U.S. stocks are on the bear during this midweek FOMC Minutes session. Going into the final two hours of trade, the DJIA DOW (-184), S&P 500 SPX (-20), and NASDAQ (-65) are all sliding into the red. For the time being, a formal end to the FED’s streak of rate cuts appears to be driving equities values down.

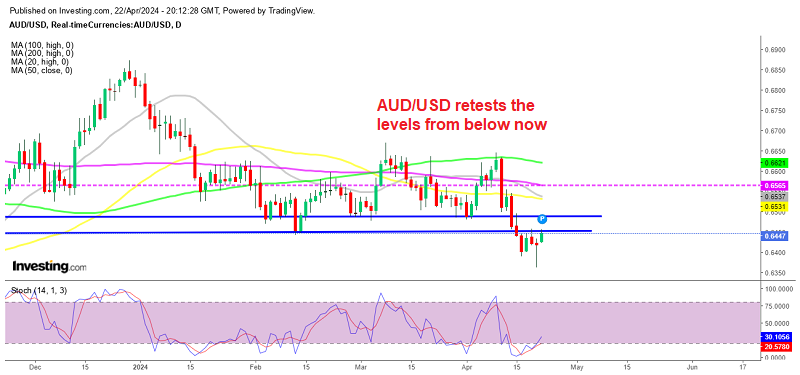

On the forex front, the Greenback is holding its own against the majors. Breakout gains vs the Canadian dollar and Aussie have been the headlines, with modest action against the safe-havens grabbing secondary consideration. At this point, it appears that currency traders agree with equities players ― future FED easing is less-than-likely.

In addition to the FOMC Minutes, reports are currently circulating that a U.S./China trade deal may not be completed this year. Earlier, China condemned a U.S. Senate resolution that supported human rights in the Hong Kong protests. Accordingly, many in the financial community are citing this issue as stalling recent trade deal progress.

FOMC Minutes: Recap And Highlights

Today’s FOMC Minutes from the October meeting have come and gone, with little reaction from the markets. The lack of short-term volatility isn’t too much of a surprise given last week’s Congressional testimony from Jerome Powell. At this point, the markets appear to have largely priced-in a halt to FED rate cuts, growing inflation, and trade war uncertainty.

Here are a few of the key statements from today’s FOMC Minutes release:

- FOMC officials “generally viewed the U.S. economic outlook as positive.”

- “Uncertainties associated with trade tensions as well as geopolitical risks had eased somewhat, but remained elevated.”

- U.S. economic “resiliency” was a talking point among officials.

- Members voted 8-2 in favor of the ¼ point rate cut.

- “All” FED officials openly opposed adopting negative interest rates in the face of a downturn.

Bottom Line: It looks like the FED is backpedaling from summertime predictions of pending doom for the U.S. economy. While the 8-2 vote assured a third consecutive rate cut, it was likely the last for quite some time. The markets have been relatively quiet following the FOMC Minutes release, with equities holding on to losses and the USD posting gains across the majors.