Trading Course

Fundamental Forex Trading Strategies

- Fundamental Forex Trading Strategies

- Fundamental Analysis

- Importance of Combining Technical and Fundamental Analysis

- Main FX market forces

- Central Banks and Major Commercial Banks (2024)

- The Federal Open Market Committee (FOMC)

- Housing Starts

- PMI (Purchasing Managers’ Index)

- The Beige Book Overview

- Most volatile reports

- The Power of Expectations

- In Conclusion

- Practice and Revision

Fundamental Forex Trading Strategies

A fundamental approach is incredibly important, sometimes even more so than a technical one. Some of the most famous traders in the world, from George Soros to Warren Buffet, have admitted more than once that they owe their fortunes to the fundamental analysis they have made over the years.

Main market forces

Include the role of new global economic factors like post-pandemic recovery, inflationary pressures, energy crises, and geopolitical conflicts (e.g., the Russia-Ukraine war) and their influence on currency pairs.

Mention how emerging markets and digital currencies (e.g., Bitcoin, CBDCs) are changing the forex landscape.

Where can we find all the information?

Introduce sources that reflect the fast-paced digital economy, like social media sentiment analysis (Twitter, X, etc.), real-time news aggregators, and AI-powered market prediction tools. Websites like TradingView or platforms with real-time data from financial influencers can be added.

The power of expectations

In Forex trading, the power of expectations refers to how the market reacts not just to actual economic events, but to what traders anticipate will happen in the future. Traders and investors often move markets based on what they expect central banks, governments, or key economic indicators to signal, rather than waiting for the actual data release or event to occur.

Expectations are crucial because currency markets are forward-looking. If traders expect a central bank to raise interest rates, they might start buying that currency before the actual announcement. Similarly, if negative economic data is expected, traders may begin selling a currency in anticipation of weaker performance.

The Importance of the Economic Calendar

Explain how global uncertainty has made economic calendars more critical. Emphasize the significance of scheduled news (e.g., central bank rate decisions, non-farm payrolls), but also unscheduled events like surprise geopolitical events that can create large volatility.

Fundamental Analysis

Definition of Fundamental Analysis

Remember Fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors to predict currency movements.

Real-World Example (Soros)

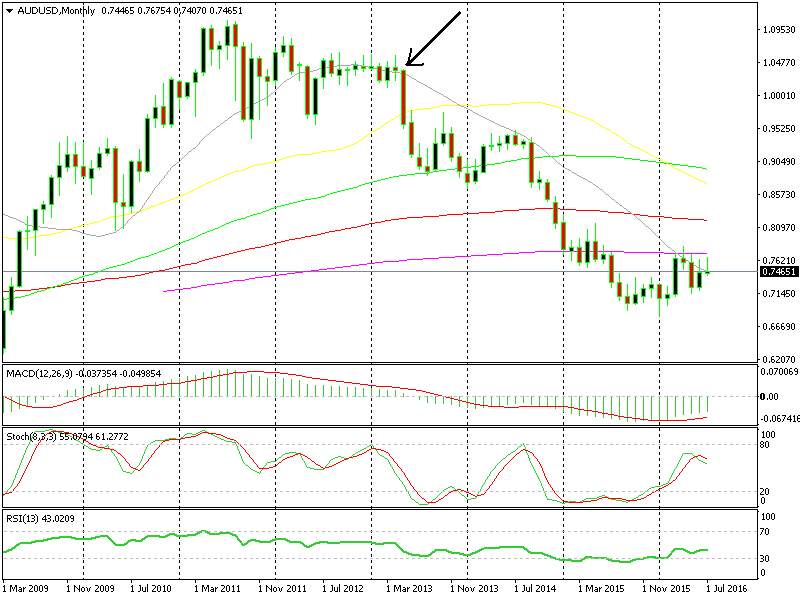

A good example of this was when George Soros made more than $1 billion on a forex trade alone going short on AUD/USD, based on fundamental analysis. The Chinese economy was showing signs of weaknesses, and the Australian economy was heavily dependent on the exports of raw materials to China. The reason behind the trade was the weakening Aussie economy and the cutting of interest rates by RBA. Now he is USD 1 billion richer. This is a good example of how fundamental analysis should be employed. economic reports, political events, etc.) have impacted currency pairs to illustrate the importance of fundamentals.

Chart showing how Soros sold AUD/USD and made $1 billion.

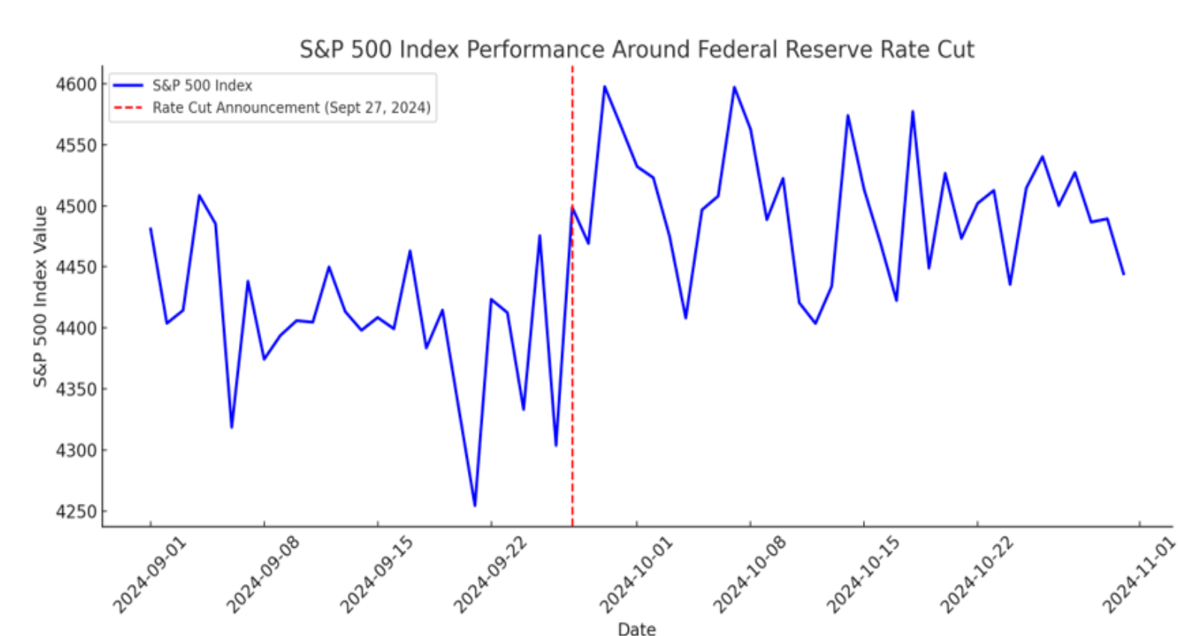

A significant recent event that affected the trading markets was the Federal Reserve’s decision to cut interest rates by 50 basis points in late September 2024. This marked the first rate cut in four years and was seen as a preemptive measure to support a cooling labor market. Following this announcement, the S&P 500 rose significantly, contributing to its best year-to-date performance since 2000, with nearly a 21% increase in the first three quarters of the year.

Importance of Combining Technical and Fundamental Analysis

Too many times fundamentals do not get the appropriate attention they deserve. Too many traders use only technical approaches without knowing anything about the economic environment and the markets in which they work. On the other hand, many traders act just the opposite – abandon technical analysis and follow only fundamentals. Our approach in the Market Leaders Forex Course, like in many other things, is that combining these two approaches is ideal. To trade like pros, you should get to know them well.

Factors Affecting Fundamentals

Fundamentals help us to understand markets and trends deeply, intuitively, and logically. Usually, fundamental traders are considered long-term investors. Fundamental traders are most often very familiar with market forces; and know one or two things about the economy, capital markets, and microeconomics. Their goal is to make a profit by taking advantage of opportunities as they arise, so they must be particularly well acquainted with the rules of the game, the players, and the playing field.

Remember: News and events that you follow on the internet, TV, and radio affect the Forex market.

What exactly is the fundamental approach based on?

How can we use it in our trading strategy? Let’s think of the different economies in the world. Think of the economy of the market in which you live. Think of market conditions, the endless amount of news every day, hour by hour. The world has become very small, a global village as the cliché goes.

Fundamentals are affected by wars, elections, politics, social issues, and many other factors. One of the great fundamental events that have recently shaken the forex market sent the Euro 500 pips down, and made the British Pound collapse by about 20 cents (2,000 pips) was the Brexit referendum to leave the EU. Each new event or announcement causes reactions from investors and speculators, not only within this market but all over the world. Governments, central and commercial banks, policies, and even natural disasters all play a part in Forex.

Think about it this way – if the owner of the grocery store next to your house would reduce prices, you would probably buy there more. If you think of buying a new stereo for your living room and find out that in one month the government is planning a tax increase on electrical goods, you will probably buy it earlier.

Now imagine there are tens of events each day influencing trade; sometimes dramatic events, drastically affecting the market. Are you starting to understand why fundamentals are so important?

Planning for the Long Term

Fundamental analysis is less efficient for forecasting trends in the short term. This approach explains and teaches what logically “should” happen right now to market prices, a reaction to events. Therefore, it is an outstanding system for the long term. It explains global trends.

Fundamentals discuss the reasons for present trends and not the trends themselves. Some events last much longer than traders’ responses, having longer effects on markets. Fundamental trading is not advised for a couple of days of trading (and not for intraday trading). It suits traders who search for long-term trends, which can be in weeks, months, and even years.

Economic news surrounding fundamental data comes from varied sources and appears as announcements, reports, and releases. You can read them online, through the Web, on news sites, economics, capital markets, and Forex sites. Many of the events are published by the regular media.

Example of an event:

“An interest rate decrease of that percentage may cause the euro to go down.” Or, “Consumer confidence rose 4% since the last report.”

We should mention that to become a fundamental expert you should see the complete picture. You should use your experience to recognize a whole basket of events connected one to the other, and not only know how to analyze a single piece of data.

One fundamental announcement might shatter all previous technical analyses you have built and followed. Also, traders who only work with short-term technical tools, on many occasions miss great longer-term investment opportunities (and vice versa).

Main FX market forces

Interest rates are the cost a borrower pays to a lender. They play a big role in determining a country’s currency strength. Each country’s central bank sets interest rates to help maintain stability in the economy. When inflation (the rise in prices) is too high, central banks raise interest rates to slow it down. Raising rates can reduce inflation, lower prices, and make the currency stronger.

- For example: in a healthy economy, interest rates usually range between 3% and 5%.

Inflation: Simply put, inflation is how much prices go up over time. It’s why a chocolate bar that cost 5 cents 20 years ago might cost much more today. Central banks want to grow the economy, but they raise interest rates when inflation goes above 2%, because inflation higher than that can hurt the economy.

- Example: If inflation last month was 2.6%, but rises to 3% this month, the central bank might raise interest rates to control it. This affects the market by making the currency stronger.

Higher interest rates can attract outside investors, making the currency even stronger. Imagine you have $1,000 to save, and you can choose between two banks: one offering 5% interest and the other offering 10%. Of course, you would choose the higher rate! The same happens when foreign investors want to put their money into an economy with higher rates.

Market Impact of Interest Rates

- When interest rates rise, economic growth slows, inflation decreases, and currencies strengthen.

- When interest rates fall, economic growth speeds up, inflation increases, and currencies weaken.

Interest rates are one of the biggest factors affecting the Forex market. Every time central banks announce changes to interest rates, currency values move.

- Example: In the early 2000s, the U.S. cut interest rates, which weakened the U.S. dollar for many years. This move also changed the U.S. real estate market during that time.

Interest Rate Differentials

- Some traders use a strategy called “Carry Trade.” This involves trading two currencies with different interest rates. They choose the currency with the higher rate to make a profit, as the currency with the higher rate usually strengthens.

Always keep an eye on interest rate announcements, as they deeply affect Forex trading!

Central Banks and Major Commercial Banks (2024)

A central bank is the national bank that manages a country’s monetary policy, ensuring the strength and stability of its currency. Central banks control inflation, interest rates, the money supply, and bank reserves. Their main goal is to keep prices stable and promote steady economic growth.

- When inflation is high, central banks usually raise interest rates to slow it down. Higher interest rates make borrowing more expensive, which helps lower inflation and strengthens the currency. As traders, we can follow these moves and adjust our trades based on the central bank’s monetary policies.

- Central banks can also print more money to increase the currency supply. This weakens the currency because when there’s more money in circulation, its value decreases. This is why it’s so important to track economic news and central bank announcements throughout the year!

In 2024, the current head of the U.S. central bank (Federal Reserve or “the Fed”) is Jerome Powell, not Janet Yellen. Powell’s announcements are crucial, as Fed policy has the biggest impact on the global Forex market.

Commercial Banks

- Large commercial banks like JPMorgan, UBS, Deutsche Bank, Barclays, and Citibank also have a big influence on the Forex market. These banks control vast amounts of capital, and their investments can signal trends in the market. For example, if a major bank invests in a country’s economy, it can strengthen that country’s currency.

- Example: In the past, many banks and investors poured money into Brazil’s fast-growing economy. This caused Brazil’s currency to strengthen as foreign capital flowed into the country.

Major Events and News

- News and major economic events can significantly impact the Forex market. To explain this, think of it like this: if a news channel like CNN or Bloomberg reports that a large company is about to go bankrupt, its stock price will likely drop. Now, if instead of a company, it’s an entire country’s economy at risk, its currency will weaken. This has happened in the past with countries like Greece, Spain, and Italy. Just like with stocks, these events create major movements in the Forex market.

- In Forex, predicting trends based on news and events is crucial for trading. Following reliable economic updates can give you the advantage of making better trading decisions.

Here are some of the major fundamental events:

Non-farm payrolls (NFP)

What is NFP?

- NFP is a monthly report that comes out on the first Friday of each month.

- It shows how many jobs were added or lost in the U.S. economy, excluding farm workers, government employees, and a few other categories.

Why is it Important?

- The NFP report is a key indicator of the health of the job market and the overall economy.

- A higher number of jobs added is a sign of a strong economy, while a lower number suggests weakness.

How to Read the Report

- Change in Employment: Look at the number of jobs created or lost compared to the previous month.

- Market Expectations: Compare the actual number to what analysts predicted. If the number is better than expected, it’s usually good for the economy and the currency.

- Trends: Take note of trends over time. For example, if NFP has been consistently negative for several months, it may indicate ongoing economic troubles.

Important Notes

- Job numbers can fluctuate due to seasonal factors like holidays or vacations.

- When interpreting the NFP, consider both the previous month’s data and analysts’ expectations to understand its impact on the market.

Gross Domestic Product (GDP)

What is GDP?

- GDP is the total value of all goods and services produced in a country over a specific period, usually a year or a quarter.

- It measures the economic output of a country and reflects the standard of living.

Why is GDP Important?

- Economic Health: A rising GDP indicates a growing economy, which usually means more jobs and better living standards.

- Interest Rates: When GDP increases, central banks may raise interest rates to keep inflation in check.

How to Interpret GDP Reports

- Positive Growth: If GDP rises compared to the previous report, it’s a sign of a healthy economy.

- Negative Growth: If GDP falls, especially for two quarters in a row, it signals economic trouble and can weaken the currency.

- Consistency: A GDP report can show lower growth than before but still be positive. For example, growing GDP is good even if the growth rate is slowing down.

Impact on Monetary Policy

- Central banks pay close attention to GDP because it influences their decisions on monetary policy, including interest rates.

- A clear understanding of GDP helps traders make informed decisions in the market.

Consumer Price Index (CPI)

- What is CPI?

CPI measures the average prices of everyday goods and services, like food, clothes, and housing. It’s published once a month and helps us see how prices are changing over time.

Why is CPI important?

- Inflation Indicator: If CPI goes up, it means prices are rising, which is called inflation. Central banks watch this closely.

- Interest Rates: When inflation gets too high, central banks may raise interest rates to cool it down.

How to Understand CPI Reports

- Rising CPI: Shows inflation, which might lead to higher interest rates.

- Slower CPI Growth (Deflation): Prices are still going up, but not as fast as before.

When CPI rises, it often leads to interest rate increases because central banks want to control inflation

Producer Price Index (PPI)

What is PPI?

PPI measures changes in the prices that producers charge for goods before they reach consumers. It looks at both the prices of finished products and the materials needed to make them.

Why is PPI important?

- Early Indicator of Inflation: When producer prices go up, it often means that consumer prices will rise later.

- Tracks Costs: PPI shows how production costs change, which helps predict future changes in consumer prices.

How to Understand PPI Reports

- Rising PPI: Signals that consumer prices may increase.

- Frequent Changes: Show potential shifts in inflation, which may impact the market.

COT (Commitment of Traders Report)

- The COT report shows what big players like banks, companies, and investors are doing in the market.

- It’s released every Friday and helps traders see where major forces are investing their money.

- This report doesn’t directly measure economic conditions but gives insights into future market trends.

- If the report shows extreme positions (either long or short), it could signal that a trend is about to change.

How different major forces in the market are going to invest their capital. It also helps to understand the general atmosphere and to predict in which direction the wind is going to blow in the future. We are talking about future movements. This report is a great helping tool for long-term traders. It is also relevant for ‘swingers’.

Tip: If you find in this report data on “extreme net long/ short”, you can know that it indicates a change in trend in the next session!

COT can be presented either as a report or a graph (below a currency chart). Unlike most of the technical indicators, COT measures volumes traded.

Consumer Sentiment – Issued once a month. It expresses consumers’ attitudes towards the economy.

Unemployment Rate

- What it is: The Unemployment Rate shows the percentage of people who are looking for jobs but can’t find one. It’s published monthly and helps us understand how the job market and economy are doing.

- Why it matters: In a strong economy, fewer people are jobless. When the unemployment rate drops, it’s a sign of a healthy market. Lower unemployment usually strengthens a country’s currency because it means more people are working, spending, and boosting the economy.

- Impact on interest rates: As the economy strengthens with lower unemployment, central banks may raise interest rates to prevent inflation. Higher interest rates can attract foreign investors, further strengthening the currency.

- Tip: When using this report, compare it to the Consumer Sentiment Report from another country’s economy. This comparison can help you decide which currency pairs (like the U.S. dollar with another major currency) might be better for trading opportunities.

Key Point for Students: A positive Capital Flow means a country is attracting investment, which can strengthen its currency. On the other hand, if the flow is negative (more money leaving than entering), the currency could weaken due to lower demand. Always monitor these flows, as they give clues about market sentiment and potential currency movements.

Teaching Trade Balance to Students

Trade Balance is an important economic report that compares a country’s exports (goods sold to other countries) with its imports (goods bought from other countries). Here’s how it works:

- 2Positive Trade Balance: If a country exports more than it imports, the Trade Balance is positive. This situation is good because it means that more money is coming into the country from selling goods abroad. A rising positive Trade Balance can strengthen the country’s currency, making it more attractive to investors and traders.

- Negative Trade Balance: Conversely, if a country imports more than it exports, it has a negative Trade Balance. This can weaken the currency since more money is leaving the country to pay for imports.

Key Points

- A positive and increasing Trade Balance indicates economic strength and can lead to a stronger currency.

- A negative Trade Balance can indicate economic challenges and might lead to a weaker currency.

- Always look at the Trade Balance in conjunction with other economic indicators to get a complete picture of a country’s economic health.

Additional Note: When analyzing the Trade Balance, it’s also helpful to consider trends over time and how they compare to previous reports. This context can provide insights into future movements in the currency market.

Teaching Retail Sales to Students:

Retail Sales is a key economic indicator that measures the total sales of goods by retailers over a specific period, typically reported monthly. It provides insights into consumer spending, which is a major driver of economic growth. Here’s what students need to know.

What Retail Sales Measures

- Consumer Spending: It reflects how much consumers are spending on goods, which can indicate overall economic health. Higher retail sales usually suggest that consumers are confident and willing to spend money.

- Types of Goods: Retail Sales data includes various sectors, such as clothing, electronics, groceries, and online sales, giving a broad view of consumer preferences.

Importance of Retail Sales

Economic Indicator: Retail Sales data helps analysts assess the strength of the economy. Strong retail sales often lead to higher GDP growth, as consumer spending accounts for a significant portion of economic activity.

Currency Impact: If Retail Sales figures exceed expectations, it can lead to a stronger currency, as it suggests a robust economy, potentially influencing central bank decisions on interest rates.

Market Expectations: Traders look at Retail Sales reports to gauge consumer behavior and market trends, which can impact their trading strategies.

Comparison to Previous Reports: Always compare current Retail Sales figures to previous months and market expectations. A significant increase or decrease can signal changes in economic conditions.

Seasonality: Be aware of seasonal effects (like holiday shopping) that can influence Retail Sales figures. For example, sales typically rise during the holiday season but may drop in January.

Correlation with Other Indicators: Retail Sales often correlate with other economic indicators, such as Consumer Confidence and Employment Rates. Understanding these relationships can provide deeper insights into market trends.

Additional Note:

- Limitations: While Retail Sales is a valuable indicator, it does not capture all aspects of consumer spending (e.g., services), so it should be considered alongside other economic indicators for a comprehensive view.

- Encouraging students to stay updated on Retail Sales reports and their implications can enhance their understanding of market dynamics and improve their trading decisions.

The Federal Open Market Committee (FOMC)

Is a key part of the U.S. Federal Reserve System, responsible for setting monetary policy in the United States. Understanding the FOMC is crucial for Forex traders, as its decisions can have a significant impact on currency values.

Key Functions of the FOMC

- Setting Interest Rates: The FOMC meets regularly to decide whether to increase, decrease, or maintain the federal funds rate. Changes in interest rates influence borrowing costs, consumer spending, and overall economic activity.

- Monetary Policy Implementation: The FOMC determines the direction of monetary policy, which can include quantitative easing or tightening measures. These actions aim to promote maximum employment, stable prices, and moderate long-term interest rates.

- Economic Assessment: During meetings, the FOMC assesses current economic conditions, including inflation, unemployment, and economic growth, to inform their decisions.

Importance of the FOMC

- Market Influence: Decisions made by the FOMC can lead to significant volatility in the Forex market. Traders pay close attention to the outcomes of FOMC meetings, as they can signal changes in economic policy.

- Forward Guidance: The FOMC often provides insights or “forward guidance” about future monetary policy, which can help traders anticipate market movements and adjust their strategies accordingly.

- Economic Reports: The FOMC reviews various economic indicators, such as GDP, inflation rates, and employment data, before making decisions. Understanding these reports can help students grasp how FOMC decisions are influenced.

Key Points

- Meeting Schedule: The FOMC meets eight times a year, typically followed by a press conference where the Chairperson discusses the committee’s decisions and outlook.

- Press Releases: After each meeting, the FOMC issues a statement summarizing their decision, which is crucial for traders to analyze. This statement includes information on economic conditions and future policy direction.

- Impact on Forex: An increase in interest rates usually strengthens the U.S. dollar, while a decrease may weaken it. Understanding the FOMC’s decisions can help students predict potential currency movements.

Additional Notes

- Historical Context: Understanding the FOMC’s history and its role during significant economic events (like the 2008 financial crisis) can provide valuable context for its current strategies and decisions.

- Global Impact: While the FOMC focuses on the U.S. economy, its decisions can have global repercussions, affecting currencies and economies worldwide.

Encouraging traders to follow FOMC meetings and their implications can enhance their understanding of monetary policy and its effects on Forex trading.

Housing Starts

Housing Starts is an important economic indicator that measures the number of new residential construction projects that have begun during a specific period. This metric provides insights into the health of the housing market and broader economic conditions. Understanding housing starts can help Forex traders anticipate trends in currency values, especially in economies that are heavily influenced by real estate.

Key Points about Housing Starts:

Definition: Housing Starts refer to the number of new homes that are being built, measured from the groundbreaking stage. This data includes single-family homes and multi-family units.

Economic Indicator:

Demand Indicator: A rise in housing starts generally indicates strong demand for housing, reflecting consumer confidence and economic growth. Conversely, a decline may suggest economic weakness.

Construction Sector: Housing starts are a key component of the construction sector, which plays a significant role in the overall economy. A healthy construction industry contributes to job creation and economic expansion.

Monthly Report:

Housing Starts data is released monthly, typically by the U.S. Census Bureau. This report includes figures on both single-family and multi-family housing starts, as well as building permits, which can signal future construction activity.

Importance of Housing Starts for Traders

- Impact on Currency: An increase in housing starts can lead to a stronger currency because it indicates economic growth and consumer confidence. A decrease may weaken the currency.

- Related Industries: Strong housing starts can boost related industries such as manufacturing (for building materials), retail (furniture and appliances), and financial services (mortgages and loans). Understanding these relationships can provide deeper insights into market dynamics.

- Market Sentiment: Housing starts can also reflect broader market sentiment. For example, if housing starts are rising while consumer confidence is high, it may indicate a robust economic outlook.

Key Metrics to Watch

- Comparative Analysis: Comparing current housing starts data to previous months and years can help students identify trends. Are housing starts increasing or decreasing? How does this align with other economic indicators like GDP or unemployment rates?

- Geographical Variation: Housing starts can vary by region. Understanding which areas are experiencing growth can provide insights into local economies and potential investment opportunities.

Additional Considerations

- Interest Rates: Housing starts are often influenced by interest rates. Lower interest rates can encourage borrowing for home purchases, leading to more housing starts, while higher rates may have the opposite effect.

- Seasonal Trends: Housing starts may experience seasonal fluctuations. For example, construction activity may slow down in winter months due to weather conditions.

Encourage students to keep an eye on housing starts data, as it can provide valuable insights into economic conditions and potential currency movements. Understanding the implications of this indicator will enhance their overall grasp of fundamental analysis in Forex trading.

PMI (Purchasing Managers’ Index)

PMI (Purchasing Managers’ Index) is an important economic indicator that surveys purchasing managers in the manufacturing and services sectors to gauge the economic health of those industries. It is a critical tool for Forex traders because it reflects the overall business activity, economic growth, and future trends.

Key Points about Services/Industrial/Manufacturing PMI:

Definitions:

Manufacturing PMI: Focuses on the manufacturing sector, measuring factors such as new orders, production levels, supplier deliveries, and inventory levels.

Services PMI: Reflects activity in the services sector, which includes industries such as finance, healthcare, and hospitality. It measures factors like business activity, new orders, employment, and prices.

Survey Methodology:

The PMI is based on surveys of purchasing managers from various companies. These managers are asked about their purchasing trends, and the responses help create an index that ranges from 0 to 100.

A PMI reading above 50 indicates expansion in the sector, while a reading below 50 signals contraction. The further from 50 the reading is the stronger the expansion or contraction.

Release Schedule:

The PMI is typically released every month, often on the first business day of the month, and provides insights into the previous month’s activity.

Importance of PMI for Traders

Economic Health Indicator

PMI is a leading indicator of economic activity. A rising PMI suggests that the economy is growing, while a declining PMI may indicate slowing growth or potential contraction.

Both the Manufacturing and Services PMIs are vital for understanding the health of the economy, especially in countries where the services sector plays a dominant role (like the U.S.).

Currency Impact

A strong PMI can lead to an appreciation of the currency as it reflects a robust economy. Conversely, a weak PMI may result in currency depreciation.

Traders often watch PMI releases closely, as significant deviations from expectations can cause volatility in currency markets.

Market Sentiment

PMI data provides insight into business sentiment and future economic conditions. Higher new orders and employment figures within the PMI can signal increased business confidence and potential growth.

Key Metrics to Watch

Composite PMI

Some reports provide a composite PMI that combines both manufacturing and services sectors, giving a broader view of economic activity.

Comparison to Previous Reports

Analyzing changes in PMI from previous months helps students identify trends. Is the PMI increasing or decreasing? What does this mean for the economy?

Regional Variations

PMI figures can vary significantly by region. Understanding regional PMI trends can help students assess local economic conditions and potential investment opportunities.

Additional Considerations

Global PMI

Students should also consider the global PMI, as it can indicate economic trends in key markets that may affect currency pairs. A strong PMI in a major economy (e.g., China or the Eurozone) can impact global market sentiment.

Influence of External Factors

Economic events, trade tensions, and government policies can influence PMI readings. Encourage students to be aware of external factors that may impact the PMI.

Sector-Specific Insights

Since different sectors may react differently to economic changes, understanding sector-specific PMIs can provide traders with a more nuanced view of market dynamics.

Encourage traders to regularly monitor the Services/Industrial/Manufacturing PMI, as it offers valuable insights into economic conditions and potential currency movements. Understanding how to interpret PMI data will enhance their skills in fundamental analysis and help them make more informed trading decisions.

The Beige Book Overview

The Beige Book is a report published by the Federal Reserve eight times a year. It provides a summary of economic conditions across the 12 Federal Reserve Districts in the United States, based on anecdotal information gathered from various sources, including business contacts, economists, and market experts. This report serves as a key tool for understanding economic trends and can influence monetary policy decisions.

Key Points About the Beige Book

Purpose and Content:

The Beige Book offers qualitative insights into the economic conditions in different regions of the U.S. It includes information on consumer spending, labor markets, price trends, and overall economic activity.

Each report summarizes the perspectives of businesses and organizations on economic conditions, providing a snapshot of the economic climate.

Timing of Release:

The Beige Book is released two weeks before each Federal Open Market Committee (FOMC) meeting. This timing allows Federal Reserve officials to consider the report as they formulate monetary policy.

Impact on Monetary Policy:

The insights from the Beige Book can influence the decisions made by the Federal Reserve regarding interest rates and other monetary policy actions. If the report indicates economic strength, it may lead to discussions about raising interest rates.

Conversely, if the Beige Book highlights economic weakness or uncertainty, it may support a more accommodative monetary policy stance.

Importance of the Beige Book for Traders

- Market Sentiment Indicator: The Beige Book can serve as a gauge of market sentiment. Positive reports indicating strong economic activity can bolster confidence in the market, while negative reports may raise concerns about economic stability.

- Impact on Forex Markets: Since the Federal Reserve’s monetary policy significantly influences the U.S. dollar, traders should pay close attention to the Beige Book. Changes in sentiment or outlook reported can lead to volatility in currency pairs involving the U.S. dollar.

- Regional Insights: The Beige Book provides valuable insights into regional economic conditions, which can affect local currencies and industries. For example, if one district is experiencing significant growth while another is stagnating, this information can inform trading strategies.

Key Metrics to Watch

- Consumer Spending Trends: Look for mentions of changes in consumer spending, as this is a strong indicator of economic health.

- Labor Market Conditions: Insights into employment trends, wage growth, and labor shortages can signal future economic activity.

- Inflationary Pressures: Pay attention to any references to price changes, as rising costs may prompt the Federal Reserve to adjust interest rates.

Additional Considerations

- Comparison with Other Reports: Encourage students to compare the Beige Book findings with other economic reports, such as the Non-Farm Payrolls (NFP) or Consumer Price Index (CPI), to form a more comprehensive view of the economic landscape.

- Qualitative vs. Quantitative Data: Emphasize that the Beige Book relies on qualitative data, which can provide context but may not offer specific numerical forecasts.

The Beige Book is a valuable tool for understanding the economic climate in the U.S. and can greatly impact Forex trading strategies. Encourage students to stay informed about the Beige Book’s release dates and analyze its contents to enhance their understanding of economic trends and their implications for currency movements.

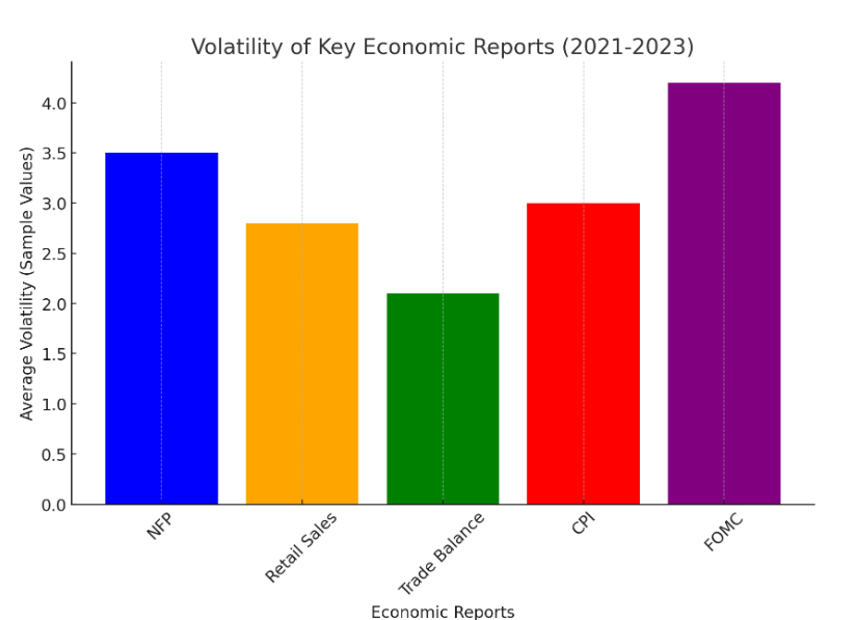

Most volatile reports

An economic calendar is a vital tool for traders, displaying significant economic announcements and releases that can influence market movements. It helps traders stay informed about global economic events and make better trading decisions.

Types of Events Listed:

- Economic calendars typically include a range of events such as:

- Economic Indicators: NFP, GDP, CPI, PPI, retail sales, etc.

- Central Bank Announcements: Interest rate decisions, monetary policy statements.

- Government Reports: Unemployment rates, trade balances, etc.

- Market Forecasts: Predictions for economic data releases, which provide context for actual results.

Benefits of Using an Economic Calendar:

- Knowing upcoming events allows traders to prepare their strategies and positions.

- By being aware of significant announcements, traders can avoid entering or holding positions that might be adversely affected by unexpected news.

- Understanding when major announcements are scheduled can help traders anticipate periods of high volatility, allowing them to position themselves accordingly.

Different Time Frames:

- Economic calendars can be viewed on different time frames (daily, weekly, monthly), which allows traders to plan their strategies according to their trading style (day trading, swing trading, etc.).

Impact on Currency Pairs:

- Certain events have a more substantial impact on specific currency pairs. For example, U.S. employment data might significantly affect the USD pairs, while European Central Bank announcements will influence EUR pairs.

Using the Calendar for Backtesting:

- Can use past economic calendars to backtest strategies, examining how historical data releases affected market movements to improve future decision-making.

Learning to Read the Calendar:

- Students should learn how to interpret the calendar, noting which events are high-impact versus low-impact, as this can influence trading strategies.

Importance of Forecasts:

- Emphasize that forecasts listed on the calendar can help traders gauge market expectations and sentiments, allowing them to make informed decisions before releases.

Traders will be encouraged to incorporate the economic calendar into their daily trading routine, stressing that staying informed about economic events is crucial for successful trading. Remind them that while they can trade during events, preparation and understanding the context of these announcements can lead to better outcomes.

These points can help round out your explanation and provide a more comprehensive understanding of the significance of economic calendars.

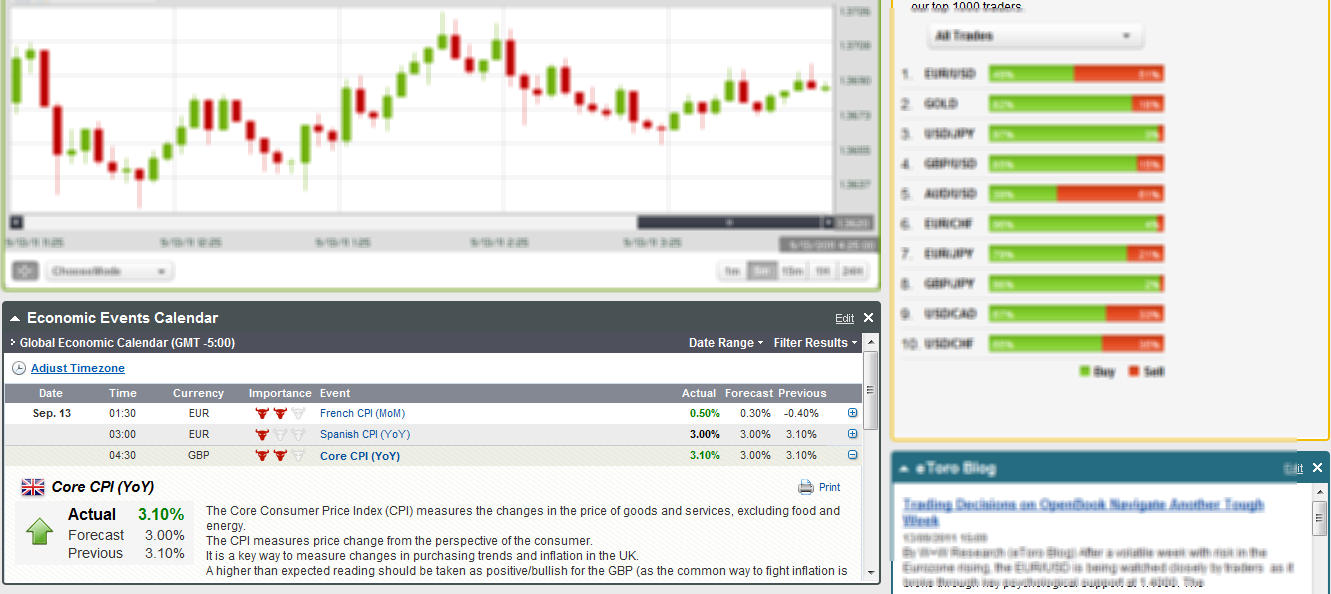

Take a look at eToro’s Economic Calendar:

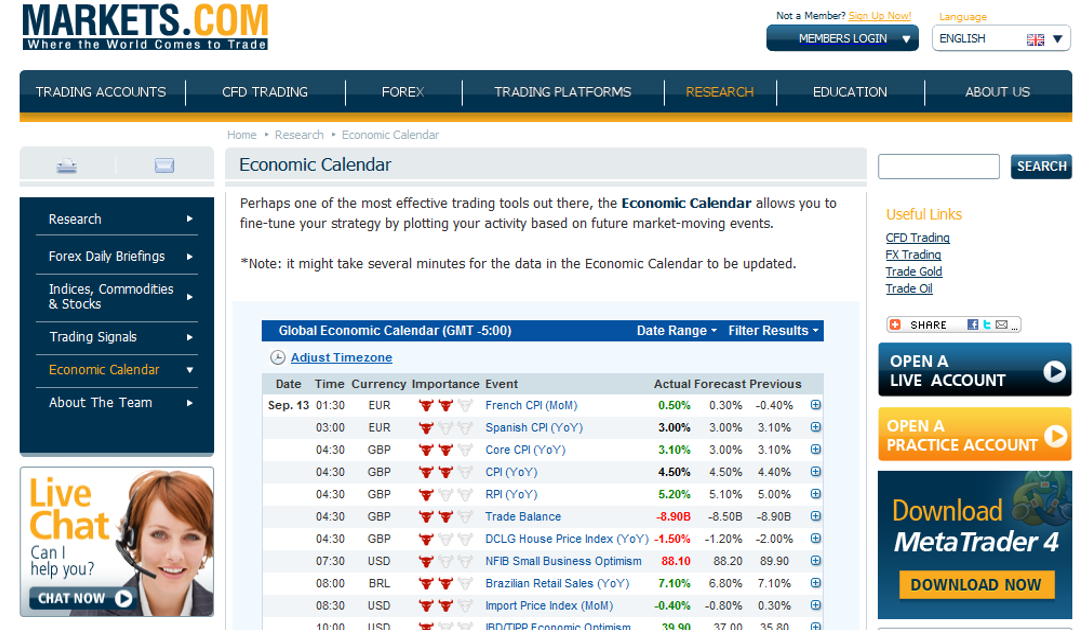

Markets.com Economic Calendar:

Let us see what to look for in an economic calendar (from left to right):

Source eToro.com Economic Calendar services by Forexpros

An explanation of how to read the Graph:

Time:

- This shows when the event will occur. Knowing the exact time helps traders prepare for potential market movements.

Currency:

- This indicates which currency will be affected by the event. For example, if the event is related to the U.S. economy, the U.S. dollar (USD) is likely to be impacted.

Importance:

- Events are marked with various levels of importance (usually color-coded or starred).

- High Importance: Major events that can lead to significant market volatility.

- Medium Importance: Events that may cause moderate movement in the market.

- Low Importance: Minor events that usually don’t affect the market much.

Event:

- This is the headline or name of the economic event, such as “Non-Farm Payrolls” or “Consumer Price Index.”

- By clicking the “+” button next to the event, students can access detailed explanations about its significance and expected impact on the market.

Actual:

This shows the actual data released during the event.

-

-

- Green: Indicates that the result is better than expected (positive impact on the currency).

- Red: Indicates that the result is worse than expected (negative impact on the currency).

- Black: Indicates that the result is as expected (neutral impact).

-

Forecast:

- This is the predicted number or outcome made by analysts before the event occurs. Traders use this to gauge market expectations.

Previous:

- This shows the data from the last release of the same event. Comparing the previous and actual results helps traders understand trends and potential shifts in the market.

Summary

Using the economic calendar effectively can help traders anticipate market movements and make informed trading decisions based on upcoming economic data releases. It’s like having a roadmap of important events that could influence currency values, allowing traders to navigate the Forex market more confidently.

The Power of Expectations

Sometimes, just the anticipation of an event can lead to significant price changes in the Forex market. Events like employment reports or central bank interest rate announcements can create excitement, causing prices to move by tens or even up to 100 pips before the actual news is released.

Market Activity

Traders prepare for these major events, leading to increased buying or selling activity. This means that significant transactions often happen before the results are known.

Consensus System

Before major events, analysts come together to forecast outcomes, creating a consensus. Big traders act on these expectations, initiating large trades before smaller ones follow.

- Expected Results: If the actual results match expectations, trading volume might be lower because most positions have already been taken.

- Surprising Outcomes: If there is a surprising announcement, whether good or bad, we can expect a large price movement as major players rush to adjust their positions. This creates opportunities for traders to make money.

Interest Rate Example

When central banks announce interest rates, speculators prepare in advance. If the announcement differs from expectations, the resulting price trends can be intense.

Caution for Traders

Many traders prefer a “Non-Directional Bias” approach, meaning they wait for the event to happen before deciding on their actions. This strategy can be safer, as it allows them to react based on the actual news.

In Conclusion

When it comes to Forex trading, understanding the impact of news is crucial. Here are the key takeaways:

- U.S. News is Key: The most influential news often comes from the United States, which is the world’s top economic power. The U.S. dollar is also the most traded currency, so news related to the U.S. economy can affect Forex markets.

- Focus on Major Currency Pairs: Fundamental analysis works particularly well with major currency pairs (the “majors”). These pairs are heavily influenced by global events and trading them usually incurs lower fees.

- Consider the Bigger Picture: Always look at the overall situation. Multiple news releases and economic events often happen at the same time, each impacting the market in diverse ways.

- Analyze Mixed Signals: For example, if the U.S. unemployment rate drops but the dollar still weakens, there could be various reasons:

- Long-Term Trends: Investors might believe that the overall trend is still negative, making them hesitant to buy dollars.

- Overall Disappointment: Even if recent numbers look good, other economic indicators may still be disappointing.

- Timing of Reports: The timing of the report matters. If it is released during or right after a holiday season when many temporary workers are employed, it may not reflect the true state of the economy.

Key Points to Watch When Trading in 2024

- Source of Information: Check who provides the news or event updates (analysts, traders, banks, or central banks). Trustworthy sources are usually governments and central banks. Be cautious with data from authoritarian countries like China, Russia, or Turkey, as they may manipulate information for their agendas.

- Type of Information: Determine whether the information is based on rumors, facts, or opinions.

- Wording Matters: Pay attention to phrases like “as expected,” “better than expected,” or “worse than expected.” Experienced traders often make their decisions based on these expectations before the event occurs.

- Price Movements: Watch for changes in price during the hours leading up to an important announcement. This can signal market sentiment.

- Fundamental Analysis: While fundamental analysis is typically reliable, the market doesn’t always react as expected. For example, between 2012 and 2014, the EUR/USD maintained a strong uptrend despite economic troubles in Europe and a recovering US economy. This shows that timing can be unpredictable.

- Past Behaviour of Monetary Bodies: Look at how central banks have acted in the past, as this can give clues about their future decisions.

Tip: It is better to make as many comparisons of reports on interest rates and inflation as you can. Compare reports to previous periods and other markets to make a good decision on which currency go short and which to go long. Say you decided that you are a fundamental type of trader; that the fundamental trading strategies attract you the most; and that you are dying to find a broker already and open an account.

Practice and Revision

It is time to go back to your demo accounts. Now, is the platform open in front of you? Let us revise what we have been studying in this lesson:

- Look for the site’s calendar. Found it? Check out a few of the events being presented. Try to read and understand them, and figure out what their consequences might be. How might they affect the market?

- Distinguish between past events and future events; notice expected dates of announcements. Notice that there are forecasts on some of the events.

Wander around amongst a few of the major news sites, such as Bloomberg for example. Go to MarketLeaders.com and study it.

Revision questions

- Assume you predict that the European economic recovery is about to turn into a recession. On the other hand, optimistic reports on the American economy are released. What kind of action would you wish to take?

- How is increasing the interest rate going to affect the USD? Why?

- Note 3 significant reports

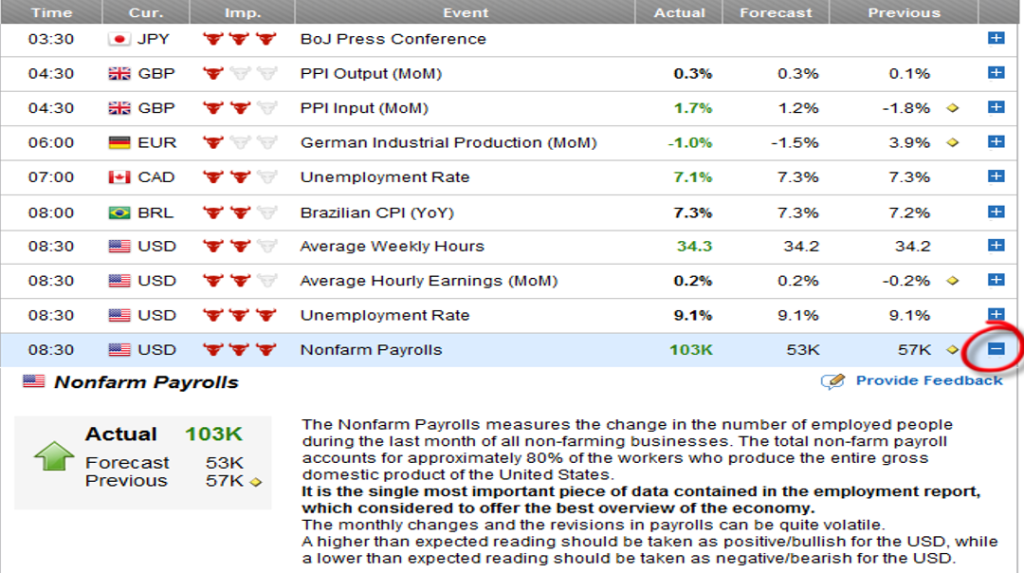

- How would you react to the following release?

- How would you trade on this news?

![]()

Answers

- Sell EUR/USD

- USD will get stronger. Price will go long. More investors will buy this currency by selling other ones.

- Housing Starts; Retail Sales; CS; CPI; GDP; PPI; COT…

- Invest against the US dollar- Sell USD

- Sell EUR/USD – which means to buy the US Dollar