Versus Trade Review

- Overview

- Trading, Non-Trading, and Hidden Costs

- What Types of Accounts Does Versus Trade Offer?

- Copy Trading

- How to Open a Versus Trade Account

- Trading Platforms and Tools

- Economic Calendar and Market News

- Versus Academy

- Markets Available for Trade

- Does Versus Trade Offer Trading Tools or Market Research?

- How Do Deposits and Withdrawals Work on Versus Trade?

- Is Versus Trade Regulated and Safe to Use?

- IB Opportunities with Versus Trade

- 100% Deposit Bonus

- Customer Support Options and Contact Details

- Versus Trade vs Exness vs HFM - A Comparison

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion

Versus Trade is a Saint Lucia-registered, FSC Mauritius-licensed, CFD broker founded in 2024 by traders with firsthand industry experience. It offers access to over 200+ CFDs on Forex, cryptocurrencies, indices, commodities, Versus pairs, U.S., EU, and HK stocks. It has a Trust Score of 85 out of 99.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Overview

Versus Trade is a Saint Lucia-registered CFD broker founded in 2024 by traders with firsthand industry experience. The team behind it identified what was lacking elsewhere and built a brokerage focused on trading access.

You’ll find over 200+ CFDs on Forex, cryptocurrencies, indices, commodities, Versus pairs, U.S., EU, and HK stocks. Four live account types are available, namely Standard, Pro, Cent, Raw Spread, and Demo, with leverage up to 1:2000 on forex and metals.

Islamic accounts are available across all four, and traders can choose a swap-free status, depending on eligibility.

Frequently Asked Questions

What markets can traders access with Versus Trade?

Traders can access over 200 CFDs, including Forex pairs, cryptocurrencies, indices, commodities, U.S., EU, and HK stocks. The broker also offers unique Versus pairs, giving traders a broad range of instruments to diversify strategies and explore various market opportunities.

Does Versus Trade provide Islamic accounts?

Yes, Versus Trade offers Islamic accounts across all four live account types. Traders can request a swap-free status depending on eligibility, ensuring compliance with Sharia principles while maintaining the same trading conditions as standard accounts.

Our Insights

Versus Trade stands out for its extensive CFD offering, competitive leverage, and inclusive account types, including Islamic options. The broker aims to bridge gaps left by others through accessibility and flexibility, making it an appealing choice for both novice and experienced traders worldwide.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Trading, Non-Trading, and Hidden Costs

Versus Trade adopts a straightforward fee structure with competitive spreads and minimal additional costs. Most accounts use marked-up spreads, while the Raw Spread account offers near-zero spreads with a commission.

Overnight swaps apply to select instruments, and notably, withdrawals are completely free of broker charges.

| Fee Type | Details |

| Spread Range | EUR/USD 0.1–1.4 pips Gold: 0.5–1.9 |

| Commission | Raw Spread: Up to $3 per side per lot |

| Swap Charges | Apply to selected instruments |

| Withdrawal Fees | None (payment provider may charge) |

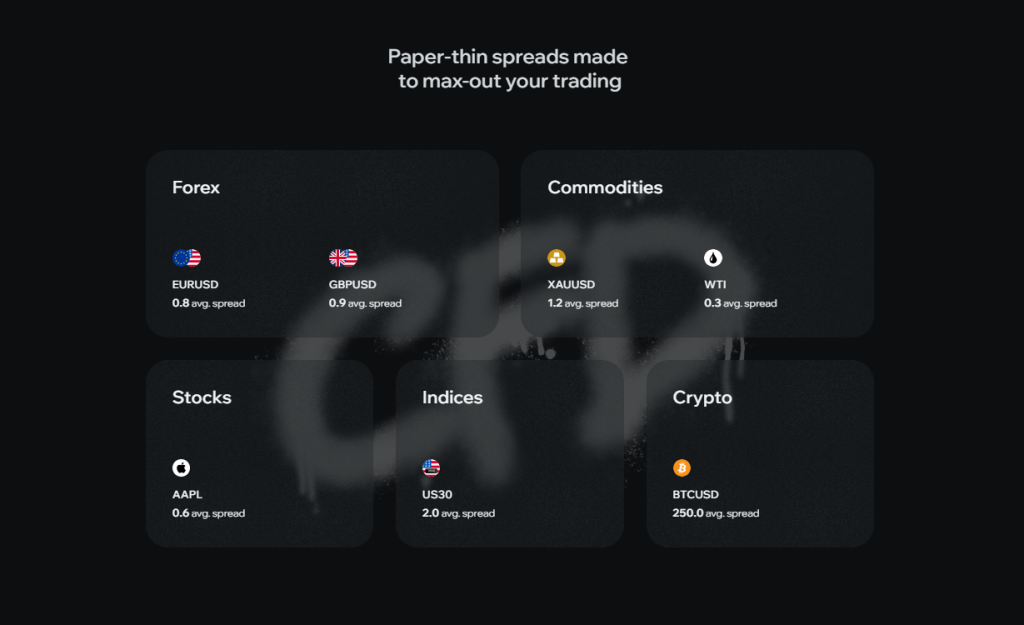

Spreads by Account and Instrument

Spreads change with market conditions, and the numbers you see are based on typical ranges from the previous trading day. During lower liquidity windows, like rollover or holidays, spreads can widen. You can expect different pricing across account types. Here’s how that looks on some of the more popular instruments:

- EUR/USD starts from around 1.4 pips on the Standard account, 0.7 on Pro, and from 0.1 on Raw Spread.

- Gold (XAU/USD) ranges from 0.5 to 1.9 pips, depending on the account.

- Brent oil averages under 1 pip across all accounts.

- Stock spreads vary, with Apple, for example, starting at 1.8 pips on Pro.

- BTC/USD averages 245–354 pips, depending on the account.

Cent and Standard accounts have the broadest spreads since there is no commission fee charged. On Raw Spread, spreads start from zero, and that’s where the broker’s fee to facilitate the trade is charged separately.

Commissions

The only account with commission fees is Raw Spread, which charges up to $3 per side, per lot. All others use marked-up spreads instead.

Swaps and Overnight Costs

Swaps apply if you hold trades overnight. These are charged automatically at rollover, which happens at 00:00 GMT+3. Positions held on Wednesdays face a triple fee to account for the weekend. Not all products are charged swaps. These are for non-Islamic residents:

- Major and minor forex pairs

- Gold (XAU/USD)

- All index CFDs

- All crypto CFDs

Sample Swap Charges

For context, here’s what you can expect across a few instruments:

- HKD/JPY long: -0.086 pips

- XAG/USD short: +17 pips

- Brent crude long: +18 pips

- Apple long: -0.086 pips

Withdrawals

Versus Trade doesn’t charge any withdrawal fees – all withdrawals are free. But your payment provider might charge you.

Frequently Asked Questions

Does Versus Trade charge withdrawal fees?

No, Versus Trade does not charge any withdrawal fees. However, traders should note that third-party payment providers might apply their transaction charges, which are outside the broker’s control.

How are spreads and commissions structured?

Cent, Standard, and Pro accounts have marked-up spreads without commission, while Raw Spread accounts start from 0.0 pips and charge up to $3 per side per lot. Spreads vary by instrument, market conditions, and liquidity windows like rollovers and holidays.

Our Insights

Versus Trade’s pricing structure is competitive and transparent. With zero withdrawal fees, low Raw Spread commissions, and reasonable overnight swap charges, it caters to traders seeking clarity and affordability without hidden costs.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

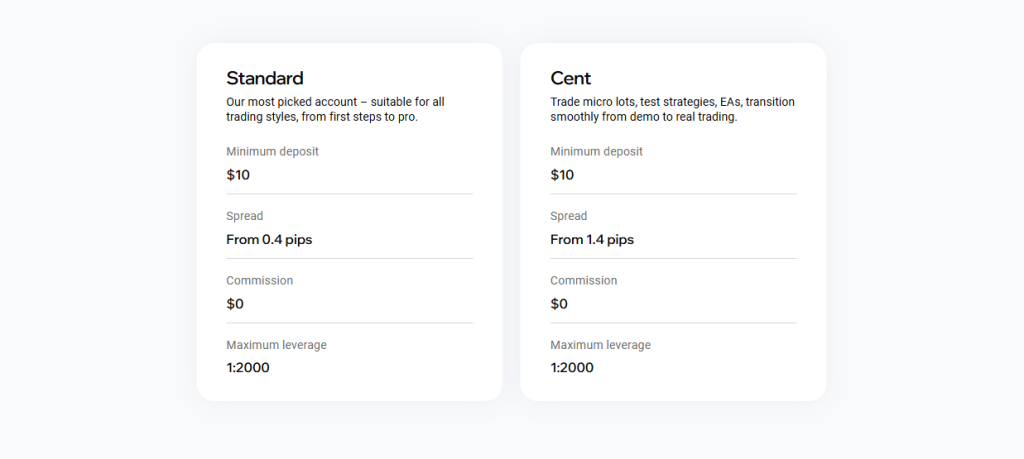

What Types of Accounts Does Versus Trade Offer?

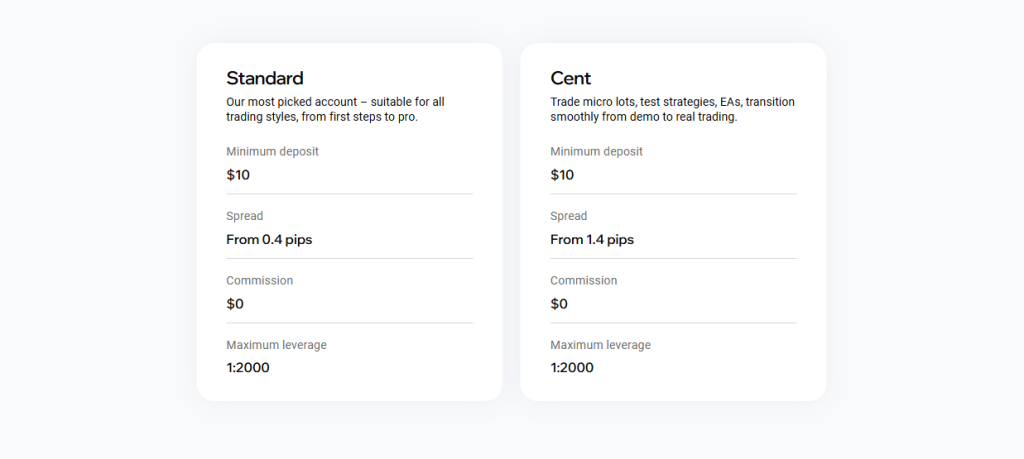

Versus Trade offers four account types: Standard, Cent, Pro, and Raw Spread. Each one gives you access to MetaTrader 5 and supports market execution, flexible lot sizes, and leverage up to 1:2000.

Standard Account

This account gives you access to every instrument on the platform. You don’t pay commission fees, and the spreads start from 0.4 pips. It’s the kind of setup that’s perfect whether you trade a few positions a week or stay more active during key sessions.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Cent Account

Same platform and execution, but on a different scale. Trades are priced in cents, not dollars, which makes it easier to test strategies or bridge the gap between demo and live trading.

You can automate, adjust, or run small-sized trades with less exposure. Spreads start a little wider, from 1.4 pips, but it’s the trade-off for being able to trial ideas without putting too much capital at risk.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

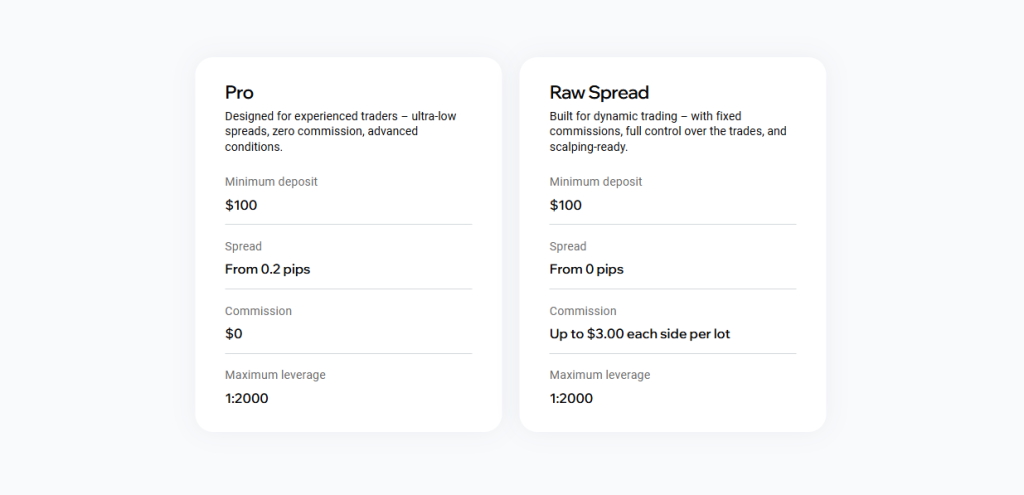

Pro Account

The spreads start from 0.2 pips. No commission is added, and the lower margin call threshold is set for experienced traders who know how to manage their risk.

The pricing setup suits more active approaches, especially if you enter and exit positions throughout the day. It’s meant for volume, not passive holds.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Raw Spread Account

This is the only account with fixed commission charges up to $3 per side. In exchange, spreads are as tight as they can get, starting from zero. This account is for strategies that depend on timing, precision, and tighter cost control.

The Raw Spread account suits scalping, algorithmic setups, and anyone who values predictability in execution over blended pricing.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Islamic Account

Any Versus Trade account (Standard, Cent, Pro, or Raw Spread) has an Islamic version. These accounts follow Sharia principles, and there’s no interest charged or paid on overnight positions. Trading conditions remain the same as those of the regular accounts, and there are no changes to spreads, execution, or leverage.

Eligible countries include Afghanistan, Algeria, Bahrain, Bangladesh, Egypt, Indonesia, Iraq, Jordan, Kazakhstan, Kuwait, Lebanon, Libya, Malaysia, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Tunisia, Türkiye, UAE, and others in this category.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Swap-free Accounts for Non-Muslim Traders

Accounts are available at two levels to non-Islamic countries: standard swap or swap-free. The difference is the possibility to trade on instruments with zero swaps. Swap-free level is offered by default, with trading activity determining whether an account becomes standard or remains swap-free. To maintain swap-free status, you need to trade mostly within the day and hold a low amount of overnight positions.

Swap-free applies to the entire Personal Area; in other words, all trading accounts and account types will have the swap-free program if your Versus Trade account is swap-free.

Specific instruments are considered swap-free under the Swap-free level (see below); for all other trading instruments, swaps are applied.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Demo Account

- Preloaded with $10,000 virtual balance.

- Choice of Standard or Pro configuration.

- Full access to MetaTrader 5 on desktop, mobile, and browser.

- Live spreads, market prices, and similar

Traders from Muslim-majority countries, all account types, Standard, Pro, etc., are automatically opened as Islamic (swap-free) accounts. There’s no need to request it separately. For example, if you’re in Malaysia, your account will be opened as Standard Islamic, Pro Islamic, and so on.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Frequently Asked Questions

What is the difference between Standard and Cent accounts?

The Standard account uses regular pricing and suits most traders, while the Cent account prices trades in cents. This makes Cent ideal for strategy testing or transitioning from demo to live trading with lower risk and smaller exposure.

Does Versus Trade provide Islamic and swap-free accounts?

Yes. All four accounts—Standard, Cent, Pro, and Raw Spread—are available as Islamic accounts with no interest on overnight positions. Non-Muslim traders can also request swap-free status, provided they maintain mostly intraday positions with limited overnight exposure.

Our Insights

Versus Trade’s diverse account lineup ensures a suitable option for every trading style. From low-risk Cent accounts to Raw Spread for precision strategies, combined with Islamic and swap-free solutions, the broker provides a flexible and inclusive environment for global traders.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Copy Trading

Versus Trade released its full-featured Copy Trading system, supporting flexible copying models and advanced risk control. Core functionality:

- Multiple offers under one provider account, allowing different strategies with separate terms.

- Copying models: Multiplier, Fixed Volume, Auto-Scale, Lot-Proportional.

- Advanced risk management tools, including auto-unsubscribe, drawdown limits, take-profit on subscription, position close functions, and volume filters.

- Flexible commission settings with daily, weekly, and monthly models, including support for agent assignments and commission splits.

- Smart volume handling with rounding, thresholds, and minimum-lot logic.

- Full compatibility with real trading: pending orders, SL/TP, and market execution.

- Automated fee calculation and transaction accounting.

- Built-in IB/agent support.

- Administrative controls for limiting, suspending, or archiving providers.

- White-label ready and integrated into the Versus Trade client cabinet.

In Short, Versus Trade’s new Copy Trading system allows traders to replicate strategies with flexibility and precision. With multiple copying models, advanced risk management, and smart commission handling, the system empowers both providers and followers to trade efficiently while maintaining full control over exposure and fees.

Frequently Asked Questions

What copying models does Versus Trade support?

The platform offers Multiplier, Fixed Volume, Auto-Scale, and Lot-Proportional copying models. These options let traders choose how trades are mirrored, providing flexibility to match individual risk appetite and investment strategies within the same provider account.

How does risk management work in the Copy Trading system?

Advanced tools include auto-unsubscribe, drawdown limits, take-profit on subscriptions, position closure functions, and volume filters. These features protect followers from excessive losses while enabling providers to manage exposure safely and maintain strategy performance.

Our Insights

Versus Trade’s Copy Trading solution combines flexibility, security, and automation. Its comprehensive risk tools, multiple commission structures, and full real-trading compatibility make it suitable for professional traders, portfolio managers, and followers seeking a controlled, transparent, and efficient copying environment.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

How to Open a Versus Trade Account

To register an account with Versus Trade, follow these steps:

1: Step 1: Go to the Versus Trade website.

Click “Start Now” from the homepage.

2: Step 2: Select your country from the dropdown list.

This usually auto-fills based on your location. Accept the terms by checking the box for the Client Agreement, AML Policy, and Privacy Policy.

3: Step 3: Enter your email address.

If you have a referral/partner code, enter it into the field provided.

4: Step 4: Set a password and click “Sign Up.”

Add your mobile number. Check your email and SMS for two verification codes. Enter them both to confirm your account.

Once you’re in, the dashboard will show a Standard MT5 account already set up. You can fund it straight away, or you can open a different type of account if you’d prefer.

To do that:

- Click “Open New Account.”

- Choose from Standard, Pro, Cent, or Raw Spread.

- Choose your leverage level.

- Select your account currency (Currently, it’s USD only).

Finally, Click “Continue.”

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Trading Platforms and Tools

Versus Trade delivers a seamless MetaTrader 5 experience on desktop, mobile, and web. Traders access full account features, advanced charting, and fast execution across Windows, macOS, Android, iOS, and WebTerminal. With robust tools and real-time synchronization, the platform ensures precision and flexibility for every strategy.

| Platform | Device Type | Full Account Access | Charting Tools | Supported Orders | Execution Quality |

| Windows | Desktop (Windows) | Yes | All available | All 6 types | High |

| macOS | Desktop (Apple) | Yes | All available | All 6 types | High |

| Android | Mobile | Yes | Full mobile set | All 6 types | High |

| iOS | Mobile | Yes | Full mobile set | All 6 types | High |

| WebTerminal | Browser-based | Yes | Full set | All 6 types | High |

Windows and macOS

MT5 for Windows and macOS gives you everything the platform has to offer. You can access every Versus Trade instrument, from forex and metals to crypto and stocks, all priced live and displayed in full detail.

You can toggle between 21 chart timeframes, load up custom indicators, open DOM views, and automate your strategies using MQL5.

The terminal connects directly to Versus Trade’s infrastructure in London, which handles all market order execution. Pricing updates in real time, pending orders follow the same routing as instant trades, and there’s no delay on your fills once they leave your device.

| Platform | Device Type | Full Account Access | Charting Tools | Supported Orders | Execution Quality |

| Windows | Desktop (Windows) | Yes | All available | All 6 types | High |

| macOS | Desktop (Apple) | Yes | All available | All 6 types | High |

| Android | Mobile | Yes | Full mobile set | All 6 types | High |

| iOS | Mobile | Yes | Full mobile set | All 6 types | High |

| WebTerminal | Browser-based | Yes | Full set | All 6 types | High |

MT5 Mobile

Mobile users aren’t pushed into “view only” dashboards. The Android version lets you pull up charts, add studies, monitor account health, or open and close trades on the go. You can:

- Set take profits and stop losses mid-trade.

- Adjust open orders with pinch-zoom scaling.

- Trigger alerts and notifications for price levels.

- Load past trades or analyze trade history by instrument.

- Access all four account types, including Raw Spread and Cent.

iPhone and iPad traders get the same. MT5 on iOS tracks all of your accounts, syncs instantly with your desktop platform, and supports full market access. Versus Trade also offers an app for Android (deposit, withdrawals, etc, no trading)

| Platform | Device Type | Full Account Access | Charting Tools | Supported Orders | Execution Quality |

| Windows | Desktop (Windows) | Yes | All available | All 6 types | High |

| macOS | Desktop (Apple) | Yes | All available | All 6 types | High |

| Android | Mobile | Yes | Full mobile set | All 6 types | High |

| iOS | Mobile | Yes | Full mobile set | All 6 types | High |

| WebTerminal | Browser-based | Yes | Full set | All 6 types | High |

MT5 Web

If you’re on a public machine or temporary setup, you can use the web version; all you need is a browser and your login.

- Use it in Chrome, Firefox, Safari, or Edge.

- Open, modify, or close trades with the same logic as the desktop version.

- Trade all asset classes.

- Data is encrypted before it leaves your session.

- Great fallback when you’re not on your regular device.

WebTerminal supports every order type, quotes are pulled in real time, and your charts load with saved templates if you use a synced account.

Frequently Asked Questions

Does Versus Trade offer full MT5 features on mobile?

Yes. Both Android and iOS apps offer complete trading functionality. Traders can place orders, manage positions, add indicators, and analyze charts on the go. The mobile apps also support alerts, order modifications, and real-time account synchronization for a consistent experience.

Is the WebTerminal secure and feature-rich?

Absolutely. The MT5 WebTerminal encrypts all session data and mirrors desktop capabilities, allowing traders to execute orders, access charts, and monitor positions directly in a browser. It’s an ideal solution when using shared or temporary devices without sacrificing functionality.

Our Insights

Versus Trade stands out for delivering a complete MetaTrader 5 experience on every device. With robust charting, real-time synchronization, and secure execution, it offers flexibility without compromise. Whether on desktop, mobile, or browser, traders enjoy speed, precision, and full market access.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Economic Calendar and Market News

Versus Trade introduced a built-in Economic Calendar and real-time Market News feed.

Key capabilities:

- Access to global macroeconomic events in real time.

- Integrated market-moving news stream within the platform.

- Users can monitor data releases without leaving their trading interface.

Technical integration:

- TradingView widgets embedded via iframe.

- Adapted to match the platform’s UI.

- Localization applied for user language and date formats.

Frequently Asked Questions

How does the Economic Calendar improve trading with Versus Trade?

The Economic Calendar allows users to track global macroeconomic events in real time. Traders can plan strategies around high-impact data releases, minimizing surprises and improving decision-making while staying fully within the platform interface.

What is the benefit of the integrated Market News feed?

The Market News feed delivers live updates on market-moving events, reducing the need to switch between external news sources. This integration ensures traders stay informed, react faster, and maintain focus on trading decisions within one interface.

Our Insights

Versus Trade provides an intuitive and integrated trading experience by combining real-time news with an Economic Calendar. Its seamless TradingView integration and localized interface make it a practical choice for traders seeking efficiency, responsiveness, and all-in-one market insights.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Versus Academy

Versus Academy is now available as a structured educational environment for new and existing users. Key components include:

- Landing page where users can request a free Trading Guide.

- Educational modules covering chart basics, technical and fundamental analysis, tools and widgets, risk management, beginner strategies, and practical tips.

- Automatic creation of a demo trading account for new users joining via partner links or marketing campaigns.

Existing users can also request the Guide and create a demo account manually in their Client Area.

Frequently Asked Questions

What educational content does Versus Academy offer?

The Academy features modules covering chart basics, technical and fundamental analysis, trading tools, risk management, beginner strategies, and practical tips. These structured lessons help traders build knowledge step by step while preparing them for real-market scenarios.

How can users access a demo trading account?

New users joining via partner links or campaigns receive an automatically created demo account. Existing users can request the free Trading Guide and manually create a demo account through the Client Area, allowing practice without risking real funds.

Our Insights

Versus Academy combines structured learning with practical experience. Its educational modules, free Trading Guide, and easy demo account setup make it ideal for new traders seeking guidance and existing users aiming to refine skills safely and efficiently.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Markets Available for Trade

Versus Trade provides access to an extensive selection of CFDs across forex, metals, energies, stocks, indices, crypto, and its exclusive Versus Pairs. With flexible leverage and MetaTrader 5 integration, traders can diversify strategies while enjoying competitive spreads and advanced execution features.

| Asset Class | Example Instruments | Swap-Free Coverage | Fixed Leverage |

| Forex | EURUSD GBPJPY USDTHB | Yes | up to 1:2000 |

| Metals | XAUUSD XAGUSD | Partial | up to 1:2000 |

| Energies | WTI Brent NGAS | Partial | up to 1:200 |

| Stocks | AAPL TSLA LVMH | None | 1:40 |

| Indices | US100 DE40 JP225 | Yes | 1:500 (main) |

| Crypto | BTCUSD, ETHUSD, DOGUSD | Yes | 1:500 BTC/ETH |

| Versus Pairs | BTCvsXAU AMZNvsBABA | Yes | Fixed per pair |

Forex

Versus Trade gives you access to forex pairs across majors, minors, and exotics. Every trade uses floating spreads and is executed directly via MT5.

- Majors include all standard pairs: EURUSD, USDJPY, GBPUSD, etc.

- Minors go deep with cross pairs like EURCAD, AUDCHF, and GBPNZD.

- Exotics include dozens of niche and emerging-market pairs.

- Up to 1:2000 leverage available, scaled by equity size.

Swap-free access applies to most major and minor pairs.

Metals

You’ll find a decent list of metal CFDs, available in both USD and EUR-denominated versions for most.

- Gold and silver, in both EUR and USD variants.

- Platinum, palladium, and aluminium are also included.

- All accounts have access to full-size and micro-lot trading.

- Gold (XAUUSD) is eligible for swap-free trading.

Prices float based on liquidity and market depth.

Energies

Trade major energy commodities without platform restrictions.

- Includes WTI, Brent crude oil, and natural gas.

- Full exposure through MT5, with full charting and trading tools.

- Floating spreads and fixed leverage 1:200

- WTI is swap-free on qualifying accounts.

Trading hours follow global commodity exchange calendars.

Stocks

Stock CFDs are available for major companies in the US, EU, and HK

- Big names: Tesla, Amazon, Nvidia, Apple, Meta, and more.

- European picks include BMW, LVMH, Adidas, and Siemens.

- Leverage capped at 1:40 across the board.

- Dividend adjustments are applied based on position direction.

Swaps apply unless the account qualifies for exemption.

Indices

CFD trading on 15+ global indices, covering the US, Europe, and Asia-Pacific.

- US indices: Nasdaq, S&P 500, Dow Jones, Russell 2000.

- European indices: FTSE 100, DAX 40, CAC 40.

- Asia-Pacific: Nikkei, Hang Seng, FTSE China A50, ASX 200.

- Fixed leverage: 1:500 on major indices, 1:200 on others.

All indices are swap-free by default.

Crypto

Crypto CFDs offer price exposure to the world’s most significant digital assets.

- BTCUSD, ETHUSD, XRPUSD, ADAUSD, DOGUSD, TRXUSD, LTCUSD.

- Leverage is fixed: 1:500 on BTC and ETH, 1:200 on the rest.

- Zero swaps, and overnight holding carries no rollover costs.

- No wallets required.

All trades processed within MT5.

Versus Pairs

This category lets you trade one asset directly against another in a head-to-head format.

- Examples: BTC vs Gold, Amazon vs Alibaba, Nasdaq vs WTI.

- Floating spreads.

- No swaps.

- Leverage is fixed by pair type and ranges from 1:20 to 1:100.

- Market hours follow the tradable windows of each asset in the pair.

Dividend adjustments are applied when equities are involved.

New Basket Symbols

Three new basket symbols were added to the platform:

FAANG – Facebook, Amazon, Apple, Netflix, Google.

AUTOX4 – General Motors, Ford, Toyota, Tesla.

USDX4 – EURUSD, GBPUSD, AUDUSD, NZDUSD.

All symbols are available for Standard, Pro, and Raw Spread accounts.

Frequently Asked Questions

What are Versus Pairs, and why are they unique?

Versus Pairs allow traders to take one asset long and another short in a single structured trade. Examples include Bitcoin vs Gold or Amazon vs Alibaba. This innovative format offers diversified exposure and strategic opportunities within one position.

Does Versus Trade offer swap-free options for all instruments?

No. While most forex pairs, indices, and crypto assets are swap-free, metals and energies only have partial coverage, and stocks typically incur swaps. However, Islamic accounts eliminate overnight charges for eligible traders.

Our Insights

Versus Trade stands out for its broad asset selection, innovative Versus Pairs, and flexible leverage options. It caters to diverse trading strategies on MT5 while ensuring access to popular markets like forex, crypto, and indices. This makes it a compelling choice for active traders seeking variety and unique opportunities.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Does Versus Trade Offer Trading Tools or Market Research?

Yes, Versus Trade offers trading tools and research, but not its own. Everything is already included on the MetaTrader 5 platform. Here’s what’s available:

- Economic calendar: You can filter by region, priority, or asset type, and then plot trades around the data.

- 21 chart timeframes: You can switch between 1-minute scalps and monthly levels without juggling tabs or accounts.

- 38 built-in indicators: Trend, momentum, volume, etc.

- Drawing and analysis tools: Fibonacci levels, pitchforks, Gann fans, channels, arrows, and freehand markup.

- Algo trading: You are not restricted from scripting, importing, or automating your trades. MT5 supports it all with direct access to the MQL5 codebase.

- Depth of Market (DOM): You can watch liquidity change in real time on supported Forex pairs and other instruments.

Finally, a Strategy tester. You can run backtests on automated strategies with real tick data and variable modeling parameters.

Frequently Asked Questions

Does Versus Trade offer proprietary research tools?

No, Versus Trade does not provide its research tools. Instead, all trading tools and analytics are accessible through MetaTrader 5, including indicators, charting, and the economic calendar.

Can I use algorithmic trading on Versus Trade?

Yes, the MT5 platform fully supports algorithmic trading. You can create scripts, import EAs, and automate strategies using MQL5. A built-in strategy tester helps optimize performance using real tick data.

Our Insights

Versus Trade leverages the power of MT5 to deliver a professional-grade toolkit. From in-depth charting to automated strategy testing, everything is built in. While no proprietary research is offered, the platform’s robust MT5 environment makes it suitable for serious traders.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

How Do Deposits and Withdrawals Work on Versus Trade?

Versus Trade supports both crypto and local payment channels, allowing deposits and withdrawals through digital coins, e-wallets, debit cards, credit cards, and bank transfers with no commission charged by the broker.

Most deposits are processed quickly (anywhere from instantly to under 30 minutes), while withdrawals can take up to 48 hours, depending on the payment provider or region.

| Method | Type | Commission | Timeframe | Limits (Min–Max) |

| USDT BTC ETH XRP LTC BNB | Crypto | 0% | Instant – 30 mins | $10 – $10,000 (some from $25) |

| Touch ‘n Go DuitNow QR | E-wallet (Malaysia) | 0% | Instant – 2 days | MYR 44 – 1,750 / 860 |

| QRIS | E-wallet (Indonesia) | 0% | Instant – 2 days | IDR 162,520 – 10,000,000 |

| MOMO ZaloPay ViettelPay | E-wallet (Vietnam) | 0% | Instant – 2 days | VND 255,200 - 20,000,000 |

| Malaysian Banks (Maybank, CIMB) | Local bank transfer | 0% | Instant – 2 days | MYR 44 – 8,600 |

| Vietnamese Banks (Vietcombank) | Local bank transfer | 0% | Instant – 2 days | VND 255,200 - 300,000,000 |

| Thai Banks (SCB, Krungsri, etc.) | Local bank transfer | 0% | Instant – 2 days | THB 10 – 500,000 |

| Thai QR VietQR | QR payment | 0% | Instant – 2 days | Up to 300,000,000 local currency |

How to Fund Your Versus Trade Account

Topping up an account doesn’t take long, but it involves a few mandatory checks along the way.

- Log in to your Versus Trade dashboard.

- Go to the “Funding” section and click “Deposit.”

- Pick your funding method (crypto, local bank, or e-wallet).

- Enter the amount, then confirm the destination (main wallet or trading account).

- Follow the prompts. Crypto payments generate a wallet address, bank and QR payments show a reference code and transfer details.

Finalize the transaction on your payment platform.

How to Withdraw Funds from Versus Trade

Withdrawals work off the same interface as deposits:

- Open the dashboard and go to “Wallet.”

- Click “Funding” and choose your preferred method.

- Enter the amount and wallet/bank details where needed.

Double-check the destination and confirm.

Frequently Asked Questions

How fast are Versus Trade deposits processed?

Most deposits through crypto or e-wallets are processed instantly or within 30 minutes. Bank transfers may take longer, depending on the region and intermediary processing times. There are no internal fees for deposits regardless of the payment method.

How long do withdrawals take at Versus Trade?

Withdrawals generally take up to 48 hours to process. The exact time depends on the chosen payment method and any additional security verification. Like deposits, withdrawals are commission-free from the broker’s side.

Our Insights

Versus Trade ensures a smooth and commission-free funding process, supporting a wide range of payment methods, including crypto and local options. While deposits are nearly instant, withdrawals can take longer due to third-party processing, making it a solid choice for traders prioritizing flexibility.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Is Versus Trade Regulated and Safe to Use?

Versus Trade is a 🇲🇺 FSC Mauritius licensed broker. Moreover, it is registered in Saint Lucia under company number 2024-00586 and operates within the legal framework of the country’s corporate and financial legislation.

Client Money and Account Protections

Funds are kept in segregated accounts. Your balance stays separated from the broker’s operational capital, and Versus Trade has a negative balance policy in place. That means if the account drops below zero during volatile price moves, the platform covers the difference.

AML, KYC, and Internal Security Policies

Versus Trade uses a full KYC and AML framework. Every account is monitored and assigned a risk tier based on:

- Country of residence

- Type of documentation submitted

- Source of funds

- Nature of trading activity

Clients undergo internal screening to ensure compliance with our risk management standards. This includes checks for high-risk indicators, politically exposed person (PEP) status, and presence on international watchlists. Additionally, trading activity is continuously monitored to ensure full adherence to the Client Agreement and the Company’s internal policies.

Frequently Asked Questions

Is Versus Trade currently regulated?

No, Versus Trade is not yet regulated. However, it is in the final stages of obtaining FSC regulation, aiming to enhance transparency and client security once approved.

How does Versus Trade protect client funds?

Versus Trade keeps client funds in segregated accounts, separate from operational capital. It also offers negative balance protection and follows AML and KYC standards to safeguard trading activity and user identity.

Our Insights

Versus Trade applies strong security practices such as segregated accounts, negative balance protection, and compliance with KYC and AML protocols. Once FSC approval is complete, its trust profile will significantly improve.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

IB Opportunities with Versus Trade

Versus Trade offers one path for partnership, namely an Introducing Broker (IB) program. IBs at Versus Trade earn up to 75% of the spread generated by their clients. Payouts are automated, tracked in real time, and issued daily, including weekends.

Here’s what you can expect:

- $10 minimum deposit makes onboarding clients easier, regardless of experience level.

- Traders get instant execution and zero-swap access across many CFDs, meaning better retention and higher commissions for you.

- Personal support based on region and language.

- Promo materials are provided, including banners, landing pages, and custom Versus Pairs content.

- Payment systems and onboarding are set up across 100+ countries.

- Withdrawals for IBs are processed daily.

- Daily commission payouts without holding periods or month-end delays.

Full access to live stats to track earnings, active clients, and trade volume in real time.

Frequently Asked Questions

How does the IB program at Versus Trade work?

IBs earn up to 75% of the spread generated by their referred clients. Commissions are credited in real time, and partners have access to stats for tracking earnings, active clients, and trading volumes.

When are IB commissions paid?

Commissions are processed and paid out daily, including weekends. There are no holding periods or delays, so partners can access their earnings immediately.

Our Insights

Versus Trade’s IB program is attractive for partners seeking high payouts and transparency. With real-time tracking, promotional support, and daily commission withdrawals, it provides a strong framework for client acquisition and retention.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

100% Deposit Bonus

Versus Trade introduced a 100% Deposit Bonus that provides additional margin equal to the deposit amount. Key details:

- Bonus is credited instantly and doubles the available margin for trading.

- Traders can open positions with increased volume while maintaining the same initial investment.

- Applicable to all account types.

- Profit generated from trading is fully withdrawable.

- The bonus amount itself is non-withdrawable and does not cover drawdown.

- If the client withdraws part of the deposit, the bonus is reduced proportionally.

The 100% Deposit Bonus is valid for 60 days from activation.

Frequently Asked Questions

How does the 100 Percent Deposit Bonus work?

The bonus is credited immediately upon deposit, doubling the trading margin. Traders can open larger positions while keeping their initial investment unchanged. The bonus does not cover drawdowns, and any partial withdrawal of the deposit reduces the bonus proportionally.

Who can use the deposit bonus and for how long?

The 100 Percent Deposit Bonus is available for all account types. Once activated, it remains valid for 60 days. Profits earned from trading with the bonus are fully withdrawable, allowing traders to benefit while managing their risk carefully.

Our Insights

Versus Trade’s 100 Percent Deposit Bonus enhances trading flexibility and capital efficiency. With instant crediting, full profit withdrawal, and applicability across account types, it provides an attractive opportunity to maximize margin while controlling investment exposure for a limited, 60-day period.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Customer Support Options and Contact Details

Versus Trade offers round-the-clock customer support where you’ll speak to a real agent, whether it’s about funding issues, platform help, or account questions.

| Support Channel | Availability | Notes |

| Live Chat | 24/7 | Can be accessed from the website or within the client portal |

| 24/7 | [email protected]. Replies are typically within a day |

|

| 24/7 | DM them for platform questions or referral help |

|

| Facebook Messenger | 24/7 | Available for basic support and updates |

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Versus Trade vs Exness vs HFM – A Comparison

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Customer Reviews and Trust Scores

Versus Trade earns solid feedback on Trustpilot, with a 4.6 out of 5 TrustScore based on 29 reviews. Users praise its low spreads, fast deposits and withdrawals, and intuitive platform.

| Metric | Rating/Feedback |

| Trustpilot Score | 4.6/5 from 29 reviews |

| Common Praise | Low spreads, quick funding, easy interface |

| Critical Feedback | Minimal, mostly around origin transparency |

This suggests a highly rated user experience, especially in the Malaysian market, although some seek clarity on the broker’s headquarters.

★★★★ | Minimum Deposit: $10 Regulated by: FSC (Mauritius) Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| High leverage up to 1:2000 available across forex and metals | Broker is unregulated and registered offshore in Saint Lucia |

| Multiple live account types with different pricing structures | No in-house market research, trading insights, or education portal |

| Low minimum deposit from $10 on Standard and Cent accounts | Cent Account limits you to forex and metals |

| MetaTrader 5 supported on desktop, mobile, and browser | No multi-currency accounts - USD only |

| Commission-free trading on Standard, Cent, and Pro accounts | No investor compensation fund or regulatory recourse |

| Commission-based Raw Spread account offers spreads from 0.0 pips | Swap-free doesn’t cover exotic pairs, most stocks, or non-WTI energy |

References:

In Conclusion

Versus Trade provides a strong option for traders seeking MetaTrader 5 access, high leverage, and low entry costs. Versus Trade remains upfront about its licenses and safety measures. Its standout feature is Versus Pairs – unique assets enabling traders to long one asset and short another seamlessly, like Bitcoin vs Gold or Tesla vs Ford.

Faq

Versus Trade is registered in Saint Lucia, but is not currently locally or internationally regulated by any regulatory entities.

Yes. Versus Trade keeps client funds in segregated accounts at top‑tier banks and employs SSL encryption. It also offers negative balance protection.

It offers up to 1:2000 leverage on forex pairs, between 1:200 and 1:500 on indices and crypto, 1:500 on commodities, and 1:40 on stocks.

They provide negative balance protection, SSL encryption, and segregated client funds to limit exposure.

Yes. The mobile app on iOS and Android offers account management, live pricing, alerts, charts, and trading tools.

They offer the full MetaTrader 5 suite (desktop, web, and mobile).

No, inactivity fees don’t apply, even if an account remains dormant after 90 days.

- Overview

- Trading, Non-Trading, and Hidden Costs

- What Types of Accounts Does Versus Trade Offer?

- Copy Trading

- How to Open a Versus Trade Account

- Trading Platforms and Tools

- Economic Calendar and Market News

- Versus Academy

- Markets Available for Trade

- Does Versus Trade Offer Trading Tools or Market Research?

- How Do Deposits and Withdrawals Work on Versus Trade?

- Is Versus Trade Regulated and Safe to Use?

- IB Opportunities with Versus Trade

- 100% Deposit Bonus

- Customer Support Options and Contact Details

- Versus Trade vs Exness vs HFM - A Comparison

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion