Trading Experience.

I’ve been trading with iFX Brokers for over a year now, and overall, it’s been a fantastic experience. The platform is user-friendly, withdrawals are quick, and customer support is always there when needed. – Emily

⭐⭐⭐⭐⭐

🥉 Reliable and Trustworthy Broker.

I’ve tried a few brokers before, but iFX Brokers stands out. The deposit and withdrawal process is seamless, and their platform is solid. I feel confident trading here, and the support team is always responsive. – Albert

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Customer Reviews and Trust Scores

People’s experiences with IFX Brokers are mixed – some users praise the platform’s reliability and ease of use, while others express concerns about customer service and withdrawal issues.

| Source/Platform | Summary of Feedback | Sentiment Rating |

| RatingFacts (24 reviews) | Overall rating 1.67/5; mostly 1-star reviews citing manipulation, bonus issues, and withdrawal problems | Very Negative |

| Trustpilot (South Africa) | Mixed: one user praises fast withdrawals; another reports verification issues and poor support | Mixed – Positive and Negative |

| Official Testimonials | Clients commend “easy and reliable” deposits/withdrawals and rate overall experience highly | Very Positive |

| Forex Wikibit review | Highlights the FSCA regulation and safe fund handling, though notes missing investor compensation fund | Moderately Trustworthy |

| Forex Wikibit Support Analysis | Reports technical strength (fast MT4/MT5 execution) but notes inconsistent customer support attitude | Mixed – Technical Positive, Service Weakness |

Reviews range widely – from glowing praise for deposit and execution speed to strong criticisms about support and account handling – making IFX Brokers a polarizing platform.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Discussions and Forums About IFX Brokers

Online trader communities in South Africa frequently mention IFX Brokers – often highlighting its convenience and local robustness, though skepticism about certain practices also crops up.

| Source | Key Community Commentary |

| Reddit PersonalFinanceZA | “IFX Brokers. Local. Work best for me. Speedy deposits and withdrawals. Reputable.” “I’ve been with them … withdrawals come thru the next day, … I feel safe with them.” |

| Reddit TradingView | “We use IFX a lot in South Africa as they [are] one our best, most reliable brokers.” |

| Reddit PersonalFinanceZA (critical) | Some users allege trade manipulation by promoted traders and suspect profit skewing in IFX accounts. |

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Employee Overview: What It’s Like to Work There

There’s scarce public feedback specifically about working at IFX Brokers. However, insights from similarly named financial firms like IFX Payments offer some perspective on workplace environments in related sectors.

| Company/Source | Employee Feedback Highlights |

| IFX Payments (Glassdoor) | A mix: Some reviews describe a collaborative, culture rich workplace with team events and internal promotions; others report micromanagement, poor benefits, and high turnover |

| Forex broker workplace (general Reddit) | FX broker roles are often high-pressure, commission-driven with high turnover; success can be lucrative but is performance dependent |

Although no direct employee testimonials from IFX Brokers are available, the broader brokerage industry, particularly in South Africa, often features high-pressure, sales-driven environments; similar firm reviews hint at mixed workplace cultures.

★★★★ | Minimum Deposit: $10 Regulated by: FSCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fast deposits and withdrawals | Limited to some jurisdictions |

| Zero deposit fees | No live chat 24/7 |

| Wide variety of funding options | No demo account for some accounts |

| Multilingual platform | Withdrawal processing delays (outside South Africa) |

| Low minimum deposit requirement | Limited educational resources |

References:

In Conclusion

IFC Markets maintains physical or regulated offices in selected jurisdictions and offers localized customer support across multiple countries. Below is a concise breakdown.

Local Offices/Entities

- 🇨🇾 Cyprus

- 🇻🇬 British Virgin Islands

- 🇲🇾 Malaysia (Labuan)

- 🇿🇦 South Africa

Countries with Local-Language or Localized Customer Support Channels

- 🇬🇧 United Kingdom

- 🇨🇦 Canada

- 🇿🇦 South Africa

- 🇲🇽 Mexico

- 🇨🇴 Colombia

- 🇨🇭 Switzerland

- 🇨🇾 Cyprus

- 🇧🇷 Brazil

- 🇯🇵 Japan

- 🇻🇳 Vietnam

- 🇷🇺 Russia

- 🇮🇳 India

- 🇹🇷 Turkey

- 🇮🇷 Iran

- 🇦🇪 United Arab Emirates

- 🇨🇳 China

In summary, IFC Markets has established a physical and regulatory presence in four key jurisdictions, helping them meet local financial requirements and provide localized services. Additionally, the company offers dedicated customer support channels in numerous countries to improve accessibility for clients.

Faq

iFX Brokers offers trading on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are popular platforms for multiple assets.

Yes, the minimum deposit varies depending on the account type, but it starts as low as USD 10 for the Standard account.

Withdrawals are typically processed within 2-4 hours for South African clients and up to 5 working days for international clients.

Yes, iFX Brokers is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring a secure and trustworthy trading environment.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an iFX Brokers Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- iFX Brokers Partnership

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About IFX Brokers

- Employee Overview: What It’s Like to Work There

- Pros and Cons

- In Conclusion